On December 31, 2024, Empirical Financial Services, LLC, operating as Empirical Wealth Management, made a strategic decision to reduce its position in Belpointe PREP LLC (OZ, Financial). The transaction involved a decrease of 5,879 shares, which impacted the firm's portfolio by -0.01%. This move reflects a calculated adjustment in the firm's investment strategy, possibly in response to the stock's recent performance and market conditions.

Empirical Wealth Management: A Profile

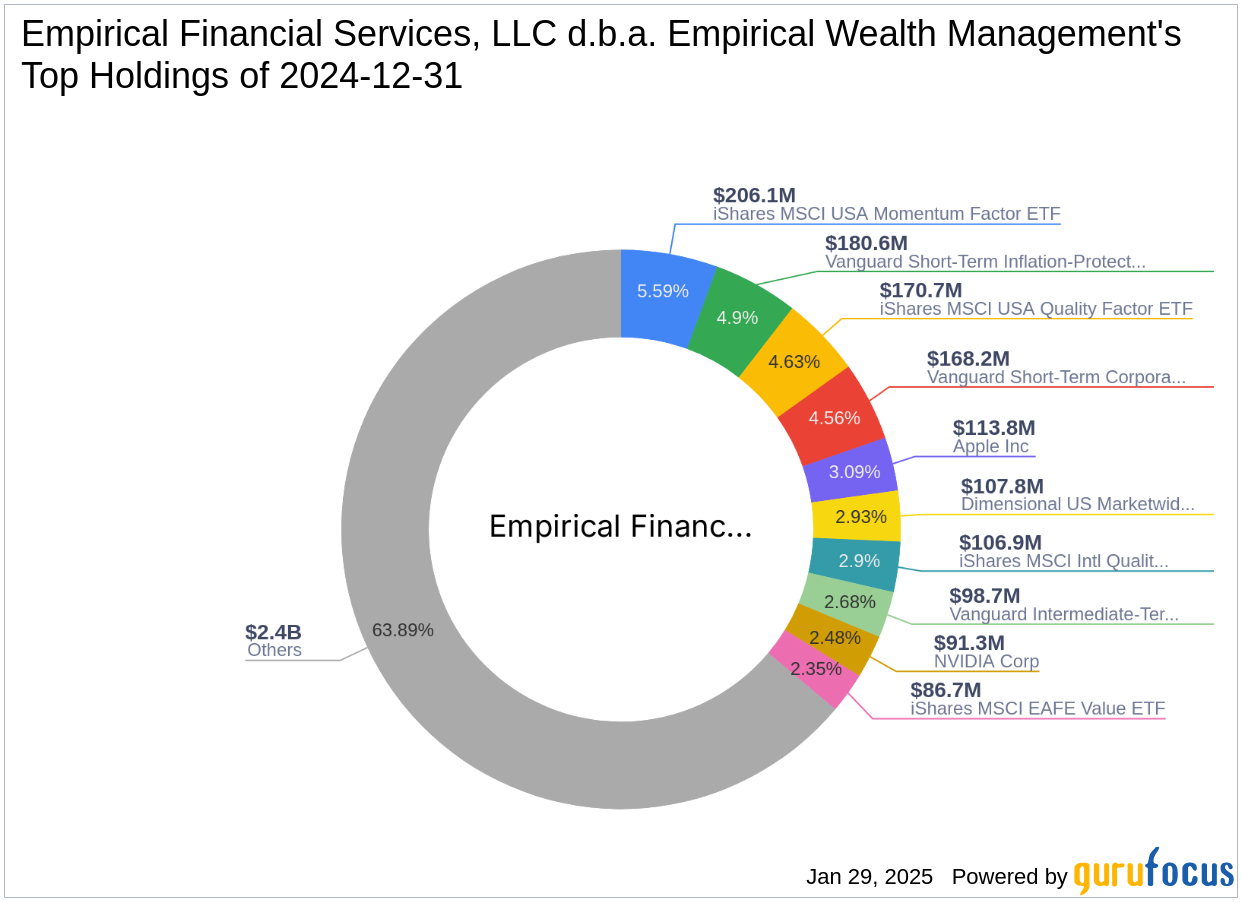

Empirical Wealth Management, based in Seattle, WA, is known for its focus on value investing. The firm manages an impressive equity portfolio valued at $3.69 billion, with significant investments in the Technology and Consumer Cyclical sectors. Among its top holdings are iShares MSCI USA Momentum Factor ETF (MTUM, Financial), iShares MSCI USA Quality Factor ETF (QUAL, Financial), and Apple Inc. (AAPL, Financial). This diverse portfolio underscores the firm's strategic approach to balancing growth and stability in its investments.

Understanding Belpointe PREP LLC

Belpointe PREP LLC is a qualified opportunity fund based in the USA, focusing on development and redevelopment projects within opportunity zones. The company invests in a variety of properties, including multifamily, student housing, and healthcare facilities, among others. With a current market capitalization of $233.450 million, Belpointe PREP LLC plays a significant role in the real estate sector, particularly in areas designated for economic revitalization.

Stock Performance and Valuation

As of the latest data, Belpointe PREP LLC's stock is priced at $64.01, marking a significant decline of 17.3% since the transaction. Since its IPO in October 2021, the stock has decreased by 36.09%. The GF Valuation suggests a "Possible Value Trap," indicating that investors should exercise caution. The stock's current price to GF Value ratio is 0.66, suggesting it is trading below its intrinsic value, yet the potential risks should not be overlooked.

Financial Metrics and Ratios

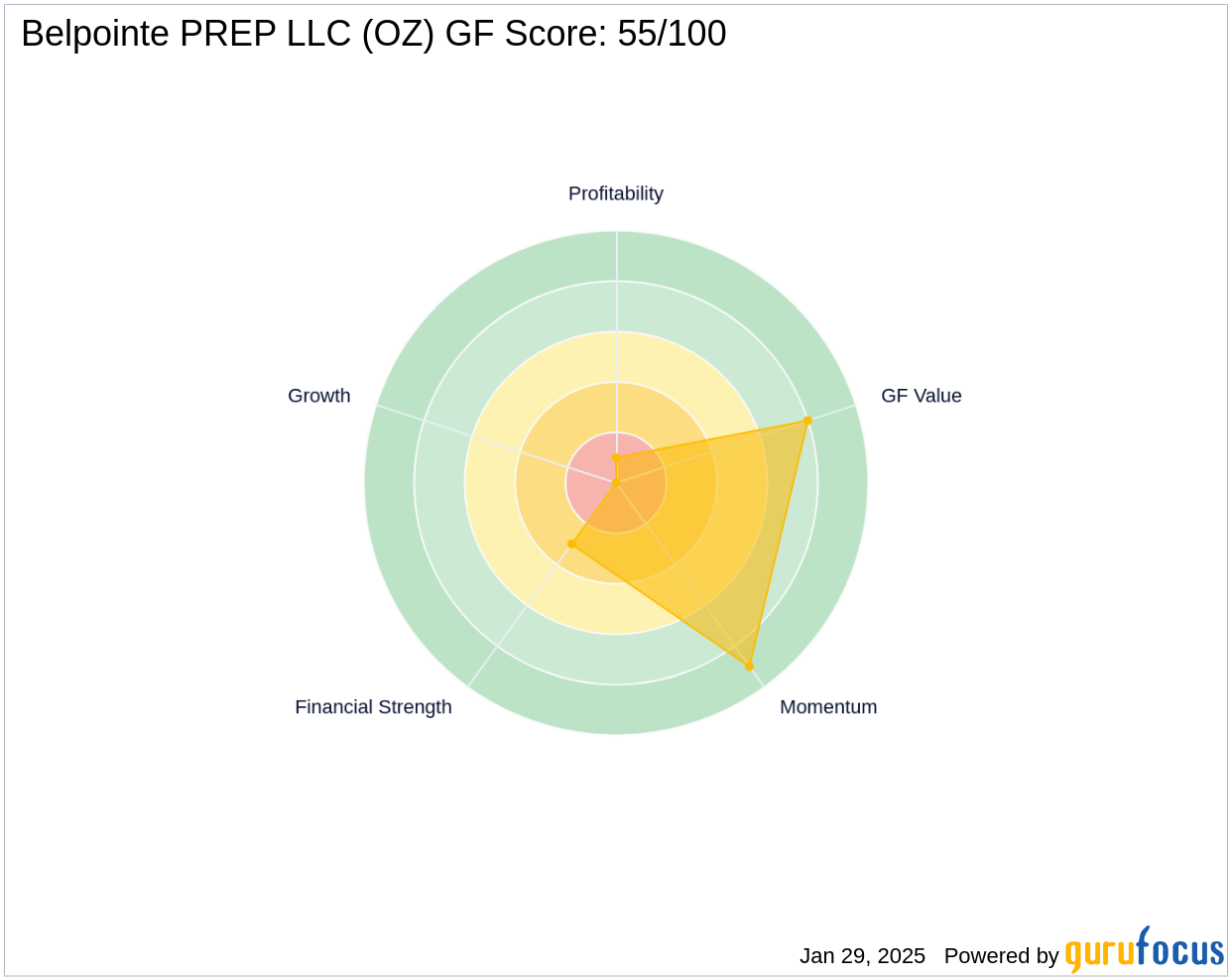

Belpointe PREP LLC's financial metrics reveal potential challenges. The stock's GF Score is 55/100, indicating poor future performance potential. The Balance Sheet Rank is 3/10, and the Profitability Rank is 1/10, reflecting financial constraints. The cash to debt ratio stands at 0.16, highlighting potential liquidity issues. These metrics suggest that the company may face challenges in maintaining financial stability and profitability.

Strategic Implications of the Transaction

The reduction in shares of Belpointe PREP LLC by Empirical Wealth Management may indicate a reassessment of the stock's potential within the firm's portfolio. This decision aligns with the firm's investment philosophy, which emphasizes value and strategic allocation. The firm's top holdings, including major ETFs and companies like Apple Inc., suggest a focus on maintaining a balanced and diversified portfolio.

Conclusion

Empirical Wealth Management's decision to reduce its stake in Belpointe PREP LLC reflects a strategic alignment with its investment philosophy. Investors should consider the stock's current valuation and performance metrics, as well as the potential risks highlighted by the GF Valuation. This transaction provides valuable insights into the firm's portfolio management strategy, emphasizing the importance of adaptability and strategic foresight in investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.