On January 27, 2025, Broadway Financial Corp (BYFC, Financial) released its 8-K filing, detailing its financial results for the fourth quarter and full calendar year of 2024. The company, a savings and loan holding entity in the United States, primarily generates revenue through interest income on loans and investments. Despite facing a challenging year, Broadway Financial Corp continues to focus on strategic growth and community service.

Quarterly and Annual Earnings Overview

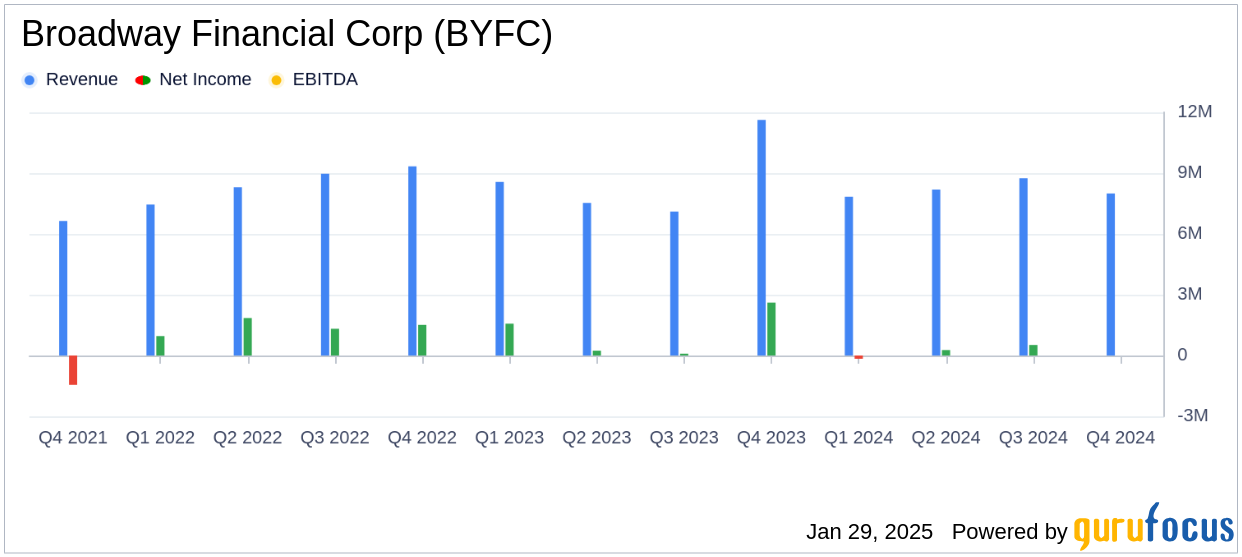

Broadway Financial Corp reported a net income of $1.3 million for Q4 2024, a decrease from $2.6 million in Q4 2023. Net income attributable to common stockholders was $550 thousand, down from $2.6 million in the previous year. The diluted earnings per common share fell to $0.06 from $0.31, reflecting the absence of a $3.7 million grant received in 2023.

For the full year 2024, net income attributable to Broadway was $1.9 million, compared to $4.5 million in 2023. Net income for common stockholders was $359 thousand, a significant drop from $4.5 million the previous year. The diluted earnings per share for the year was $0.04, down from $0.51 in 2023.

Interest Income and Expense Dynamics

During Q4 2024, net interest income increased by $850 thousand to $8.0 million, driven by a $3.1 million rise in interest income, offset by a $2.3 million increase in interest expense. For the full year, net interest income rose by $2.3 million to $31.8 million, with interest income increasing by $15.0 million, partially offset by a $12.7 million rise in interest expense.

Balance Sheet and Asset Quality

Total assets decreased by $71.7 million to $1.3 billion as of December 31, 2024. Loans receivable held for investment increased by $89.2 million to $977.0 million, while deposits grew by $62.8 million to $745.4 million. The allowance for credit losses rose to $8.1 million, reflecting loan portfolio growth.

| Financial Metric | 2024 | 2023 |

|---|---|---|

| Net Income (Q4) | $1.3 million | $2.6 million |

| Net Income (Full Year) | $1.9 million | $4.5 million |

| Net Interest Income (Q4) | $8.0 million | $7.1 million |

| Total Assets | $1.3 billion | $1.4 billion |

| Deposits | $745.4 million | $682.6 million |

Strategic Insights and Future Outlook

CEO Brian Argrett highlighted the company's strategic focus on loan and deposit growth while maintaining credit quality. He noted, "2024 was full of accomplishments and challenges for City First Broadway. Our team continues to work diligently to meet our strategic goals, while improving our operating performance as we serve our communities."

Despite the challenges, Broadway Financial Corp achieved significant loan and deposit growth, reduced borrowings, and improved net interest income after provision for credit losses. The company remains optimistic about 2025, focusing on shifting its funding mix from higher-cost borrowings to lower-cost deposits to enhance performance.

Broadway Financial Corp's performance in 2024 underscores the importance of strategic financial management in navigating industry challenges. The company's efforts to optimize its funding structure and maintain asset quality are crucial for sustaining growth and serving its community-focused mission.

Explore the complete 8-K earnings release (here) from Broadway Financial Corp for further details.