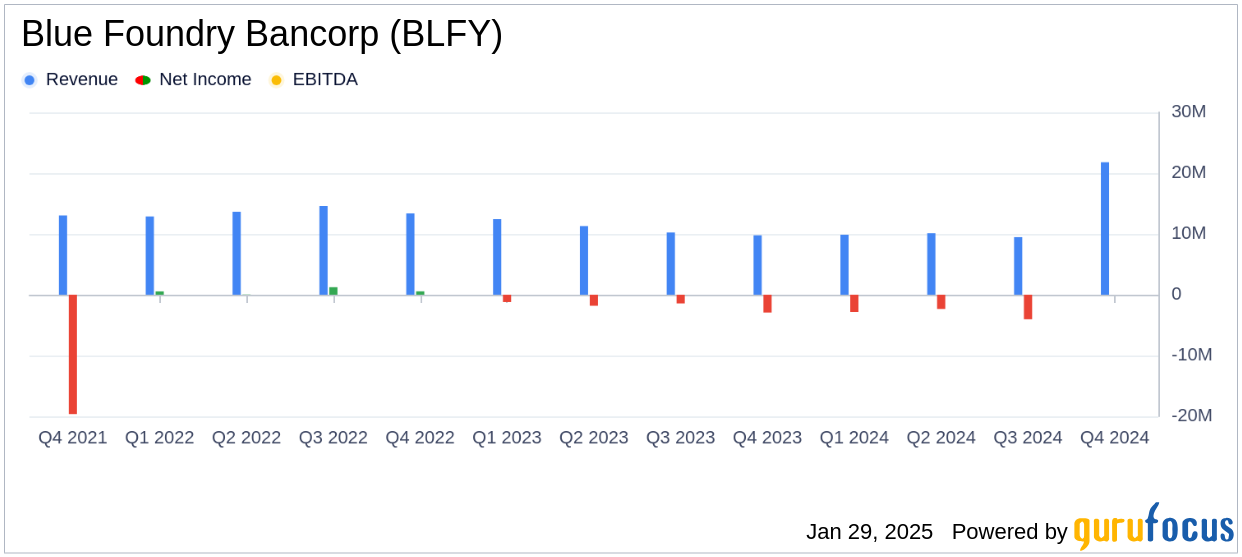

Blue Foundry Bancorp (BLFY, Financial) released its 8-K filing on January 29, 2025, reporting a net loss of $11.9 million, or $0.55 per diluted common share, for the year ended December 31, 2024. This compares to a net loss of $7.4 million, or $0.31 per diluted common share, for the previous year. For the fourth quarter of 2024, the company reported a net loss of $2.7 million, or $0.13 per diluted common share, which is an improvement from the $4.0 million loss in the third quarter of 2024 and a slight improvement from the $2.9 million loss in the fourth quarter of 2023.

Company Overview

Blue Foundry Bancorp is a full-service bank that originates various types of loans, including residential, multi-family, and commercial real estate mortgages, as well as home equity loans and commercial and industrial loans. The bank attracts deposits from the public and invests in securities, deriving revenue primarily from interest on loans and investments.

Performance and Challenges

The company's performance in 2024 was marked by a widening annual net loss, which was better than analyst estimates of a $0.61 loss per share. The fourth quarter loss of $0.13 per share was better than the estimated loss of $0.18 per share. Despite the challenges, Blue Foundry Bancorp experienced growth in both loans and deposits during the fourth quarter, with loans totaling $1.58 billion, an increase of $32.5 million from the prior quarter, and deposits increasing by $24.7 million to $1.34 billion.

Financial Achievements

Blue Foundry Bancorp achieved a net interest margin increase of seven basis points to 1.89% in the fourth quarter, reflecting improved interest income and reduced interest expenses. The bank's credit quality remained strong, with non-performing loans representing only 0.33% of total loans. The allowance for credit losses covered non-performing loans by over 2.5 times, indicating a robust credit risk management framework.

Key Financial Metrics

Interest income for the fourth quarter was $21.8 million, a 1.2% increase from the previous quarter, while interest expense decreased by 1.1% to $12.3 million. The company's tangible book value per share stood at $14.74. The bank repurchased 480,851 shares at an average price of $10.49 per share, reflecting a strategic focus on enhancing shareholder value.

Analysis of Financial Statements

The income statement reveals a decrease in net interest income for the year, down $4.4 million to $37.6 million, primarily due to increased costs of interest-bearing deposits. Non-interest income saw a slight decline, while non-interest expenses rose by $1.0 million, driven by higher compensation and benefits costs. The balance sheet showed an increase in total assets to $2.06 billion, with a notable rise in securities available-for-sale and a decrease in FHLB borrowings.

Commentary

James D. Nesci, President and CEO, stated, “We are very pleased with both the deposit and loan growth achieved in the fourth quarter and look to carry this positive momentum into 2025.”

Conclusion

Blue Foundry Bancorp's financial results for 2024 highlight both challenges and achievements. While the company faced a widening annual loss, improvements in loan and deposit growth, as well as strong credit quality, provide a foundation for potential future recovery. The bank's strategic focus on diversifying its loan portfolio and enhancing shareholder value through share repurchases are positive indicators for value investors.

Explore the complete 8-K earnings release (here) from Blue Foundry Bancorp for further details.