On January 29, 2025, Benchmark Electronics Inc (BHE, Financial) released its 8-K filing detailing the financial results for the fourth quarter and fiscal year ending December 31, 2024. Benchmark Electronics Inc, a leader in product design, engineering services, and advanced manufacturing, serves industries such as aerospace & defense, medical technologies, and semiconductor capital equipment, with a significant portion of its revenue derived from the Americas.

Performance Overview and Challenges

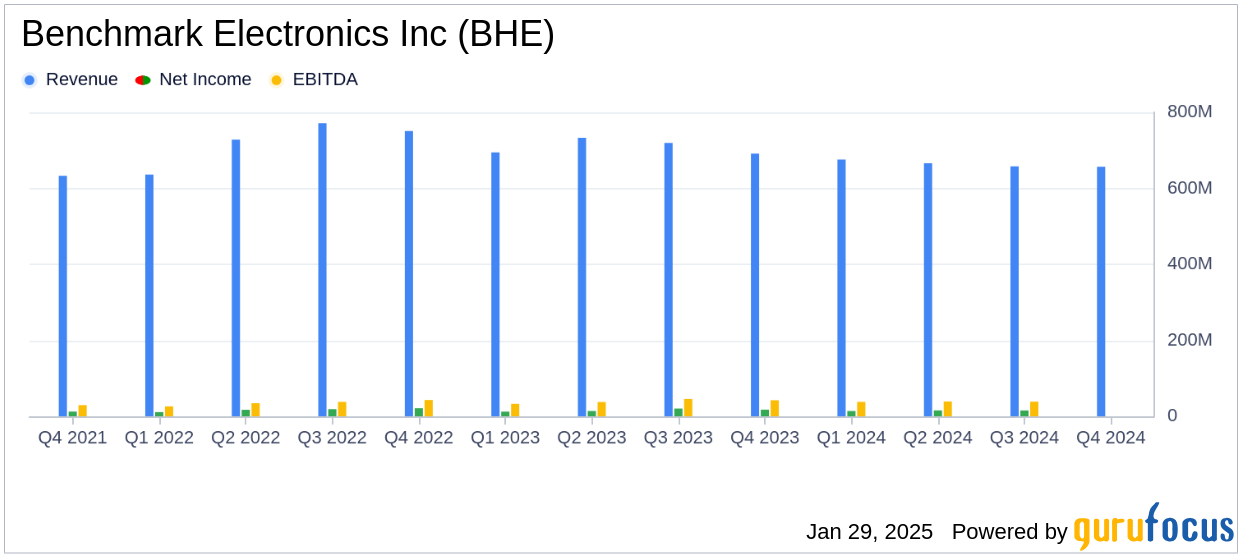

Benchmark Electronics Inc reported fourth-quarter revenue of $657 million, slightly below the analyst estimate of $660.75 million. However, the company exceeded earnings expectations with a GAAP EPS of $0.50 and a non-GAAP EPS of $0.61, surpassing the estimated EPS of $0.43. The revenue growth in sectors such as Semiconductor Capital Equipment (Semi-Cap), Aerospace & Defense (A&D), and Industrials was offset by anticipated weaknesses in Medical and Advanced Computing & Communications (AC&C).

Financial Achievements and Industry Significance

For the full year 2024, Benchmark Electronics Inc achieved revenue of $2.7 billion, driven by strong performance in the Semi-Cap and A&D sectors. The company reported a GAAP EPS of $1.72 and a non-GAAP EPS of $2.29, both surpassing the annual estimates of $1.65. The company also delivered $156 million in free cash flow, marking the seventh consecutive quarter of positive free cash flow, which is crucial for sustaining operations and funding future growth in the hardware industry.

Key Financial Metrics

Benchmark Electronics Inc's gross margin for the fourth quarter stood at 10.3% on a GAAP basis and 10.4% on a non-GAAP basis. The operating margin was 4.3% GAAP and 5.1% non-GAAP. These margins reflect the company's ability to manage costs effectively while maintaining profitability. The cash conversion cycle improved to 89 days from 98 days a year ago, indicating better efficiency in managing working capital.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Revenue (in millions) | $657 | $658 | $691 |

| Net Income (in millions) | $18 | $15 | $18 |

| GAAP EPS | $0.50 | $0.42 | $0.49 |

| Non-GAAP EPS | $0.61 | $0.57 | $0.65 |

Analysis and Future Outlook

Benchmark Electronics Inc's ability to exceed earnings expectations despite a slight revenue miss highlights its operational efficiency and strategic focus on high-growth sectors. The company's ongoing investments, such as the expansion in Penang, Malaysia, are expected to support future growth, particularly in the Semiconductor Capital Equipment sector. As stated by Jeff Benck, Benchmark’s President and CEO,

“The past year has reinforced that our strategy is working, as we have continued to drive margin expansion and free cash flow generation.”

Looking ahead, Benchmark Electronics Inc has provided guidance for the first quarter of 2025, with expected revenue between $620 million and $660 million and diluted GAAP EPS between $0.34 and $0.40. The company remains focused on maintaining financial discipline while strategically investing in growth opportunities.

Explore the complete 8-K earnings release (here) from Benchmark Electronics Inc for further details.