On January 29, 2025, Silgan Holdings Inc (SLGN, Financial) released its 8-K filing, announcing record fourth-quarter results and projecting significant earnings and free cash flow growth for 2025. Silgan Holdings, a major player in the packaging industry, manufactures approximately half of the metal food containers in North America, serving prominent clients such as Campbell Soup, Nestle, and Del Monte. The company also operates in the plastic dispensers and containers segment for personal and healthcare products, along with a closures business that produces metal and plastic lids and caps.

Performance and Challenges

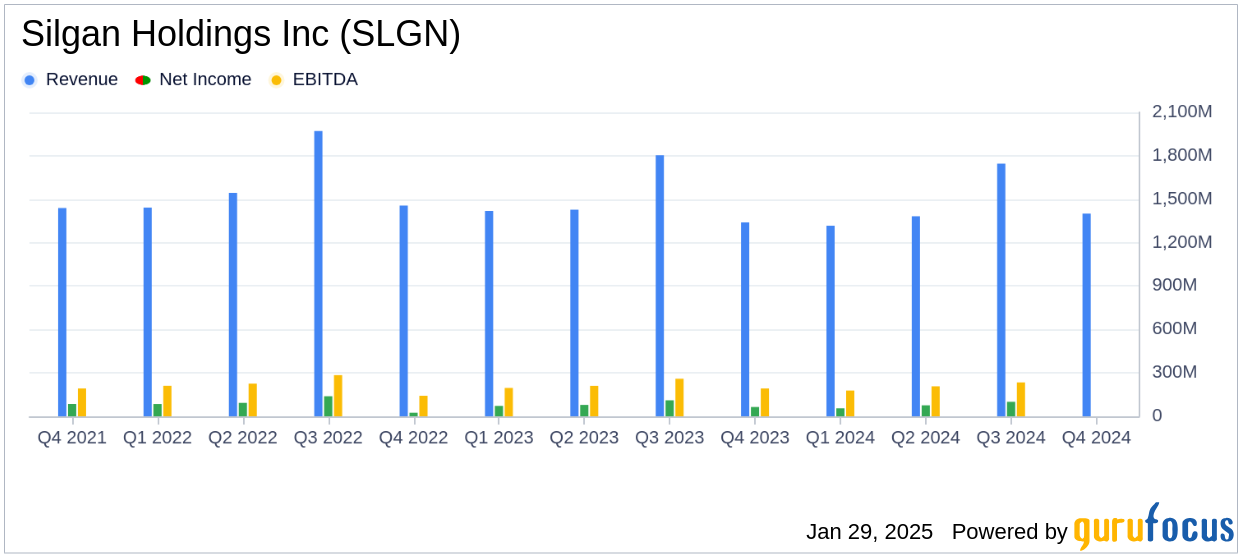

Silgan Holdings Inc (SLGN, Financial) reported net sales of $1.4 billion for the fourth quarter of 2024, marking a 5% increase from the same period in the previous year. This growth was primarily driven by the acquisition of Weener Packaging in the Dispensing and Specialty Closures segment. However, the company faced challenges in the Metal Containers segment due to a less favorable product mix.

The company's net income for the fourth quarter was $45.1 million, or $0.42 per diluted share, compared to $64.4 million, or $0.60 per diluted share, in the fourth quarter of 2023. Despite the decline in net income, the adjusted net income per diluted share reached a record $0.85, a 35% increase over the previous year's fourth quarter.

Financial Achievements

Silgan Holdings Inc (SLGN, Financial) achieved record adjusted EBIT in its Dispensing and Specialty Closures segment, with a 22% increase in net sales to $639.4 million. This growth was attributed to the Weener Packaging acquisition and a 5% increase in organic volume/mix. The company's strategic focus on expanding its dispensing business has proven successful, contributing significantly to its financial achievements.

The company's free cash flow exceeded estimates due to improved working capital management and a restructuring program. This achievement is crucial for Silgan Holdings Inc (SLGN, Financial) as it supports its strategy of investing in growth and acquisitions.

Key Financial Metrics

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Net Sales | $1.4 billion | $1.34 billion |

| Net Income | $45.1 million | $64.4 million |

| Adjusted Net Income per Diluted Share | $0.85 | $0.63 |

These metrics highlight the company's ability to maintain strong performance despite challenges in certain segments. The adjusted net income per diluted share is particularly important as it reflects the company's operational efficiency and profitability.

Analysis and Outlook

Silgan Holdings Inc (SLGN, Financial) has demonstrated resilience and strategic growth through its acquisition of Weener Packaging and focus on expanding its dispensing business. The company's ability to achieve record adjusted EBIT and free cash flow growth positions it well for future success. The anticipated double-digit earnings and free cash flow growth in 2025 further underscore its strong market position.

However, challenges remain in the Metal Containers segment, where unfavorable product mix and external factors such as severe weather have impacted performance. Addressing these challenges will be crucial for sustaining growth in the coming years.

The Silgan team delivered another year of strong results, with record fourth quarter adjusted EPS and Adjusted EBIT and double-digit free cash flow growth, and made significant progress on several important long-term strategic objectives that will benefit our Company in 2025 and beyond," said Adam Greenlee, President and CEO.

Overall, Silgan Holdings Inc (SLGN, Financial) continues to leverage its strategic initiatives and operational strengths to drive growth and create value for shareholders. The company's focus on innovation and market expansion positions it well for continued success in the packaging industry.

Explore the complete 8-K earnings release (here) from Silgan Holdings Inc for further details.