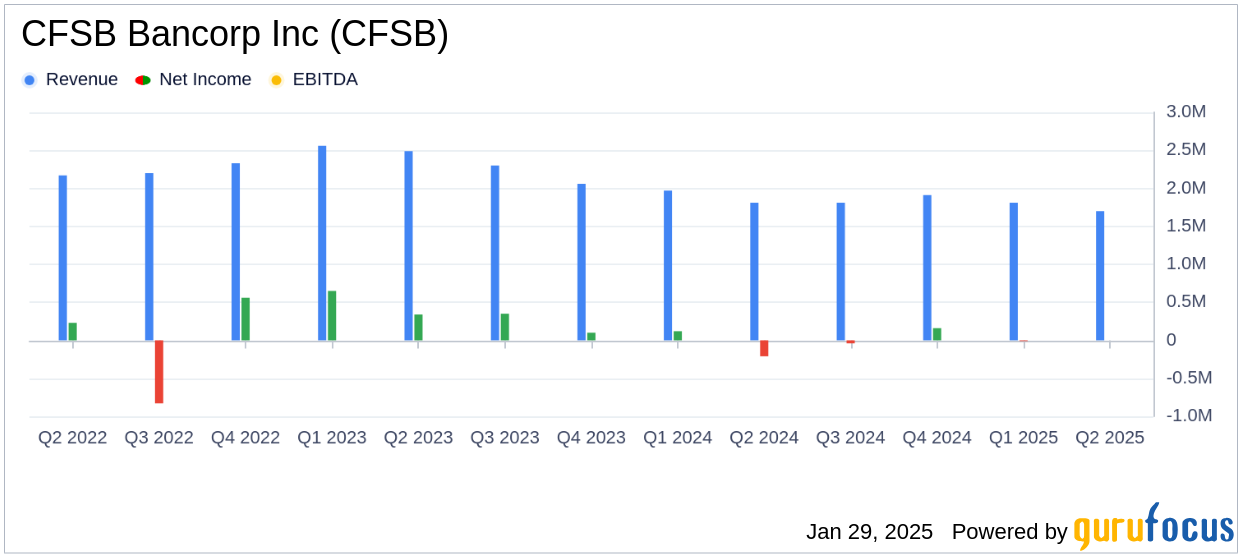

CFSB Bancorp Inc (CFSB, Financial) released its 8-K filing on January 29, 2025, reporting a net loss of $162,000, or $0.03 per share, for the fiscal second quarter ended December 31, 2024. This compares to a net loss of $6,000, or $0.00 per share, for the previous quarter and a net loss of $210,000, or $0.03 per share, for the same quarter last year. CFSB Bancorp Inc provides banking services through its offices in Quincy, Holbrook, and Weymouth, focusing on residential mortgage loans and various deposit products.

Performance and Challenges

The company's performance reflects ongoing challenges in the banking sector, particularly in managing interest rate environments and deposit costs. The net interest margin increased slightly to 1.98% from 1.92% in the previous quarter. It decreased from 2.02% in the same quarter last year. This indicates a struggle to maintain profitability amidst rising interest expenses, which increased by 35.1% year-over-year.

Financial Achievements

Despite the net loss, CFSB Bancorp Inc achieved a 2.7% increase in net interest income on a fully tax-equivalent basis, reaching $1.7 million for the quarter. This was driven by higher average yields on interest-earning assets, as the company replaced lower-yielding assets with higher-yielding ones. Such strategic asset management is crucial for banks to enhance profitability in a competitive market.

Key Financial Metrics

Interest income rose by 16.0% year-over-year, primarily due to increased interest on cash and short-term investments. However, interest expense also rose significantly, reflecting the higher cost of deposits and Federal Home Loan Bank advances. The allowance for credit losses on loans decreased to 0.83% of total loans, indicating improved asset quality and economic conditions.

| Metric | Q2 2025 | Q1 2025 | Q2 2024 |

|---|---|---|---|

| Net Interest Income | $1.7 million | $1.7 million | $1.7 million |

| Net Interest Margin | 1.98% | 1.92% | 2.02% |

| Net Loss | $(162,000) | $(6,000) | $(210,000) |

Analysis and Outlook

CFSB Bancorp Inc's financial results highlight the challenges faced by banks in managing interest rate fluctuations and deposit costs. The company's focus on loan growth and expense reductions is a positive strategy, as noted by CEO Michael E. McFarland:

Returns on interest-earning assets continue to show improvement while the cost of deposits have peaked and short-term instruments should continue to decline."This approach, coupled with favorable repricing conditions, could improve future profitability.

Overall, while CFSB Bancorp Inc faces significant challenges, its strategic initiatives and improved asset quality provide a foundation for potential recovery and growth in the coming quarters. Value investors may find interest in monitoring the company's progress in navigating these market conditions.

Explore the complete 8-K earnings release (here) from CFSB Bancorp Inc for further details.