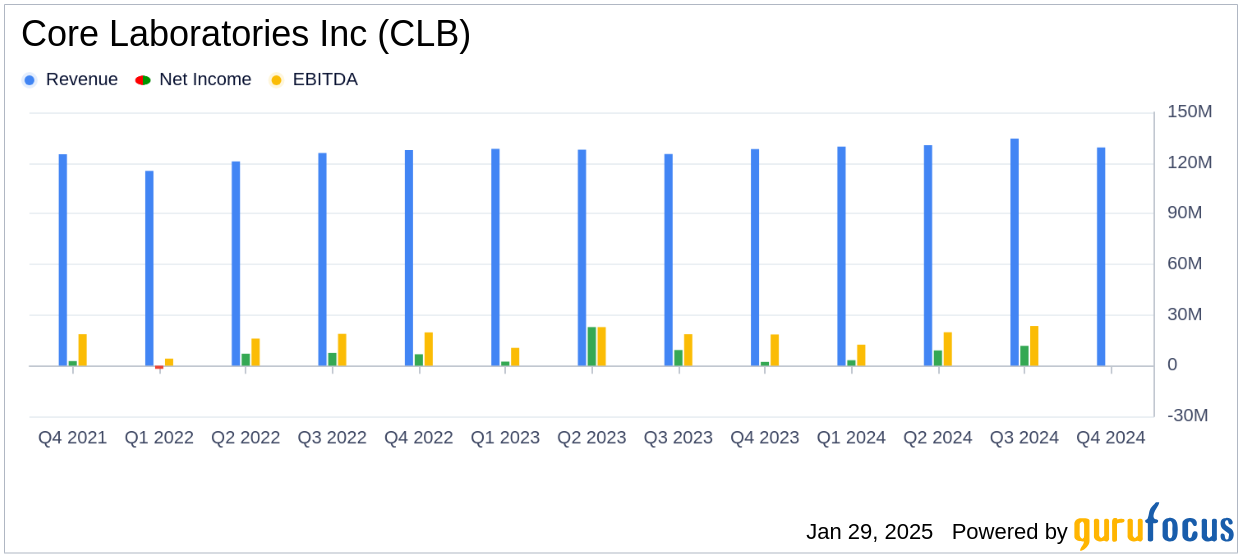

On January 29, 2025, Core Laboratories Inc (CLB, Financial) released its 8-K filing detailing its financial performance for the fourth quarter and full year of 2024. Core Laboratories, a leading provider of reservoir description and production enhancement services for the oil and gas industry, reported a fourth-quarter revenue of $129.2 million, which fell short of the analyst estimate of $132.44 million. The company's GAAP earnings per share (EPS) for the quarter was $0.15, below the estimated EPS of $0.23.

Performance and Challenges

Core Laboratories Inc (CLB, Financial) experienced a 4% sequential decline in revenue for the fourth quarter, although it saw a slight year-over-year increase. The company's operating income, excluding items, was $15.7 million, down 14% sequentially but up 4% year-over-year. The challenges faced by the company included reduced U.S. land activity and geopolitical conflicts impacting international operations. These factors are crucial as they directly affect the company's ability to generate revenue and maintain profitability in a volatile oil and gas market.

Financial Achievements

Despite the challenges, Core Laboratories Inc (CLB, Financial) achieved several financial milestones. The company reported a full-year revenue of $523.8 million, below the estimated revenue of $527.93 million, a 3% increase from 2023. The full-year GAAP EPS was $0.66, below the estimated EPS of $0.75, with an EPS, excluding items, of $0.87, reflecting a 9% growth. The company's free cash flow for the year was $43.4 million, marking an impressive increase of over 200% compared to the previous year. These achievements are significant as they demonstrate the company's resilience and ability to generate cash flow, which is vital for sustaining operations and funding future growth.

Key Financial Metrics

Core Laboratories Inc (CLB, Financial) reported a reduction in its debt leverage ratio to 1.31, the lowest in over eight years, and reduced its net debt by $11.7 million during the fourth quarter. The company repurchased 264,982 shares of common stock, valued at $4.9 million, and announced a quarterly dividend for Q1 2025. These actions highlight the company's focus on strengthening its balance sheet and returning value to shareholders.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Revenue | $129.2 million | $134.4 million | $128.2 million |

| Operating Income | $14.2 million | $19.8 million | $14.6 million |

| Net Income | $7.4 million | $11.7 million | $2.2 million |

| EPS | $0.15 | $0.25 | $0.05 |

Analysis and Outlook

Core Laboratories Inc (CLB, Financial) continues to navigate a challenging environment with a strategic focus on international growth and debt reduction. The company's investments in the Middle East are beginning to yield returns, and its proprietary technologies are enhancing production capabilities. However, the decline in U.S. onshore well completions poses a risk to future revenue growth. The company's ability to adapt to geopolitical and market challenges will be crucial in maintaining its competitive edge in the oil and gas industry.

Core’s CEO, Larry Bruno stated, “Our full year financial results delivered improvements in revenue, operating income, operating margins, free cash flow and earnings per share. Our performance was driven by resilient demand for our Reservoir Description services which continued to grow across our international laboratory network despite headwinds from reduced U.S. land activity and disruptions caused by on-going geopolitical conflicts and associated sanctions.”

Core Laboratories Inc (CLB, Financial) remains committed to executing its strategic business priorities, including further debt reduction and pursuing growth opportunities. The company's focus on maximizing return on invested capital and free cash flow is expected to support long-term shareholder value.

Explore the complete 8-K earnings release (here) from Core Laboratories Inc for further details.