The Cigna Group (CI, Financial) released its 8-K filing on January 30, 2025, detailing its financial performance for the fourth quarter and full year 2024. The global health company, known for its pharmacy benefit management and health insurance services, reported a significant increase in total revenues but faced challenges with earnings per share (EPS) due to higher medical costs.

Company Overview

The Cigna Group primarily offers pharmacy benefit management and health insurance services. The company's operations were significantly expanded by its 2018 merger with Express Scripts. It serves a wide range of clients, including health insurance plans, employers, and the Department of Defense. The company operates mainly in the U.S., covering 17 million U.S. and 2 million international medical members as of September 2024.

Financial Performance and Challenges

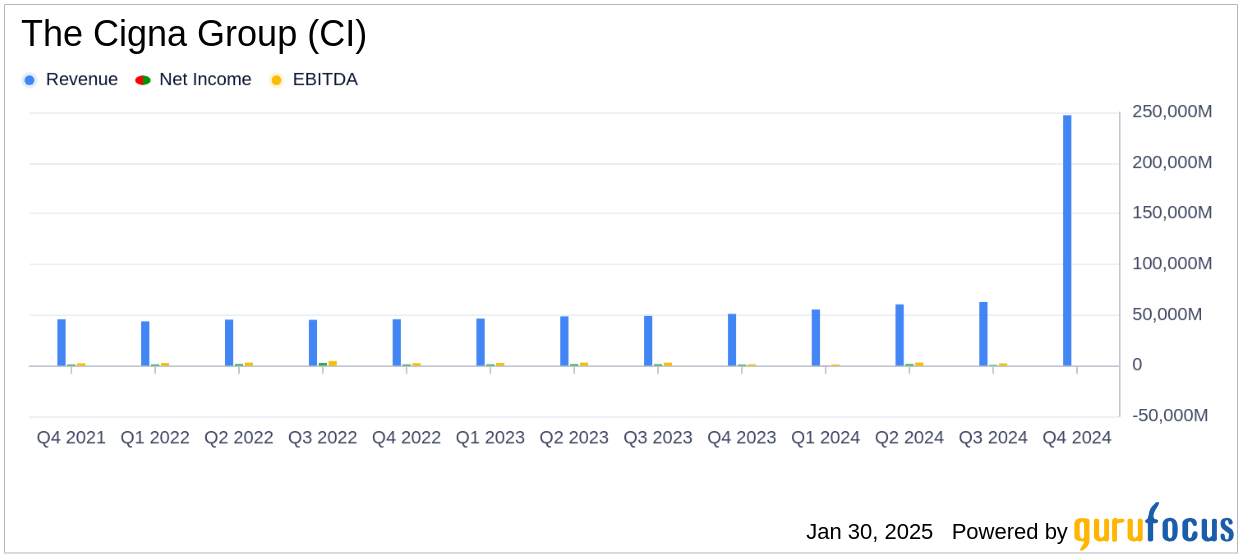

The Cigna Group reported a 27% increase in total revenues for 2024, reaching $247.1 billion. However, shareholders' net income for the year was $3.4 billion, or $12.12 per share, which fell short of the annual estimated EPS of $14.57. This shortfall was partly due to a non-cash after-tax investment loss of $2.7 billion related to the impairment of VillageMD equity securities.

In the fourth quarter of 2024, shareholders' net income was $1.4 billion, or $5.13 per share, compared to $1.0 billion, or $3.49 per share, in the same quarter of 2023. Despite this increase, the adjusted income from operations for the fourth quarter was $1.8 billion, or $6.64 per share, down from $2.0 billion, or $6.79 per share, in the previous year. The decline was primarily due to higher stop loss medical costs impacting Cigna Healthcare.

Key Financial Achievements

The Cigna Group's adjusted income from operations for 2024 was $7.7 billion, or $27.33 per share, surpassing the previous year's $7.4 billion, or $25.09 per share. This achievement highlights the company's ability to generate substantial operational income despite challenges in specific segments.

The Board of Directors declared an 8% increase in the quarterly dividend to $1.51 per share and approved a $6.0 billion increase in share repurchase authorization, bringing the total authorization to $10.3 billion. These actions reflect the company's commitment to returning value to shareholders.

Segment Performance and Strategic Outlook

The Evernorth Health Services segment, which includes Pharmacy Benefit Services and Specialty and Care Services, showed strong contributions, particularly within Specialty and Care Services. However, Cigna Healthcare faced challenges due to higher stop loss medical costs.

“While higher medical costs in our stop loss product impacted fourth quarter earnings, we are taking corrective actions to address these near-term pressures and we are simultaneously taking steps to further advance our long-term growth strategy,” said David M. Cordani, chairman and CEO of The Cigna Group.

Financial Metrics and Analysis

| Metric | 2024 | 2023 |

|---|---|---|

| Total Revenues | $247.1 billion | Not Provided |

| Shareholders' Net Income | $3.4 billion | $5.2 billion |

| Adjusted Income from Operations | $7.7 billion | $7.4 billion |

The company's financial metrics indicate robust revenue growth but highlight the impact of increased medical costs on net income. The adjusted income from operations provides a clearer picture of the company's operational efficiency, excluding one-time losses.

Conclusion

The Cigna Group's 2024 financial results demonstrate strong revenue growth and operational income, despite facing challenges with medical costs and investment losses. The company's strategic initiatives and increased shareholder returns through dividends and share repurchases position it for potential future growth. Investors and stakeholders will be keenly watching how The Cigna Group navigates these challenges and leverages its strengths in the coming year.

Explore the complete 8-K earnings release (here) from The Cigna Group for further details.