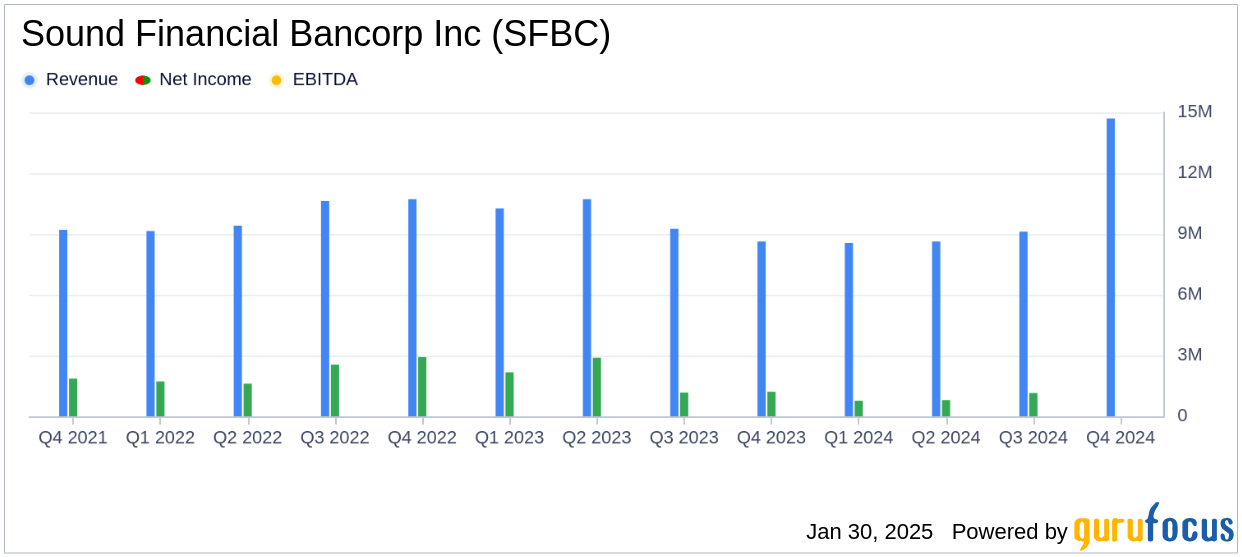

Sound Financial Bancorp Inc (SFBC, Financial) released its 8-K filing on January 30, 2025, reporting a net income of $1.9 million for the quarter ended December 31, 2024, translating to $0.74 diluted earnings per share. This marks an improvement from the $1.2 million, or $0.45 diluted earnings per share, recorded in the previous quarter and the $1.2 million, or $0.47 diluted earnings per share, from the same quarter last year.

Sound Financial Bancorp Inc operates as the holding company for Sound Community Bank, offering a range of traditional banking and financial services. The bank focuses on attracting retail and commercial deposits and invests these funds in various loan products, including residential, commercial, and consumer loans.

Performance Highlights and Challenges

The company reported a notable increase in net interest income, which rose by $347 thousand, or 4.4%, to $8.2 million compared to the previous quarter. This increase was primarily driven by a reduction in deposit costs and an improved net interest margin, which rose by 15 basis points to 3.13%. However, total assets decreased by $107.3 million, or 9.7%, to $993.6 million, reflecting strategic decisions to reduce asset size for operational flexibility.

Challenges remain, particularly in managing nonperforming loans, which, despite a decrease of 11.8% from the previous quarter, increased by 110.7% year-over-year. The loans-to-deposits ratio stood at 108%, indicating a high level of loan issuance relative to deposits, which could pose liquidity challenges.

Financial Achievements and Strategic Moves

Sound Financial Bancorp Inc's strategic focus on reducing funding costs and controlling expenses has yielded positive results. The company successfully decreased its total noninterest expense by 8.1% compared to the previous quarter. Additionally, the bank's capital levels remain robust, categorizing it as "well-capitalized" under regulatory standards.

The Bank ended the year with many positives, including a 15-basis-point increase in net interest margin compared to the third quarter of 2024. This was largely due to our significant progress in reducing deposit costs, which fell by 16 basis points, remarked Laurie Stewart, President and Chief Executive Officer.

Income Statement and Balance Sheet Overview

Net interest income for the quarter increased by 8.6% year-over-year, driven by higher average yields on loans and investments. Interest income on loans rose by 1.5% from the previous quarter, reflecting new loan originations at higher rates. However, total deposits decreased by 9.9% from the previous quarter, primarily due to strategic movements of reciprocal deposits.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Income | $1.9 million | $1.2 million | $1.2 million |

| Net Interest Income | $8.2 million | $7.9 million | $7.6 million |

| Total Assets | $993.6 million | $1.10 billion | $995.2 million |

Analysis and Future Outlook

Sound Financial Bancorp Inc's performance in Q4 2024 reflects effective cost management and strategic asset reduction, positioning the company for continued operational flexibility. The increase in net interest margin and reduction in nonperforming loans are positive indicators of financial health. However, the decrease in total deposits and the high loans-to-deposits ratio warrant careful monitoring to ensure liquidity and stability.

Overall, Sound Financial Bancorp Inc's strategic initiatives and financial discipline have set a solid foundation for future growth, with a focus on maintaining capital strength and enhancing operational efficiencies.

Explore the complete 8-K earnings release (here) from Sound Financial Bancorp Inc for further details.