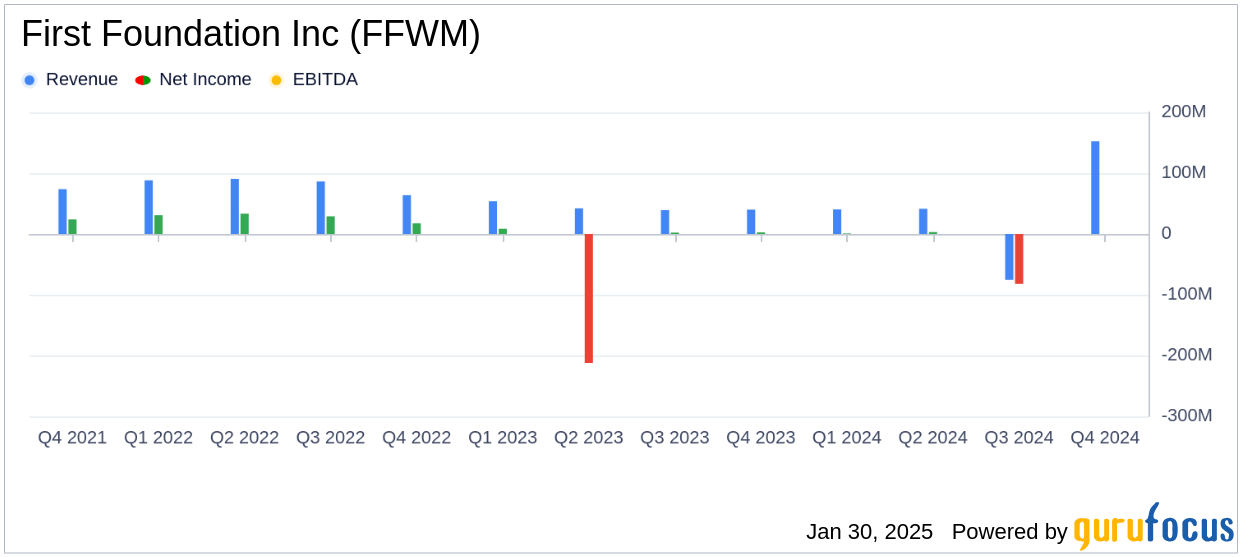

On January 30, 2025, First Foundation Inc (FFWM, Financial) released its 8-K filing detailing its financial results for the fourth quarter and full year of 2024. The company, a financial services provider specializing in investment management and financial planning, reported a net loss attributable to common shareholders of $14.1 million, or $0.17 per share, for the fourth quarter. This result fell short of the analyst estimate of $0.04 earnings per share. For the full year, the net loss was $92.4 million, or $1.41 per share, compared to the annual estimate of a $0.91 loss per share.

Company Overview and Strategic Moves

First Foundation Inc is engaged in providing comprehensive financial services, including banking and wealth management, to high-net-worth individuals and various institutions. The company has been actively managing its loan portfolio, selling approximately $489 million in multifamily loans to reduce exposure to low coupon fixed-rate loans and concentration in multifamily commercial real estate loans.

Performance and Challenges

The company's performance was marked by a significant provision for loan losses of $20.1 million, increasing the allowance for credit losses to 0.41% of total loans held for investment. This provision reflects the company's cautious approach amid challenging market conditions. The net loss for the quarter and year highlights the impact of strategic adjustments, including a $117.5 million lower of cost or market (LOCOM) adjustment related to the reclassification of loans.

Financial Achievements and Industry Context

Despite the losses, First Foundation Inc achieved a gain of $4.4 million from the sale of loans, contributing to noninterest income. The company's efforts to manage its loan portfolio and reduce high-cost brokered deposits are crucial in maintaining financial stability. In the banking industry, such strategic moves are essential to navigate interest rate fluctuations and credit risks.

Key Financial Metrics

Net interest income for the quarter was $51.3 million, an increase from $49.1 million in the previous quarter. The net interest margin improved to 1.58%, reflecting a decrease in interest expense and a strategic focus on optimizing interest-earning assets. However, the efficiency ratio rose to 103.1%, indicating higher noninterest expenses relative to revenue.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Interest Income | $51.3 million | $49.1 million | $42.5 million |

| Net Interest Margin | 1.58% | 1.50% | 1.36% |

| Efficiency Ratio | 103.1% | 98.1% | 98.5% |

Analysis and Outlook

First Foundation Inc's financial results underscore the challenges faced in the current economic environment, including rising interest rates and credit risks. The company's strategic focus on reducing exposure to low-yield assets and managing deposit costs is critical for future stability. However, the increased provision for loan losses and net charge-offs highlight ongoing credit quality concerns.

Overall, First Foundation Inc's efforts to realign its portfolio and manage costs are essential steps in navigating the complex financial landscape. Investors and stakeholders will be closely monitoring the company's ability to improve profitability and maintain asset quality in the coming quarters.

Explore the complete 8-K earnings release (here) from First Foundation Inc for further details.