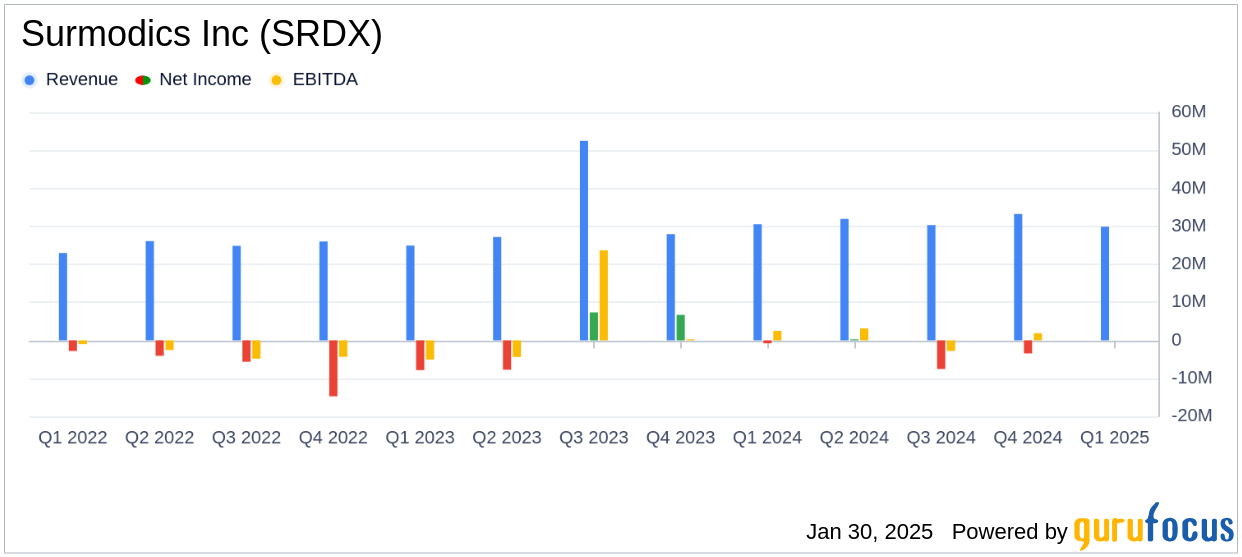

On January 30, 2025, Surmodics Inc (SRDX, Financial) released its 8-K filing detailing the financial results for the first quarter of fiscal year 2025, ending December 31, 2024. Surmodics Inc, a provider of performance coating technologies for intravascular medical devices and in vitro diagnostic components, reported a total revenue of $29.9 million, which represents a 2% decrease year-over-year. This figure falls short of the analyst estimate of $33.37 million. The company also reported a GAAP net loss of $3.7 million, or $(0.26) per diluted share, compared to an estimated loss of $(0.16) per share.

Company Overview and Segment Performance

Surmodics Inc operates primarily through two segments: Medical Device and In Vitro Diagnostics. The Medical Device segment, which generates the majority of the company's revenue, focuses on manufacturing and licensing performance coatings and vascular intervention medical devices. The In Vitro Diagnostics segment provides chemical and biological components for diagnostic tests. The company derives significant revenue from its domestic market.

Financial Performance and Challenges

The first quarter of fiscal 2025 presented several challenges for Surmodics Inc. The company's total revenue decreased by $0.6 million compared to the same period last year. The Medical Device segment saw a slight revenue decline of 1% to $23.3 million, while the In Vitro Diagnostics segment experienced a 5% decrease to $6.6 million. The decline in Medical Device revenue was primarily due to a reduction in SurVeil DCB commercial revenue, which had benefited from initial stocking shipments in the prior year.

Financial Achievements and Industry Context

Despite the challenges, Surmodics Inc achieved growth in performance coatings royalty revenue and sales of its Pounce thrombectomy device platforms. The performance coatings royalties and license fee revenue increased by 14% to $9.4 million, driven by the continued growth in customer utilization of the company's Serene™ hydrophilic coating. This growth is significant in the medical devices industry, where innovation and product differentiation are crucial for maintaining competitive advantage.

Key Financial Metrics

The company's product gross profit decreased by 9% to $9.1 million, although the product gross margin improved to 55.1% from 53.2% in the previous year, indicating a favorable product mix. Operating costs and expenses, excluding product costs, increased by 13% to $25.0 million, largely due to merger-related charges associated with the pending acquisition by GTCR.

| Metric | Q1 FY2025 | Q1 FY2024 | Change |

|---|---|---|---|

| Total Revenue | $29.9 million | $30.6 million | -2% |

| GAAP Net Loss | $(3.7) million | $(0.8) million | N/A |

| Adjusted EBITDA | $3.6 million | $3.9 million | -8% |

Analysis and Future Outlook

Surmodics Inc's performance in the first quarter of fiscal 2025 highlights the challenges faced by the company, including decreased revenue and increased net loss. The pending acquisition by GTCR and the associated merger-related costs have also impacted the company's financials. However, the growth in performance coatings royalties and the expansion of the Pounce thrombectomy platform demonstrate the company's potential for future growth in the medical devices sector.

“We were pleased with the efforts of our team during the first quarter of fiscal 2025, which enabled Surmodics to deliver strong growth in revenue from both our medical device performance coatings royalties and sales of our Pounce thrombectomy platforms,” said Gary Maharaj, President and CEO of Surmodics, Inc.

As Surmodics Inc navigates these challenges, the company's focus on innovation and strategic partnerships will be crucial in driving future growth and improving financial performance.

Explore the complete 8-K earnings release (here) from Surmodics Inc for further details.