On January 30, 2025, NetScout Systems Inc (NTCT, Financial) released its 8-K filing detailing its financial performance for the third quarter of fiscal year 2025, ending December 31, 2024. The company, known for its service assurance and cybersecurity solutions, reported a robust quarter with revenue and earnings surpassing expectations, driven by strategic customer orders.

Company Overview

NetScout Systems Inc is a provider of service assurance and cybersecurity solutions to enterprise and government networks. Its proprietary adaptive service intelligence technology aids customers in monitoring performance issues and identifying network-based security threats. The company generates revenue primarily from network management tools and security solutions, with the USA being its largest market, followed by Europe, Asia, and the rest of the world.

Performance Highlights

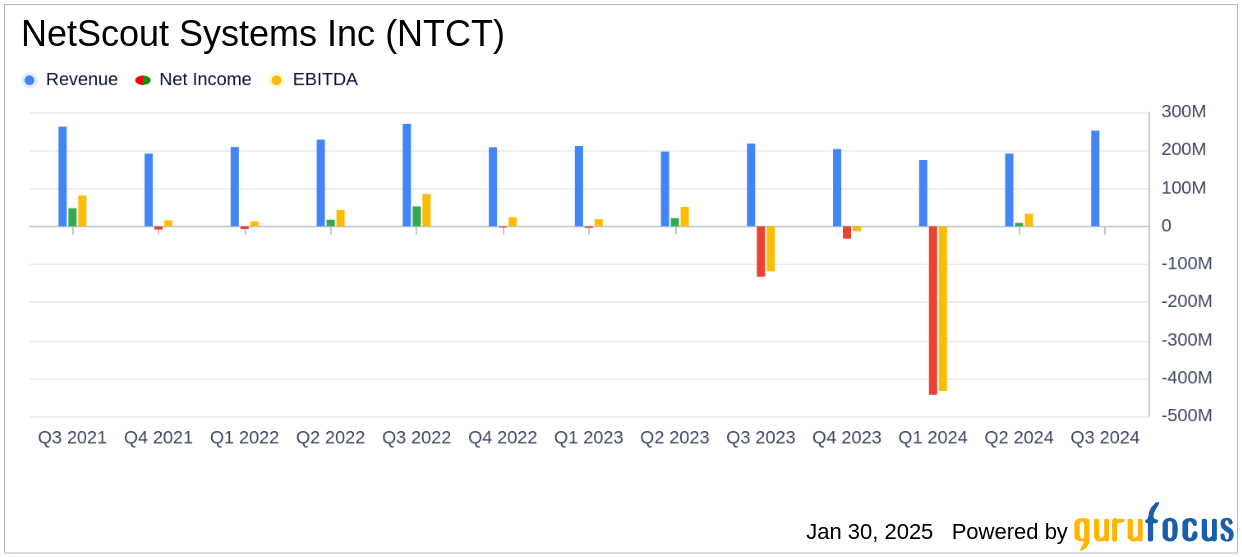

NetScout Systems Inc reported total revenue of $252.0 million for Q3 FY25, significantly exceeding the analyst estimate of $221.42 million. This marks an increase from $218.1 million in the same quarter of the previous year. The company's earnings per share (EPS) also outperformed expectations, with a GAAP EPS of $0.67 and a non-GAAP EPS of $0.94. Both figures surpassed the estimated EPS of $0.43.

Financial Achievements and Challenges

The company's strong performance was attributed to early customer orders, which were initially expected in the fourth quarter but were realized in the third quarter. This strategic shift provided enhanced visibility and confidence in achieving full fiscal year objectives. However, the company faces challenges, including restructuring charges and a significant goodwill impairment charge, which impacted its overall financial health.

Income Statement and Key Metrics

NetScout's product revenue for Q3 FY25 was $128.2 million, accounting for 51% of total revenue, up from $95.8 million in Q3 FY24. Service revenue was $123.8 million, slightly up from $122.2 million in the previous year. The company's GAAP income from operations was $61.7 million, a significant improvement from a loss of $134.4 million in Q3 FY24, which included a goodwill impairment charge.

| Metric | Q3 FY25 | Q3 FY24 |

|---|---|---|

| Total Revenue | $252.0 million | $218.1 million |

| Product Revenue | $128.2 million | $95.8 million |

| Service Revenue | $123.8 million | $122.2 million |

| GAAP Net Income | $48.8 million | $(132.6) million |

| Non-GAAP Net Income | $68.3 million | $52.0 million |

Balance Sheet and Cash Flow

As of December 31, 2024, NetScout reported cash and cash equivalents of $427.9 million, slightly up from $424.1 million as of March 31, 2024. The company did not repurchase any shares during the quarter and plans to repay $75.0 million of outstanding debt in the fourth quarter.

Analysis and Outlook

NetScout's ability to exceed revenue and earnings expectations highlights its strategic positioning in the cybersecurity and service assurance markets. The early realization of customer orders not only boosted Q3 performance but also provided a solid foundation for future quarters. However, the company must navigate restructuring challenges and manage its goodwill impairment effectively to sustain its growth trajectory.

“Our Q3 fiscal year 2025 revenue and earnings results exceeded our expectations with strong performance across both our Cybersecurity and Service Assurance product lines,” stated Anil Singhal, NETSCOUT’s President & CEO.

NetScout's outlook for fiscal year 2025 remains optimistic, with revenue expected to range between $810 million and $820 million, maintaining the midpoint of previous guidance. The company continues to focus on leveraging its 'Visibility Without Borders' platform to address the evolving challenges in the digital landscape.

Explore the complete 8-K earnings release (here) from NetScout Systems Inc for further details.