On January 30, 2025, Oshkosh Corp (OSK, Financial) released its 8-K filing detailing its financial performance for the fourth quarter and full year of 2024. The company reported a notable increase in both earnings and revenue, surpassing analyst estimates. Oshkosh Corp, a leading producer of access equipment, specialty vehicles, and military trucks, serves diverse markets and is recognized as a market leader in North America and globally for certain products.

Financial Performance and Achievements

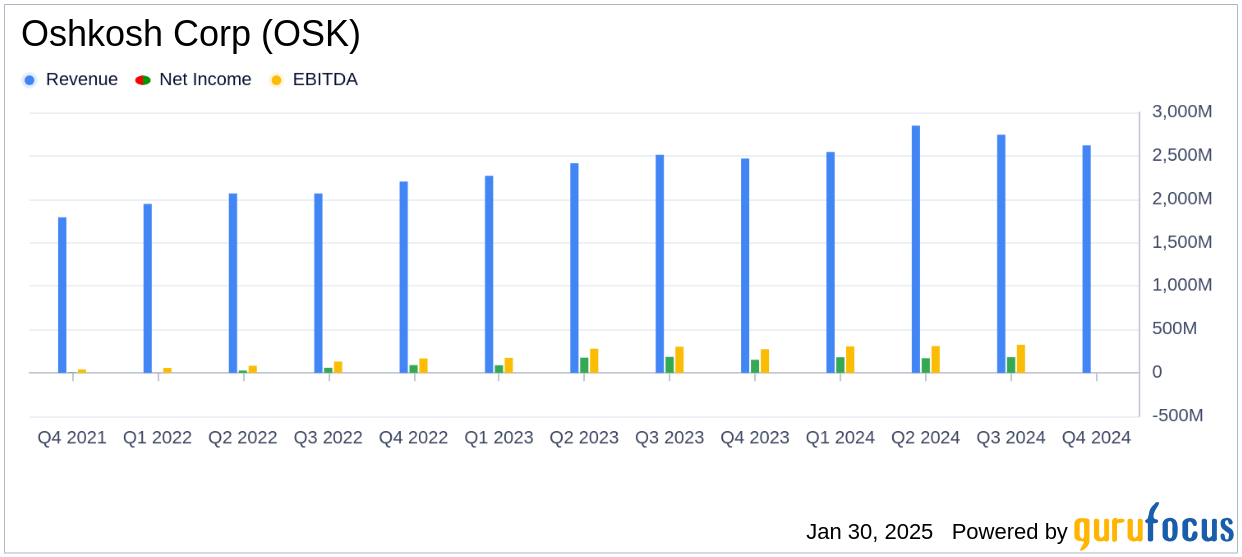

Oshkosh Corp reported fourth-quarter sales of $2.62 billion, marking a 6% increase from the previous year. This figure exceeded the analyst revenue estimate of $2.418 billion. The company's earnings per share (EPS) for the quarter stood at $2.33, surpassing the estimated EPS of $2.11. Adjusted EPS was reported at $2.58, reflecting strong operational performance.

For the full year 2024, Oshkosh Corp achieved net sales of $10.76 billion, a significant rise from $9.66 billion in 2023. The annual EPS was $10.35, with an adjusted EPS of $11.74, both exceeding the annual estimates of $10.11 EPS and $10.545 billion in revenue. The company also announced an 11% increase in its quarterly cash dividend to $0.51 per share, highlighting its commitment to returning value to shareholders.

Segment Analysis and Challenges

The Access segment reported sales of $1.16 billion for Q4 2024, remaining relatively flat compared to the previous year. However, operating income decreased by 11.9% due to unfavorable price/cost dynamics. The Vocational segment experienced a robust 19.8% increase in sales to $880.6 million, driven by improved pricing and sales volume. Operating income for this segment surged by 149.8%.

The Defense segment faced challenges with flat sales at $559.1 million, impacted by changes in cumulative catch-up adjustments on contracts. Operating income for the Defense segment decreased significantly by 75.8%, primarily due to higher costs and unfavorable product mix.

Key Financial Metrics and Analysis

Oshkosh Corp's consolidated operating income for Q4 2024 increased by 3.9% to $223.9 million, driven by higher sales volume and favorable pricing. The company's balance sheet showed total assets of $9.48 billion, with cash and cash equivalents increasing to $204.9 million from $125.4 million in the previous year.

The company's cash flow from operating activities was $550.1 million for 2024, reflecting strong cash generation capabilities. Despite challenges in the Defense segment, Oshkosh Corp's overall performance was bolstered by its strategic focus on the Vocational and Access segments.

“We delivered another strong quarter as our team grew fourth quarter adjusted earnings per share to $2.58, leading to full year 2024 adjusted earnings per share of $11.74, an increase of 17.6 percent over the prior year,” said John Pfeifer, president and chief executive officer of Oshkosh Corporation.

Outlook and Strategic Initiatives

Looking ahead, Oshkosh Corp has initiated its 2025 earnings per share guidance of approximately $10.30 and adjusted EPS guidance of approximately $11.00, with projected net sales of around $10.6 billion. The company remains optimistic about its growth prospects, particularly in the Vocational and Defense segments, while navigating softer market conditions in the Access segment.

Oshkosh Corp's strategic initiatives, including the production of the Next Generation Delivery Vehicle (NGDV) for the US Postal Service, are expected to contribute positively to its future performance. The company's strong backlog and focus on innovation position it well for continued success in the competitive Farm & Heavy Construction Machinery industry.

Explore the complete 8-K earnings release (here) from Oshkosh Corp for further details.