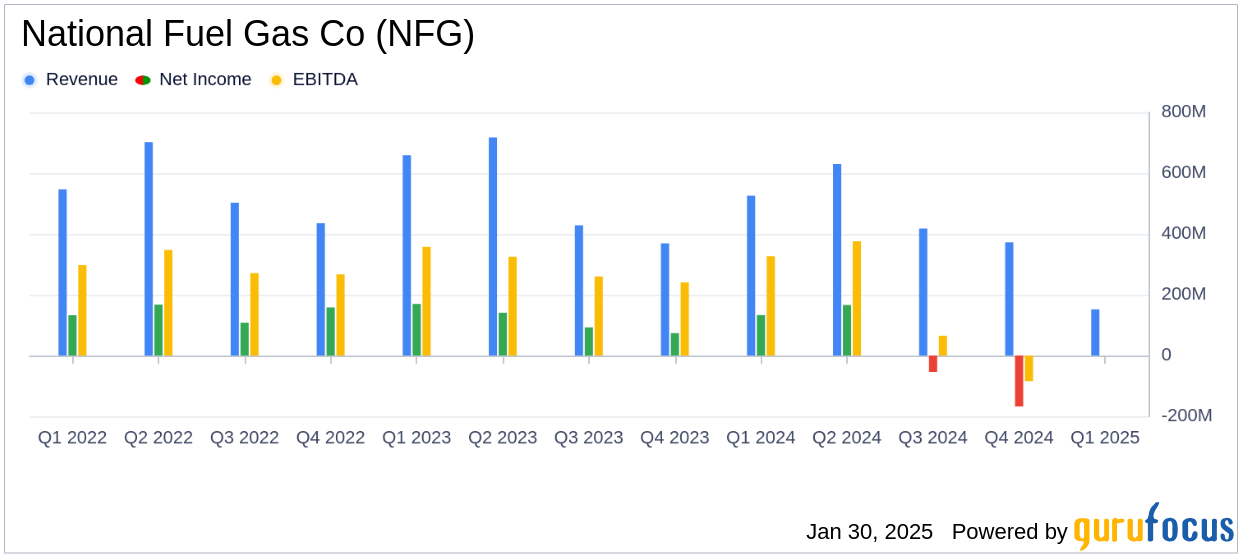

National Fuel Gas Co (NFG, Financial) released its 8-K filing on January 30, 2025, detailing its financial performance for the first quarter of fiscal 2025. The company reported a GAAP net income of $45.0 million, or $0.49 per share, which includes significant non-cash impairment charges. However, the adjusted operating results showed a robust performance with earnings of $151.9 million, or $1.66 per share, exceeding the analyst estimate of $1.56 per share.

Company Overview

National Fuel Gas Co is a diversified energy company involved in the production, gathering, transportation, distribution, and marketing of natural gas. The company operates primarily in the United States, with its major revenue generated from the Exploration and Production segment, focusing on natural gas in the Appalachian region.

Performance and Challenges

The company's GAAP net income was significantly impacted by $104.6 million in non-cash, after-tax impairment charges in the Exploration & Production segment. This resulted in a decrease from the previous year's GAAP net income of $133.0 million, or $1.44 per share. Despite these challenges, the adjusted operating results increased by 14% compared to the prior year, highlighting the company's resilience and operational efficiency.

Financial Achievements

National Fuel Gas Co's adjusted operating results per share of $1.66 surpassed the analyst estimate of $1.56, demonstrating strong performance across its segments. The Pipeline & Storage segment saw a 35% increase in net income, driven by a rate case settlement, while the Utility segment's net income rose by 22% due to a rate proceeding settlement in New York.

Income Statement and Key Metrics

The company's adjusted operating results were bolstered by hedging-related gains in the Exploration and Production segment, which offset a decrease in natural gas prices. The Pipeline & Storage segment benefited from increased transportation and storage rates, contributing to higher operating revenues.

| Segment | GAAP Earnings (in thousands) | Adjusted EBITDA (in thousands) |

|---|---|---|

| Exploration and Production | $(46,777) | $156,645 |

| Pipeline and Storage | $32,454 | $70,953 |

| Gathering | $27,145 | $51,936 |

| Utility | Increased by 22% | Not specified |

Analysis and Outlook

National Fuel Gas Co's strategic focus on operational efficiency and hedging strategies has positioned it well despite the challenges posed by impairment charges. The company's ability to exceed adjusted EPS estimates and increase its fiscal 2025 guidance range to $6.50 to $7.00 per share reflects confidence in its future performance. The ongoing improvements in natural gas prices and operational efficiencies are expected to drive continued growth.

David P. Bauer, President and CEO, stated, "Fiscal 2025 is off to a great start for National Fuel, with each business contributing to our strong consolidated adjusted operating results."

Overall, National Fuel Gas Co's first quarter results highlight its resilience and strategic positioning in the energy sector, making it a company to watch for value investors seeking opportunities in the natural gas industry.

Explore the complete 8-K earnings release (here) from National Fuel Gas Co for further details.