On January 30, 2025, LCNB Corp (LCNB, Financial) released its 8-K filing, showcasing a significant improvement in its financial performance for the fourth quarter of 2024. The company, a financial institution providing commercial and personal banking services in the United States, reported a GAAP net income of $0.44 per diluted share, exceeding the analyst estimate of $0.32. This performance highlights the success of LCNB's strategic acquisitions and balance sheet optimization efforts.

Performance Highlights and Strategic Achievements

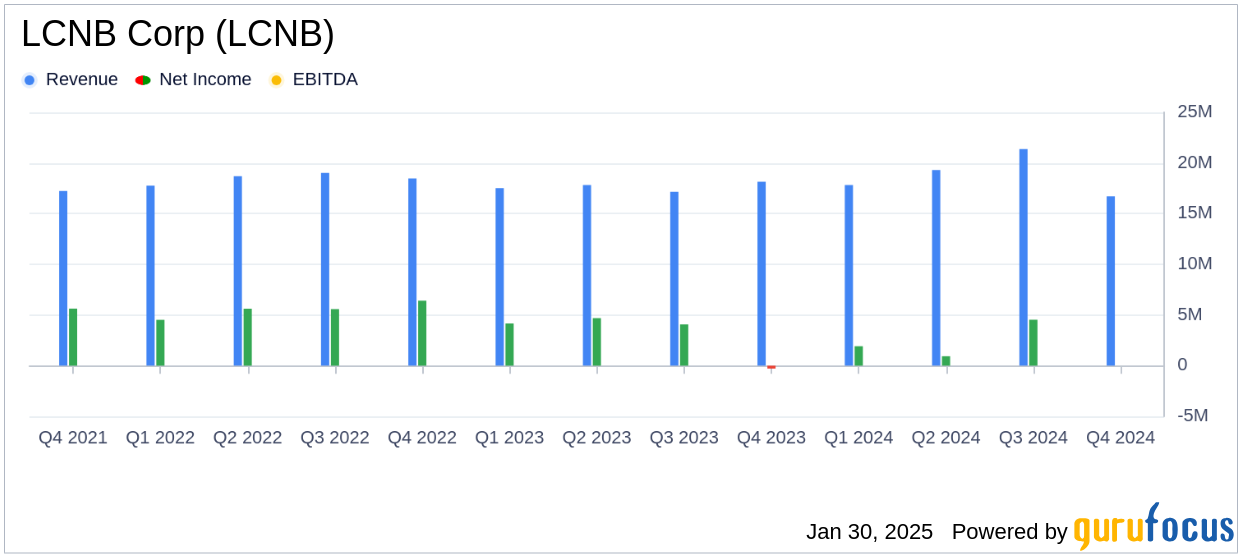

LCNB Corp's Q4 2024 results reflect a 41.9% increase in GAAP net income quarter-over-quarter, driven by recent acquisitions and strong operating performance. The company's return on average assets was 1.04% for the quarter, indicating efficient asset utilization. LCNB Wealth Management also reported a 15.1% year-over-year increase in assets, reaching a record $1.38 billion, which contributed to robust fiduciary income of $2.3 million for the quarter.

Eric Meilstrup, President and CEO of LCNB, commented on the results, stating,

“As expected, our 2024 fourth-quarter results demonstrate the success of our multi-year growth plan, strategic improvements we have made to our balance sheet, and the hard work and dedication of LCNB’s associates.”

Financial Metrics and Income Statement Overview

LCNB Corp reported a net income of $6.1 million for Q4 2024, a significant turnaround from a net loss of $(293,000) in the same period last year. Earnings per share for the quarter were $0.44, compared to a loss of $(0.02) last year. For the full year, net income was $13.5 million, with earnings per share of $0.97, exceeding the annual estimate of $0.85.

Net interest income for Q4 2024 was $16.7 million, up from $14.7 million in the previous year, driven by higher loan volumes and rates. The tax equivalent net interest margin improved to 3.22% from 2.99% last year. Non-interest income also saw a substantial increase, reaching $6.0 million for the quarter, up from $4.6 million, primarily due to net gains from loan sales and increased fiduciary income.

Balance Sheet and Asset Quality

LCNB Corp's total assets grew to $2.31 billion as of December 31, 2024, a 0.7% increase from the previous year. Total deposits rose by 3.0% to $1.88 billion. The company's asset quality remains strong, with non-performing assets to total assets at 0.20%. The equity to assets ratio improved by 70 basis points to 10.97% year-over-year.

LCNB's provision for credit losses was $649,000 for Q4 2024, down from $2.2 million in the previous year. Net charge-offs were $595,000, or 0.14% of average loans, compared to $102,000, or 0.02% last year, indicating a slight increase in credit losses.

Analysis and Future Outlook

LCNB Corp's strong Q4 performance underscores the effectiveness of its strategic initiatives, including successful acquisitions and balance sheet optimization. The company's ability to exceed analyst estimates and improve key financial metrics positions it well for future growth. However, the increase in non-performing loans and net charge-offs warrants close monitoring as the company navigates potential challenges in maintaining asset quality.

Overall, LCNB Corp's financial results for Q4 2024 demonstrate a solid foundation for continued profitability and growth in 2025, supported by its expanded banking platform and strong asset management capabilities.

Explore the complete 8-K earnings release (here) from LCNB Corp for further details.