On January 30, 2025, Meta Platforms Inc, the world's largest social media conglomerate, filed its annual 10-K report, revealing a financial landscape that investors and market analysts eagerly dissect. With a user base nearing 4 billion monthly active users, Meta's financial tables reflect a company at the forefront of digital innovation and connectivity. The firm's revenue streams are predominantly derived from its advertising business, capitalizing on the extensive data collected across its Family of Apps. Despite the substantial investments in its Reality Labs segment, it remains a minor contributor to the overall sales. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as disclosed in the recent SEC filing, providing a comprehensive overview for stakeholders.

Strengths

Market Leadership and User Base: Meta Platforms Inc's unparalleled market leadership is anchored by its massive global user base. With nearly 4 billion monthly active users, Meta's social media applications, including Facebook, Instagram, Messenger, and WhatsApp, serve as the cornerstone of digital communication and business for a significant portion of the world's population. This extensive reach provides Meta with a vast pool of data, which is leveraged to offer targeted advertising solutions, yielding a high average revenue per person (ARPP). The company's dominance is further solidified by its innovative use of artificial intelligence (AI) across its platforms, enhancing user experience and engagement.

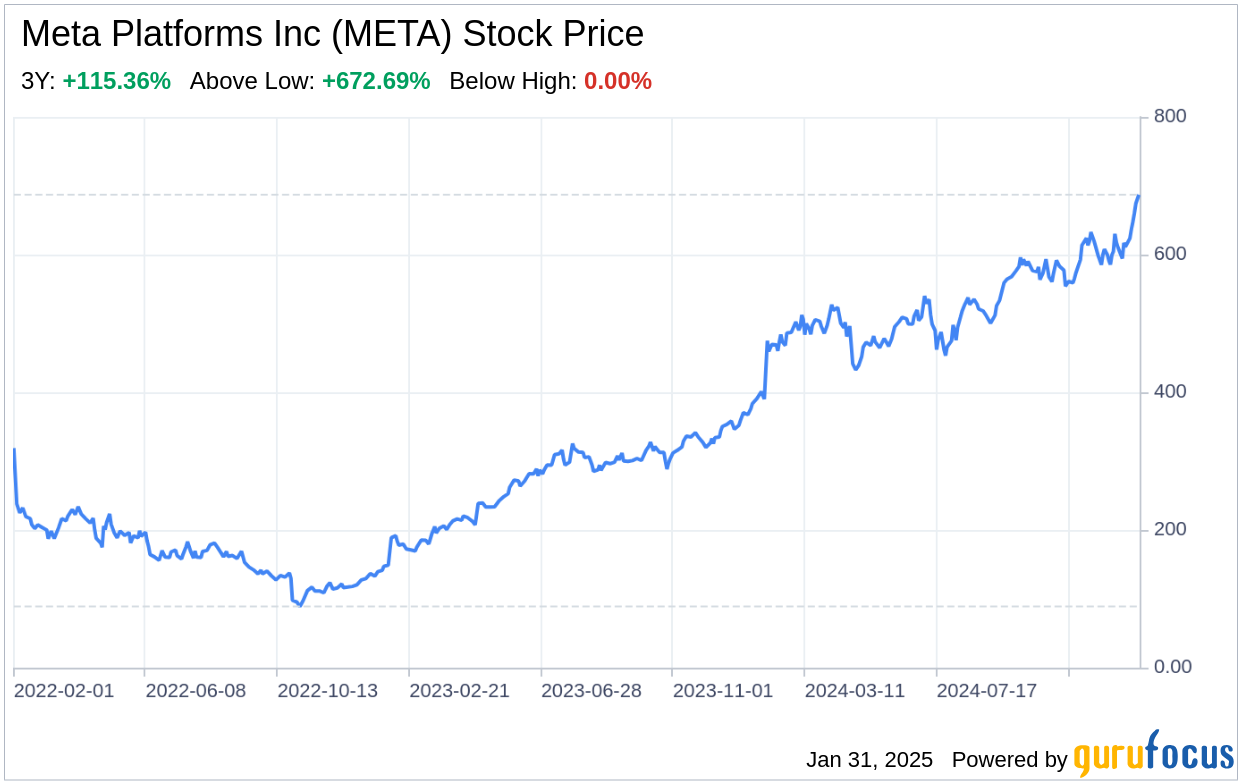

Financial Robustness: Meta Platforms Inc's financial health is evidenced by its impressive market capitalization, which stood at $1,103 billion as of June 30, 2024. The company's ability to generate substantial revenue from its advertising business model underscores its financial strength. This robust financial position enables Meta to invest in long-term strategic initiatives, such as the development of the metaverse and AI technologies, positioning it well for future growth.

Weaknesses

Dependence on Advertising Revenue: Despite its financial strength, Meta Platforms Inc's heavy reliance on advertising revenue is a significant weakness. This dependence makes the company vulnerable to fluctuations in advertising demand and changes in marketer spending patterns. As digital advertising becomes increasingly competitive, Meta must continuously innovate to maintain its appeal to advertisers and sustain its revenue growth.

Regulatory and Legal Challenges: Meta Platforms Inc faces ongoing regulatory scrutiny and legal challenges, particularly concerning data privacy, content moderation, and competition laws. Compliance with a complex web of global regulations requires significant resources and can lead to substantial fines, as well as operational constraints. These challenges not only pose financial risks but also threaten to erode user trust and confidence in the company's platforms.

Opportunities

Expansion into the Metaverse: The metaverse represents a significant opportunity for Meta Platforms Inc to diversify its revenue streams and establish a foothold in the next frontier of digital interaction. As the company invests in virtual and augmented reality technologies, it stands to benefit from the first-mover advantage in creating immersive experiences that could redefine social connectivity and commerce.

Advancements in AI and Machine Learning: Meta's strategic investments in AI and machine learning technologies present opportunities to enhance its advertising efficiency, content recommendation algorithms, and overall user experience. By leading the charge in generative AI, Meta can develop new products and services that attract users and advertisers alike, driving future revenue growth.

Threats

Competitive Pressures: The technology and social media landscapes are highly competitive, with new entrants and established players vying for market share. Meta Platforms Inc must continuously innovate to stay ahead of competitors who are also investing in similar technologies, such as AI and the metaverse. Failure to outpace the competition could lead to a loss of users and advertisers, impacting the company's market position and financial performance.

Data Security Concerns: As a company that handles vast amounts of user data, Meta Platforms Inc is a prime target for cyber-attacks and data breaches. Any significant security incident could damage the company's reputation, lead to legal and regulatory repercussions, and result in user attrition. Maintaining robust cybersecurity measures is crucial for protecting user data and ensuring the continued trust and engagement of Meta's user base.

In conclusion, Meta Platforms Inc's SWOT analysis reveals a company with formidable strengths, including market leadership and financial robustness, which are counterbalanced by vulnerabilities such as reliance on advertising revenue and regulatory challenges. Opportunities for growth lie in the burgeoning metaverse and advancements in AI, while threats from competitive pressures and data security concerns loom large. As Meta navigates these dynamics, its strategic decisions will be pivotal in shaping its future trajectory in an ever-evolving digital landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.