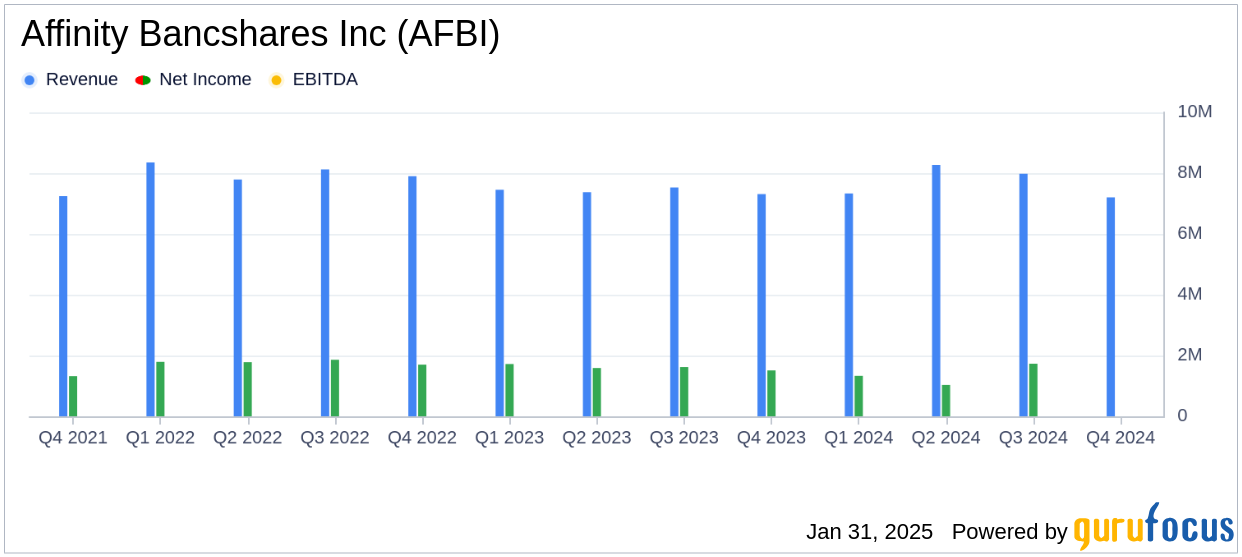

On January 31, 2025, Affinity Bancshares Inc (AFBI, Financial) released its 8-K filing, detailing the financial performance for the fourth quarter and full year of 2024. Affinity Bancshares Inc, the holding company for Affinity Bank, offers a range of deposit accounts and invests in various loan types and securities. The company reported a net income of $5.4 million for the year ended December 31, 2024, a decrease from $6.4 million in 2023. For the fourth quarter, net income was $1.3 million, down from $1.5 million in the same period of the previous year.

Performance and Challenges

The decline in net income for both the quarter and the year was primarily attributed to increased noninterest expenses, particularly related to a recently terminated merger. This was partially offset by an increase in net interest income. The company's operating income for the year rose to $6.8 million from $6.4 million in 2023, indicating some operational resilience despite the challenges.

Financial Achievements

Despite the challenges, Affinity Bancshares Inc achieved a notable increase in net interest income, which rose to $28.7 million for the year, up from $27.2 million in 2023. This was driven by higher interest income on loans and investment securities, although offset by increased deposit and borrowing costs. The net interest margin improved to 3.54% from 3.35% in the previous year, reflecting better yield management on earning assets.

Key Financial Metrics

Several key metrics from the financial statements highlight the company's performance:

| Metric | 2024 | 2023 |

|---|---|---|

| Net Income (in thousands) | $5,441 | $6,448 |

| Diluted EPS | $0.83 | $0.98 |

| Total Assets (in thousands) | $866,817 | $843,258 |

| Return on Average Assets | 0.62% | 0.75% |

| Return on Average Equity | 4.33% | 5.43% |

Analysis of Financial Condition

Affinity Bancshares Inc's total assets increased by $23.6 million to $866.8 million, driven by loan growth. Total gross loans rose by $54.2 million, reflecting strong demand in various loan categories. However, cash and cash equivalents decreased by $8.6 million, and deposits saw a slight decline of $1.0 million. The company's borrowings increased significantly by $18.8 million, indicating a strategic move to enhance liquidity.

Asset Quality and Risk Management

Asset quality showed improvement, with non-performing loans decreasing to $4.8 million from $7.4 million. The allowance for credit losses as a percentage of non-performing loans increased to 177.9%, suggesting a robust risk management approach. However, net loan charge-offs rose to $650,000 from $404,000, indicating some pressure on credit quality.

The increase in noninterest expenses, particularly related to merger activities, has impacted our net income. However, our strategic focus on loan growth and yield management has helped us maintain a strong net interest margin," commented a company spokesperson.

Overall, Affinity Bancshares Inc's financial performance in 2024 reflects a challenging environment with increased expenses impacting profitability. However, the company's strategic initiatives in loan growth and asset management have provided some stability, positioning it for potential future growth.

Explore the complete 8-K earnings release (here) from Affinity Bancshares Inc for further details.