On December 31, 2024, Vanguard Group Inc executed a strategic transaction involving the reduction of its holdings in Nerdwallet Inc by 242,124 shares. This adjustment brought Vanguard's total shares in Nerdwallet to 3,829,918. The transaction was conducted at a trade price of $13.30 per share. Despite this reduction, Nerdwallet remains a significant component of Vanguard's portfolio, representing 9.17% of the firm's holdings in the traded stock. This move reflects Vanguard's ongoing portfolio management strategy, which is closely aligned with its investment philosophy.

Vanguard Group Inc: A Legacy of Cost Efficiency

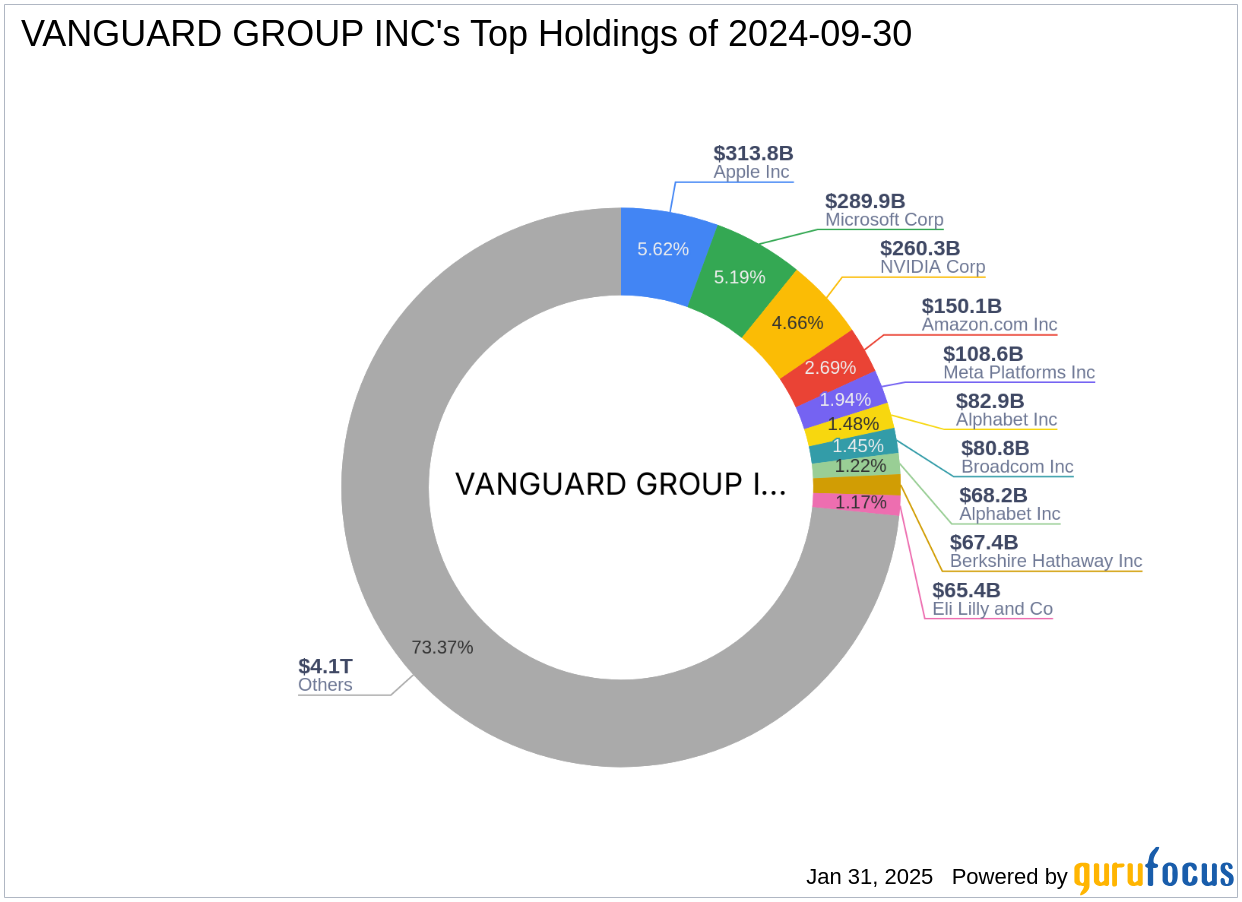

Founded in 1975 by John C. Bogle, Vanguard Group Inc has established itself as a leader in the mutual funds industry. The firm's core mission is to advocate for investors, ensuring fair treatment and maximizing investment success. Vanguard's unique client-owned structure allows it to minimize costs and enhance returns for its investors. This approach has been pivotal in Vanguard's growth, enabling it to offer a diverse range of low-cost mutual funds and ETFs. Vanguard's top holdings include major technology and financial services companies such as Apple Inc, Amazon.com Inc, and Microsoft Corp, underscoring its strategic focus on these sectors.

Nerdwallet Inc: A Financial Advisory Platform

Nerdwallet Inc, which went public on November 4, 2021, operates as a consumer-driven financial advisory platform. The company connects individuals and small to mid-sized businesses with financial product providers, generating revenue through various fee structures, including revenue per action and revenue per click. Nerdwallet's business segments encompass credit cards, loans, and SMB products, positioning it as a versatile player in the interactive media industry. With a market capitalization of $1.07 billion and a current stock price of $14.60, Nerdwallet is considered fairly valued according to its GF Value of $14.26.

Impact of the Transaction on Vanguard's Portfolio

The reduction in Vanguard's stake in Nerdwallet Inc is a strategic decision that aligns with the firm's broader investment strategy. Despite the reduction, Nerdwallet continues to hold a significant position in Vanguard's portfolio. The transaction's impact on the stock was minimal, as indicated by a trade impact of 0. This suggests that the market absorbed the transaction without significant fluctuations in Nerdwallet's stock price. Vanguard's decision to adjust its holdings may reflect a reassessment of Nerdwallet's growth prospects or a rebalancing of its portfolio to optimize returns.

Financial Metrics and Market Performance of Nerdwallet Inc

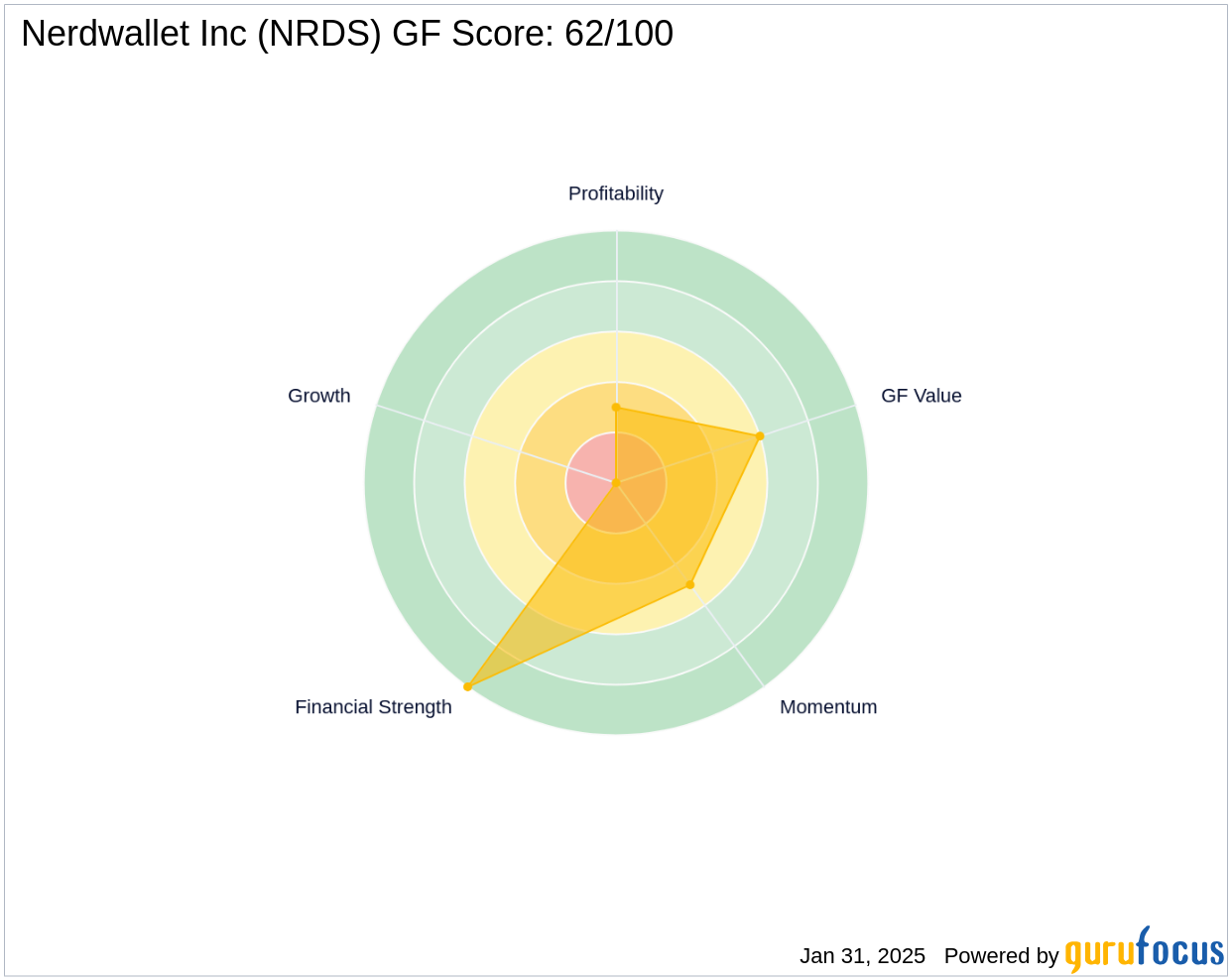

Nerdwallet Inc's financial metrics present a mixed picture. The company has a Financial Strength rank of 10/10, indicating robust financial health. However, its Profitability Rank is low at 3/10, and its Growth Rank is 0/10, suggesting challenges in profitability and growth. Nerdwallet's GF Score of 62/100 indicates poor future performance potential. Since its IPO, Nerdwallet's stock has declined by 37.87%, although it has gained 9.77% since the transaction, reflecting some positive momentum.

Conclusion: Strategic Implications for Value Investors

Vanguard Group Inc's decision to reduce its holdings in Nerdwallet Inc is a strategic move that reflects its ongoing portfolio management strategy. For value investors, this transaction highlights the importance of evaluating Nerdwallet's current valuation and market position. While the company faces challenges in profitability and growth, its strong financial health and market presence offer potential opportunities. Investors should consider these factors, along with Nerdwallet's fair valuation and recent stock performance, when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.