On December 31, 2024, Vanguard Group Inc executed a strategic reduction of its holdings in Synchronoss Technologies Inc, decreasing its position by 148,000 shares. This transaction was conducted at a price of $9.60 per share, leaving Vanguard with a total of 425,710 shares in the company. This move reflects a 25.80% reduction in Vanguard's stake in Synchronoss Technologies, a decision that may have significant implications for both the firm and the stock's future performance.

Vanguard Group Inc: A Profile

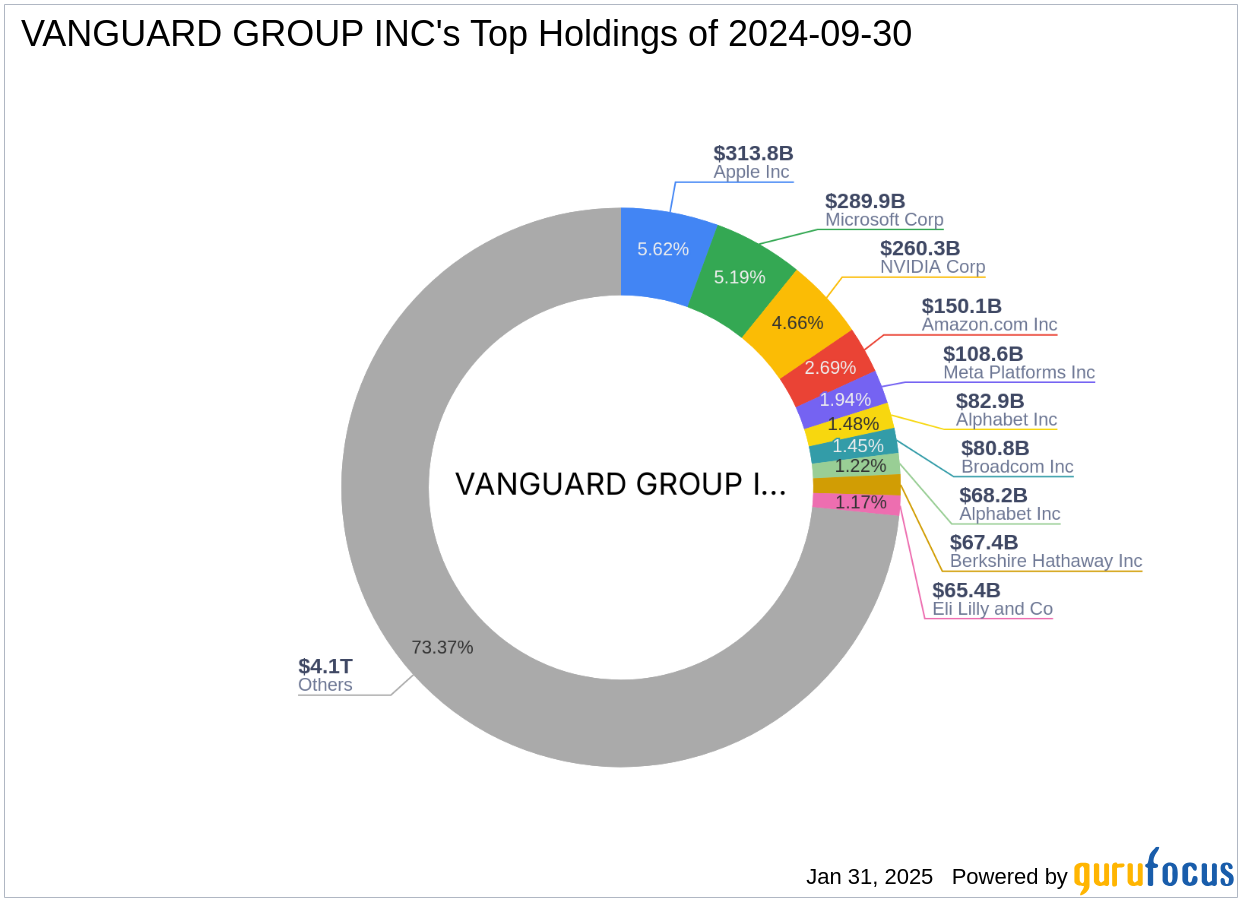

Founded in 1975 by John C. Bogle, Vanguard Group Inc has established itself as a leading mutual funds company with a strong focus on cost efficiency and investor fairness. The firm is renowned for its client-owned structure, which allows it to lower costs and enhance returns for investors. Vanguard's investment philosophy emphasizes eliminating sales commissions and maintaining low operating expenses. Over the years, Vanguard has expanded its offerings to include index mutual funds, ETFs, and various retirement and savings plans, catering to over 20 million clients worldwide. The firm's top holdings include major technology and financial services companies such as Apple Inc, Amazon.com Inc, and Microsoft Corp.

About Synchronoss Technologies Inc

Synchronoss Technologies Inc, a prominent player in the software industry, specializes in providing cloud, messaging, and network management solutions. The company's offerings, such as the Synchronoss Personal CloudTM platform, are designed to enhance customer engagement and content management. Synchronoss generates revenue primarily through subscriptions and transaction-based fees, with a significant portion of its business concentrated in the United States. Despite its innovative solutions, the company faces challenges in maintaining profitability and growth, as reflected in its financial metrics.

Transaction Analysis and Impact

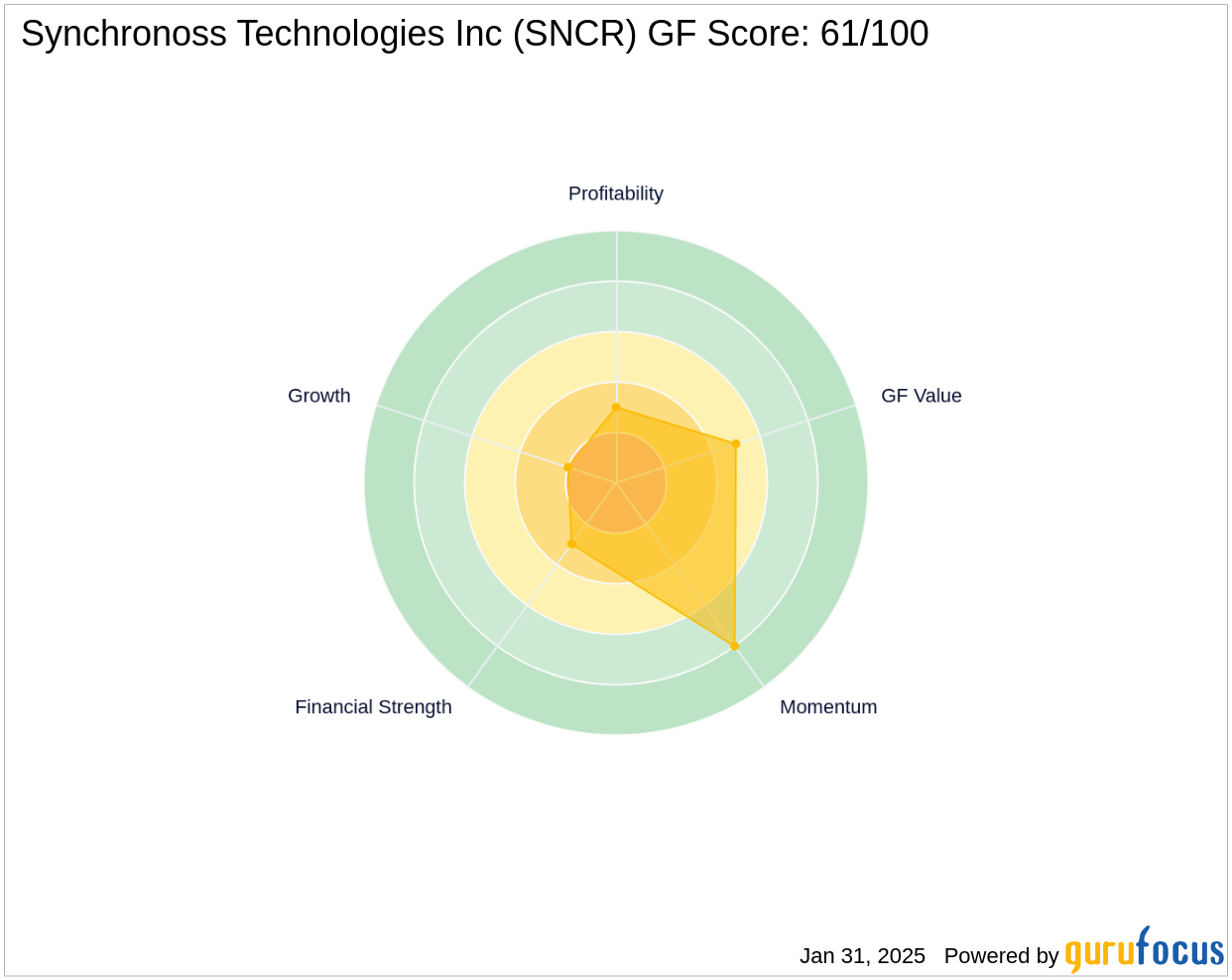

The reduction of Vanguard's stake in Synchronoss Technologies at $9.60 per share suggests a strategic reassessment of its investment in the company. This transaction impacts Vanguard's portfolio, reducing its position in Synchronoss to 3.92%. The decision to decrease holdings may be influenced by Synchronoss's current market conditions and financial performance, which include a market capitalization of $106.861 million and a stock price of $9.8587. The stock is currently considered "Modestly Overvalued" with a GF-Score of 61/100, indicating poor future performance potential.

Financial Overview of Synchronoss Technologies Inc

Synchronoss Technologies faces several financial challenges, as evidenced by its Financial Strength rank of 3/10 and a Profitability Rank of 3/10. The company's Altman Z score of -0.98 indicates potential financial distress, while its Piotroski F-Score of 4 suggests moderate financial health. Synchronoss's interest coverage ratio of 1.31 further highlights its financial constraints. Despite these challenges, the company has shown some positive signs, such as a 28.60% increase in earnings growth over the past three years.

Performance Metrics and Valuation

Synchronoss Technologies' stock performance is characterized by a GF Value Rank of 5/10 and a Momentum Rank of 8/10. The stock's price-to-GF Value ratio of 1.16 indicates that it is trading above its intrinsic value, suggesting limited upside potential. The company's Growth Rank of 2/10 reflects its struggles in achieving sustainable growth, while its Operating Margin growth remains stagnant.

Conclusion

Vanguard Group Inc's decision to reduce its holdings in Synchronoss Technologies Inc underscores a strategic shift in its investment approach. For value investors, this move highlights the importance of assessing Synchronoss's financial health and market position. While the company offers innovative solutions, its financial metrics and valuation suggest caution. Investors should consider these factors when evaluating the potential risks and rewards associated with Synchronoss Technologies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.