On February 3, 2025, Alliance Resource Partners LP (ARLP, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. The company, a prominent coal mining entity in the United States, operates through four segments: Illinois Basin, Appalachia, Oil & Gas Royalties, and Coal Royalties. Despite its diversified operations, ARLP faced challenges in the recent quarter, impacting its financial performance.

Quarterly and Annual Financial Highlights

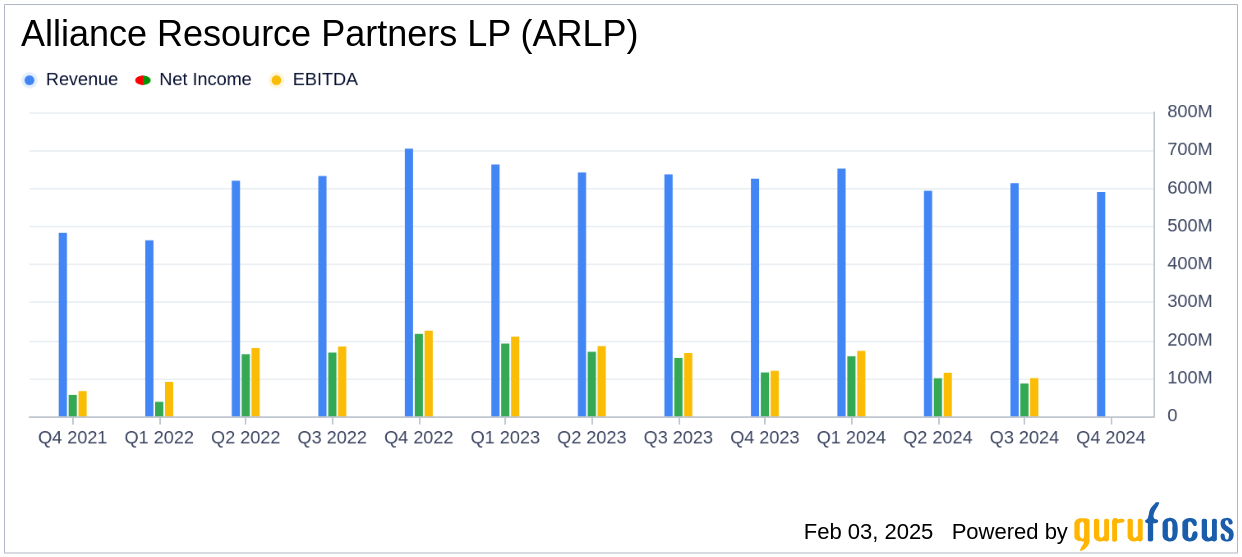

For the fourth quarter of 2024, ARLP reported total revenue of $590.1 million, a 5.6% decrease from $625.4 million in the same quarter of 2023. This decline was primarily due to reduced coal sales volumes and lower transportation revenues. Net income for the quarter was $16.3 million, or $0.12 per unit, significantly below the analyst estimate of $0.65 per share. The company's adjusted EBITDA for the quarter was $124.0 million, down from $185.4 million in the previous year.

On an annual basis, ARLP's total revenue for 2024 was $2.45 billion, a 4.6% decrease from $2.57 billion in 2023. The net income for the year stood at $360.9 million, or $2.77 per unit, falling short of the annual earnings estimate of $3.29 per share. The adjusted EBITDA for the full year was $714.2 million, compared to $933.1 million in 2023.

Operational Challenges and Strategic Initiatives

ARLP's performance was impacted by several operational challenges, including higher per ton operating expenses and non-cash impairment charges due to market uncertainties at the MC Mining operation. Additionally, the company faced challenging geological conditions at its Tunnel Ridge and MC Mining operations in Appalachia, leading to increased costs.

Due to the continued strength of our coal contracts, our average coal sales price per ton for the 2024 Full Year of $63.38 came close to the record level achieved in the 2023 Full Year of $64.17. However, lower sales volumes, higher operating costs and several non-cash accruals caused 2024 Full Year financial results to fall short of last year’s record revenues and net income," said Joseph W. Craft III, Chairman, President and CEO.

Financial Achievements and Industry Context

Despite the challenges, ARLP achieved record oil & gas royalty volumes of 3.4 million BOE in 2024, marking a 9.6% increase year-over-year. The company also completed $9.6 million in oil & gas mineral interest acquisitions during the fourth quarter, demonstrating its commitment to expanding its royalty segments.

In January 2025, ARLP declared a quarterly cash distribution of $0.70 per unit, maintaining an annualized rate of $2.80 per unit. This consistent distribution reflects the company's focus on returning value to its unitholders.

Balance Sheet and Liquidity Position

As of December 31, 2024, ARLP reported total debt and finance leases of $490.8 million, including $400 million in Senior Notes due 2029. The company's total liquidity was $593.9 million, comprising $137.0 million in cash and cash equivalents and $456.9 million in available borrowings. ARLP also held 482 bitcoins valued at $45.0 million, highlighting its diversified asset base.

Analysis and Future Outlook

ARLP's financial performance in 2024 reflects the challenges faced by the coal industry, including lower sales volumes and increased operating costs. However, the company's strategic initiatives, such as infrastructure improvements and expansion in the royalties segment, position it for potential growth in 2025. The anticipated increase in electricity demand and a supportive regulatory environment could provide opportunities for ARLP to strengthen its market position.

Overall, while ARLP's recent earnings fell short of expectations, its strategic focus on operational efficiency and asset diversification may support its long-term growth objectives in the evolving energy landscape.

Explore the complete 8-K earnings release (here) from Alliance Resource Partners LP for further details.