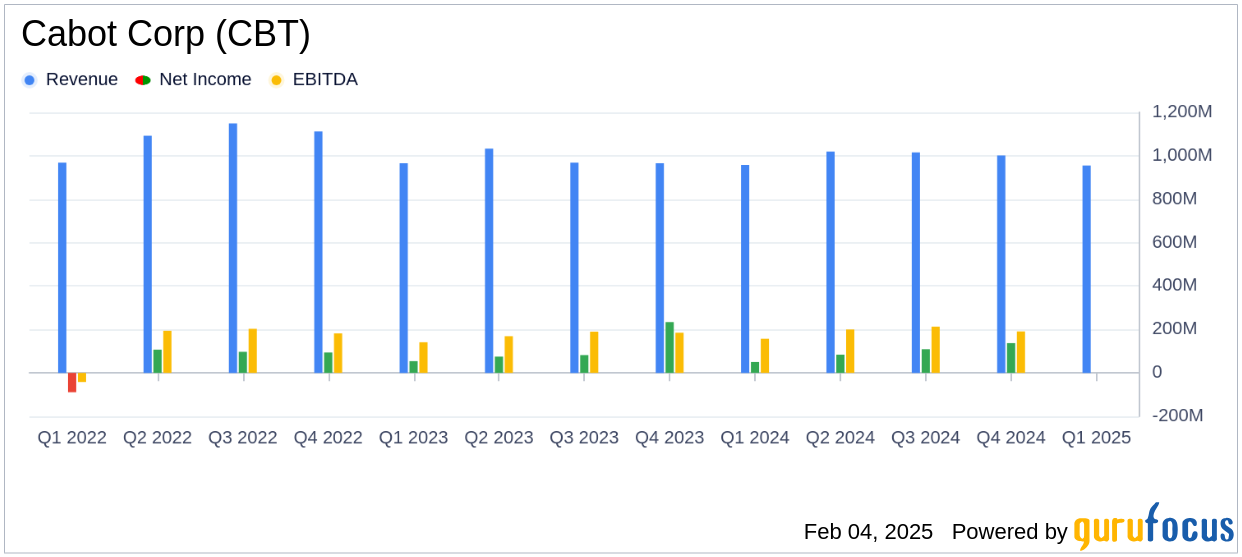

On February 4, 2025, Cabot Corp (CBT, Financial) released its 8-K filing detailing the financial results for the first quarter of fiscal year 2025. Cabot Corp, a global specialty chemicals and performance materials company, reported a diluted earnings per share (EPS) of $1.67, falling short of the analyst estimate of $1.84. However, the adjusted EPS was $1.76, reflecting a 13% increase compared to the same quarter in the previous year.

Company Background

Cabot Corp manufactures and sells a variety of chemicals, materials, and chemical-based products. The company operates through segments such as Reinforcement Materials, which provides reinforcing carbon products used in tires and industrial products, and Performance Chemicals, which includes specialty carbons, compounds, and other chemical products. The company derives maximum revenue from Europe, the Middle East, and Africa, with additional contributions from the Americas and Asia Pacific regions.

Financial Performance and Challenges

Cabot Corp's net sales for the quarter were $955 million, slightly below the analyst estimate of $997.10 million. The Reinforcement Materials segment reported an EBIT of $130 million, a modest 1% increase from the prior year, driven by volume growth in Asia Pacific and Europe, Middle East, and Africa. However, the Americas saw a 1% decline in volumes due to increased tire imports from Asia.

The Performance Chemicals segment showed significant improvement with a 32% increase in EBIT to $45 million, attributed to an 8% rise in volumes. Despite these gains, the company faced challenges such as higher maintenance costs and new asset expenses.

Key Financial Achievements

Cabot Corp generated $124 million in cash flows from operations, enabling the return of $66 million to shareholders through dividends and share repurchases. The company maintained a strong balance sheet with approximately $1.3 billion in liquidity at the end of the quarter.

Income Statement and Balance Sheet Insights

The company's net income attributable to Cabot Corp was $93 million, up from $50 million in the previous year. The gross profit increased to $235 million from $218 million, reflecting improved operational efficiency. However, selling and administrative expenses remained stable at $66 million.

Cabot Corp ended the quarter with a cash balance of $183 million, down from $223 million at the end of September 2024. The company invested $77 million in capital expenditures during the quarter.

Commentary and Analysis

Sean Keohane, Cabot President and Chief Executive Officer, stated, “We continued to execute against our Creating for Tomorrow strategy, delivering another quarter of strong results and in-line with our expectations. The Cabot team demonstrated operational excellence and agility in a challenging market environment, resulting in Adjusted EPS of $1.76, up 13% year-over-year.”

Despite missing the EPS estimate, Cabot Corp's performance highlights its resilience and strategic focus on growth. The company's ability to generate strong cash flows and maintain a robust balance sheet positions it well for future investments and shareholder returns.

Conclusion

Cabot Corp's first-quarter results reflect a mixed performance with notable achievements in operational efficiency and segment growth, yet challenges remain in meeting analyst expectations. The company's strategic initiatives and financial discipline continue to support its long-term growth objectives.

Explore the complete 8-K earnings release (here) from Cabot Corp for further details.