Mesa Laboratories Inc (MLAB, Financial) released its 8-K filing on February 4, 2025, announcing its third fiscal quarter results for the period ending December 31, 2024. The company, a leader in life sciences tools and quality control products, operates through four divisions: Sterilization and Disinfection Control, Clinical Genomics, Biopharmaceutical Development, and Calibration Solutions.

Performance Overview

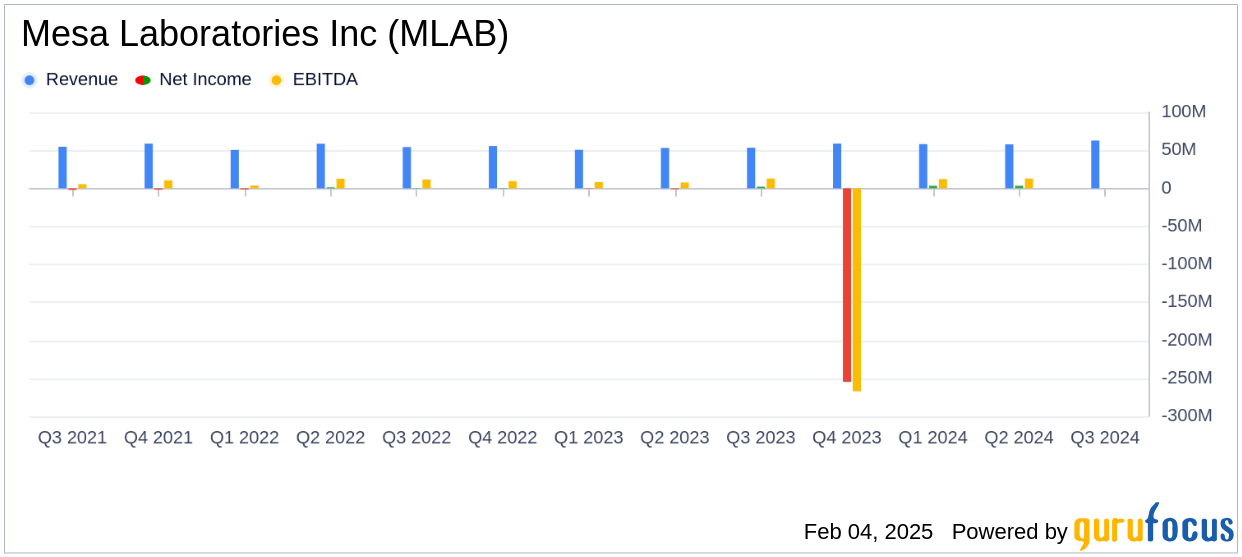

Mesa Laboratories Inc (MLAB, Financial) reported total revenues of $62.84 million for the third quarter, marking a 17.5% increase compared to the same period last year. This figure exceeded the analyst estimate of $58.77 million. The company's non-GAAP core organic revenues grew by 13.2%, driven by strong performance across its divisions.

Despite the revenue growth, Mesa Laboratories Inc (MLAB, Financial) reported a net loss of $1.68 million, or $(0.31) per diluted share, a significant decline from the previous year's net income of $2.12 million. This loss was primarily attributed to unrealized foreign currency losses and interest expenses.

Financial Achievements and Challenges

The company's operating income saw a remarkable increase of 8,725% to $5.78 million. Non-GAAP adjusted operating income, excluding unusual items, rose by 13.3% and accounted for 23.5% of revenues. However, the net loss highlights challenges such as foreign currency fluctuations and interest expenses that could impact future profitability.

The company hit on all cylinders in 3Q25 with strong sequential and year over year growth in revenues, orders, and AOI with a continued reduction in debt levels," said Gary Owens, CEO of Mesa Laboratories Inc.

Division Performance

| Division | Revenues (in thousands) | Core Organic Revenues Growth |

|---|---|---|

| Sterilization and Disinfection Control | $23,507 | 8.2% |

| Calibration Solutions | $14,429 | 18.9% |

| Biopharmaceutical Development | $12,237 | 31.3% |

| Clinical Genomics | $12,667 | 1.9% |

The Sterilization and Disinfection Control division, which contributed 37% of total revenues, saw a core organic growth of 8.2%. The Calibration Solutions division experienced a robust growth of 18.9%, driven by commercial momentum and price increases. The Biopharmaceutical Development division led with a 31.3% growth, fueled by increased capital spending in North America and Europe. Meanwhile, the Clinical Genomics division showed a modest growth of 1.9%, with challenges in China and the U.S. market.

Financial Metrics and Analysis

Mesa Laboratories Inc (MLAB, Financial) reported a gross profit of $39.75 million, up from $33.40 million in the previous year. The company's balance sheet showed total assets of $437.15 million and liabilities of $281.93 million, with a stockholders' equity of $155.21 million. The company also reduced its debt by $9.4 million, lowering its Net Leverage Ratio to 3.20.

The company's focus on non-GAAP measures, such as adjusted operating income and core organic revenues growth, provides a clearer picture of its operational performance. These metrics are crucial for investors to assess the company's ability to generate sustainable growth and profitability.

Overall revenues for the quarter of $62,840 increased 17.5% versus prior year on the back of 12.6% organic growth and 4.9% inorganic contribution from GKE," added Mr. Owens.

In conclusion, Mesa Laboratories Inc (MLAB, Financial) demonstrated strong revenue growth in the third quarter, surpassing analyst estimates. However, the net loss underscores the challenges the company faces, particularly in managing foreign currency risks and interest expenses. The company's strategic focus on reducing debt and enhancing operational efficiency will be critical in navigating these challenges and achieving long-term growth.

Explore the complete 8-K earnings release (here) from Mesa Laboratories Inc for further details.