Foundations Investment Advisors, LLC (Trades, Portfolio) recently increased its investment in the Vanguard U.S. Minimum Volatility ETF (VFMV, Financial) by acquiring an additional 6,649 shares on December 31, 2024. This transaction brings the firm's total holdings in VFMV to 101,199 shares. The acquisition was executed at a trade price of $120.51 per share, reflecting a strategic move to bolster the firm's position in this ETF. The transaction resulted in a 7.03% increase in the firm's stake in VFMV, with a portfolio impact of 0.02%.

About Foundations Investment Advisors, LLC (Trades, Portfolio)

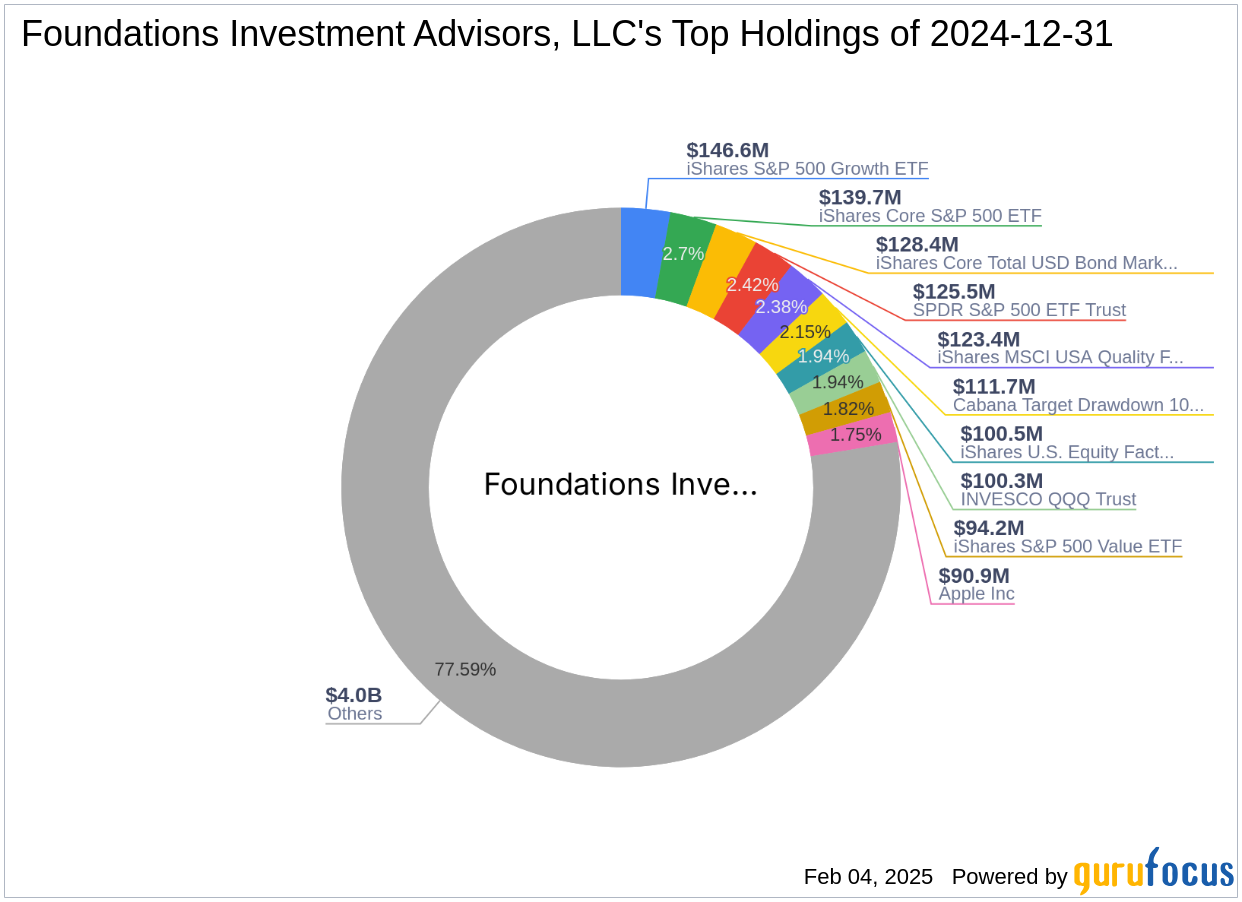

Based in Scottsdale, Arizona, Foundations Investment Advisors, LLC (Trades, Portfolio) is a prominent investment firm known for its focus on the technology and financial services sectors. The firm operates with a robust investment philosophy that emphasizes strategic growth and value investing. With a diverse portfolio valued at $5.18 billion, the firm holds significant positions in various ETFs, including iShares Core Total USD Bond Market ETF (IUSB, Financial), iShares Core S&P 500 ETF (IVV, Financial), and SPDR S&P 500 ETF Trust (SPY, Financial). These holdings reflect the firm's commitment to maintaining a balanced and diversified investment strategy.

Vanguard U.S. Minimum Volatility ETF: A Closer Look

The Vanguard U.S. Minimum Volatility ETF (VFMV, Financial) is designed to provide investors with exposure to U.S. equities while minimizing volatility. As of the latest data, VFMV has a market capitalization of $156.31 million and is trading at $125.39 per share. The ETF boasts a price-to-earnings (PE) ratio of 18.62 and a GF Score of 82/100, indicating good outperformance potential. This score suggests that VFMV is well-positioned for future growth, making it an attractive option for investors seeking stability and potential returns.

Impact of the Transaction

The recent acquisition by Foundations Investment Advisors, LLC (Trades, Portfolio) has increased its holdings in VFMV to 101,199 shares, representing 0.26% of the firm's overall portfolio and 7.91% of its holdings in VFMV. This strategic move underscores the firm's confidence in the ETF's potential to deliver stable returns. The transaction's impact on the portfolio is relatively modest at 0.02%, yet it signifies a deliberate effort to enhance the firm's exposure to low-volatility investments.

Financial Metrics and Valuation

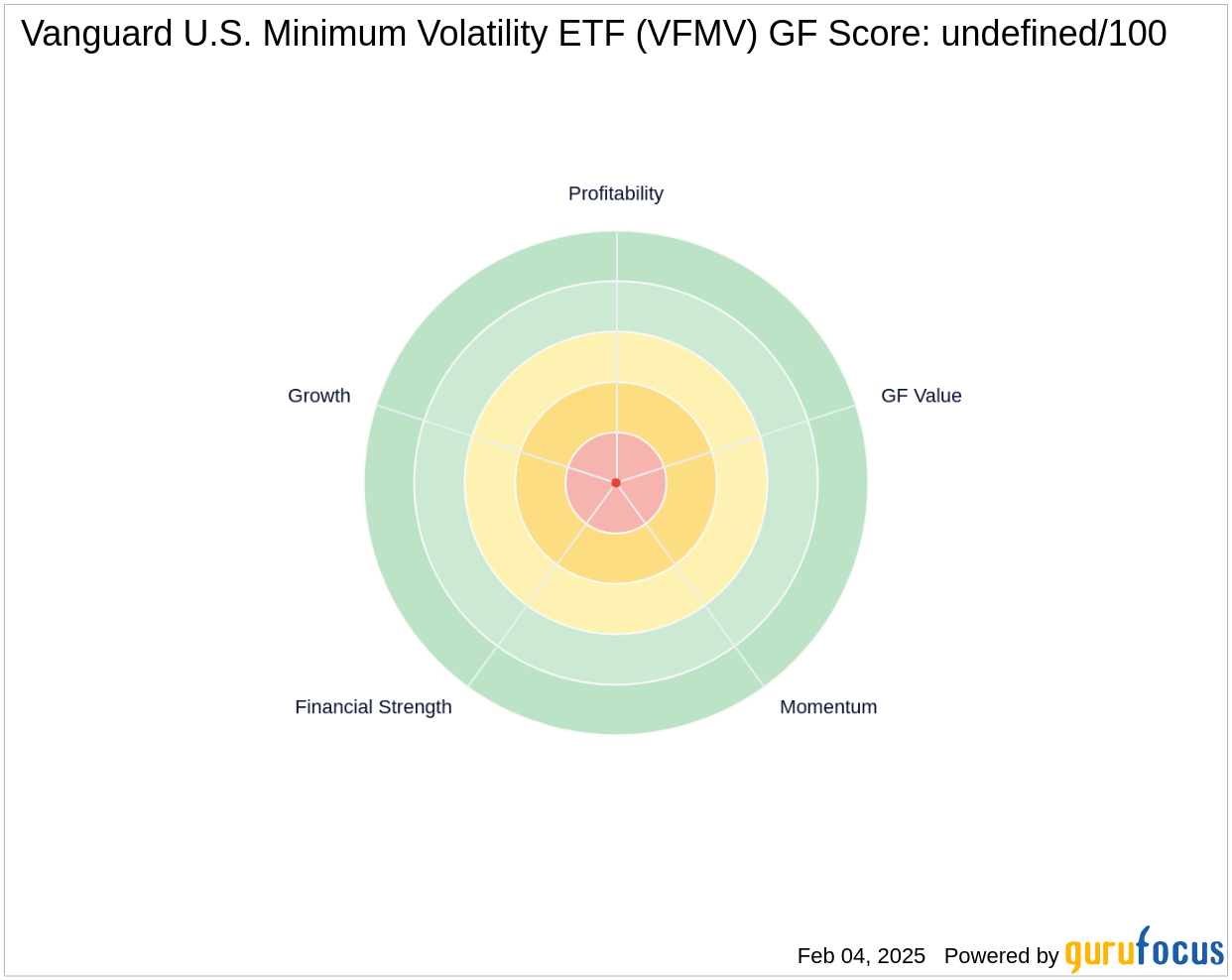

VFMV's current GF Value is estimated at $101.50, with a price to GF Value ratio of 1.23, suggesting that the ETF is trading above its intrinsic value. The ETF's financial metrics are robust, with a Profitability Rank of 8/10 and a Growth Rank of 7/10. These indicators reflect strong profitability and growth potential, supported by a solid balance sheet and a interest coverage ratio of 80.31.

Stock Performance and Growth Indicators

Since the transaction, VFMV has experienced a gain of 4.05%, highlighting its positive momentum in the market. The ETF's growth metrics are impressive, with a 3-year revenue growth rate of 9.51% and an EBITDA growth rate of 10.90%. These figures demonstrate VFMV's ability to generate consistent revenue and earnings growth, making it a compelling choice for investors seeking long-term value.

Conclusion

The strategic acquisition of additional shares in VFMV by Foundations Investment Advisors, LLC (Trades, Portfolio) reflects the firm's commitment to enhancing its portfolio with low-volatility investments. Given the ETF's strong financial metrics and growth potential, this transaction is likely to contribute positively to the firm's overall performance. As VFMV continues to demonstrate robust growth and stability, it remains a promising investment for those seeking to capitalize on its potential future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.