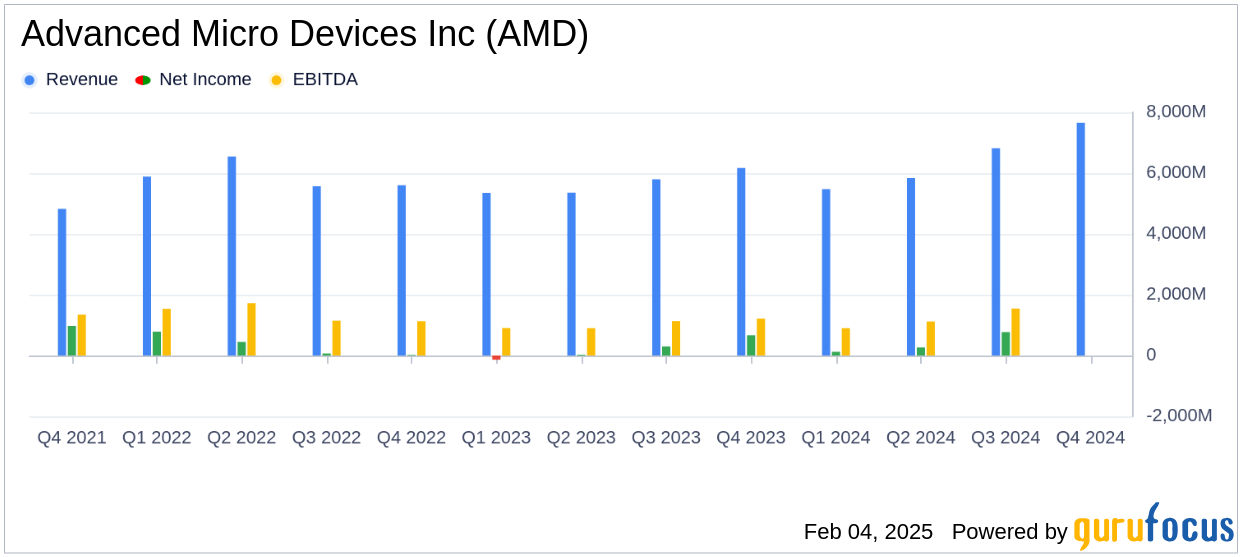

Advanced Micro Devices Inc (AMD, Financial) released its 8-K filing on February 4, 2025, reporting its financial results for the fourth quarter and full year of 2024. The company, known for designing digital semiconductors for various markets including PCs, gaming consoles, and data centers, achieved record quarterly revenue of $7.7 billion, surpassing the analyst estimate of $7,526.14 million. However, its GAAP diluted earnings per share (EPS) of $0.29 fell short of the estimated $0.64.

Performance and Challenges

AMD's performance in Q4 2024 was marked by a significant 24% year-over-year increase in revenue, driven by strong demand in its Data Center and Client segments. However, the company faced challenges with a 28% decline in net income compared to the previous year, primarily due to increased operating expenses and a decrease in Gaming and Embedded segment revenues.

Financial Achievements

Despite the challenges, AMD's financial achievements in 2024 were noteworthy. The company reported record annual revenue of $25.8 billion, a 14% increase from 2023. The Data Center segment was a standout performer, with revenue nearly doubling to $12.6 billion, driven by the adoption of EPYC processors and AMD Instinct accelerators. These achievements underscore AMD's strategic focus on high-performance computing and adaptive solutions, which are crucial in the competitive semiconductor industry.

Key Financial Metrics

AMD's gross margin for Q4 2024 was 51% on a GAAP basis and 54% on a non-GAAP basis, reflecting improvements in operational efficiency. Operating income reached $871 million, a 155% increase year-over-year, while non-GAAP operating income was a record $2.0 billion. These metrics highlight AMD's ability to manage costs effectively while scaling its operations.

| Metric | Q4 2024 | Q4 2023 | Change |

|---|---|---|---|

| Revenue ($M) | 7,658 | 6,168 | Up 24% |

| Net Income ($M) | 482 | 667 | Down 28% |

| Diluted EPS | $0.29 | $0.41 | Down 29% |

Segment Performance

The Data Center segment achieved record quarterly revenue of $3.9 billion, up 69% year-over-year, driven by strong sales of AMD Instinct GPUs and EPYC CPUs. The Client segment also saw robust growth, with revenue increasing by 58% to $2.3 billion, fueled by demand for Ryzen processors. Conversely, the Gaming segment experienced a 59% decline in revenue due to reduced semi-custom revenue, and the Embedded segment saw a 13% decrease as market demand remained mixed.

Analysis and Outlook

AMD's strong revenue growth and strategic investments in AI and innovation position the company for continued success in the semiconductor industry. However, the decline in net income and EPS highlights the need for careful management of operating expenses and strategic focus on high-growth segments. As AMD continues to expand its product portfolio and partnerships, the company is well-positioned to capitalize on the growing demand for high-performance computing solutions.

“2024 was a transformative year for AMD as we delivered record annual revenue and strong earnings growth,” said AMD Chair and CEO Dr. Lisa Su. “Data Center segment annual revenue nearly doubled as EPYC processor adoption accelerated and we delivered more than $5 billion of AMD Instinct accelerator revenue.”

For the first quarter of 2025, AMD expects revenue to be approximately $7.1 billion, with a non-GAAP gross margin of around 54%, indicating continued growth momentum despite the challenges faced in the gaming and embedded segments.

Explore the complete 8-K earnings release (here) from Advanced Micro Devices Inc for further details.