On February 4, 2025, Varonis Systems Inc (VRNS, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full-year 2024. Varonis Systems, a New York-based cybersecurity vendor, is focused on data privacy and security, currently transitioning its on-premises customers to cloud-based software-as-a-service (SaaS) products.

Performance Overview and Challenges

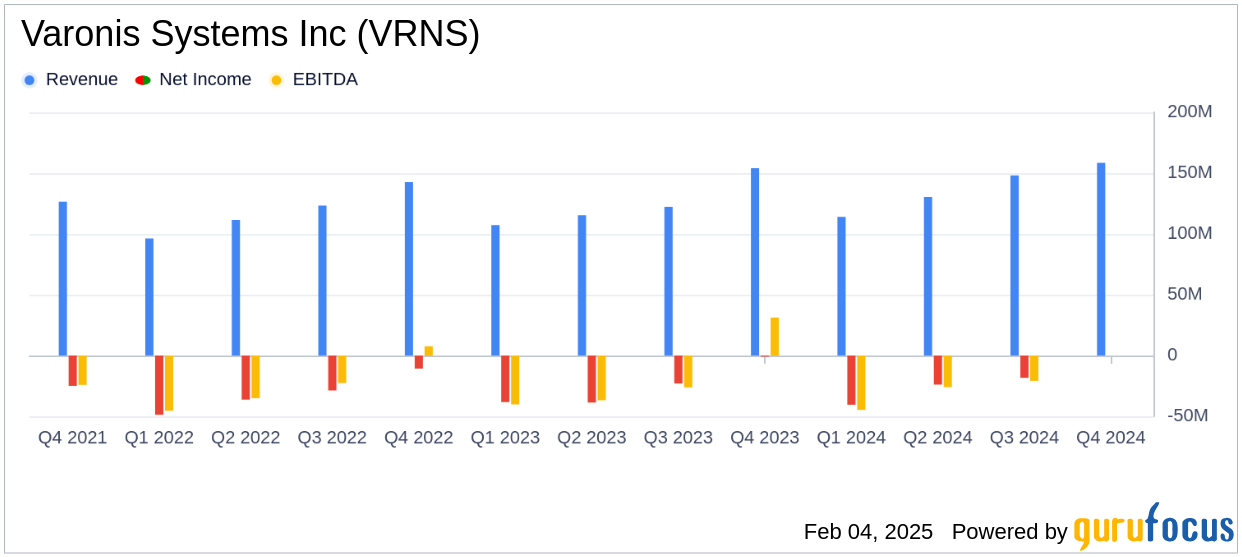

Varonis Systems Inc reported total revenues of $158.5 million for Q4 2024, falling short of the analyst estimate of $165.56 million. The company also reported a GAAP operating loss of $17.6 million, a significant increase from the $5.2 million loss in Q4 2023. This performance highlights the challenges faced during its transition to a SaaS model, which, while promising, has yet to fully offset declines in traditional revenue streams.

Financial Achievements and Industry Importance

Despite the challenges, Varonis Systems Inc achieved a notable milestone with SaaS revenues reaching $72.2 million in Q4 2024, a substantial increase from $23.0 million in the same quarter of the previous year. This shift is crucial as SaaS now represents 53% of the company's total annual recurring revenue (ARR), positioning Varonis for future growth in the competitive software industry.

Key Financial Metrics

For the full year 2024, Varonis reported total revenues of $551.0 million, slightly below the annual estimate of $558.28 million. The company's GAAP operating loss for the year was $117.7 million, nearly unchanged from the previous year's loss of $117.2 million. However, the non-GAAP operating income was $15.9 million, indicating some operational improvements.

| Metric | Q4 2024 | Q4 2023 | 2024 | 2023 |

|---|---|---|---|---|

| Total Revenues | $158.5M | $154.1M | $551.0M | $499.2M |

| GAAP Operating Loss | ($17.6M) | ($5.2M) | ($117.7M) | ($117.2M) |

| Non-GAAP Operating Income | $15.3M | $27.2M | $15.9M | $28.7M |

Analysis and Outlook

Varonis Systems Inc's transition to a SaaS model is a strategic move aimed at capturing a larger market share in the data security sector. The increase in SaaS revenues is a positive indicator of customer acceptance and the potential for future growth. However, the company faces ongoing challenges in balancing this transition with maintaining profitability, as evidenced by the increased operating losses.

Yaki Faitelson, Varonis CEO, stated, "We are excited by the approximately 50% increase in ARR from new customers, which was driven by the simplicity of SaaS and MDDR as well as customer interest in utilizing Generative AI raising awareness for our solution."

Looking ahead, Varonis expects continued growth in ARR and improvements in free cash flow generation, supported by strategic investments. The company's financial outlook for 2025 includes projected revenues of $610.0 million to $625.0 million, indicating a year-over-year growth of 11% to 13%.

Explore the complete 8-K earnings release (here) from Varonis Systems Inc for further details.