On February 4, 2025, Golub Capital BDC Inc (GBDC, Financial) released its 8-K filing for the quarter ended December 31, 2024. Golub Capital BDC Inc is an externally managed, closed-end, non-diversified management investment company focused on generating income and capital appreciation through investments in senior secured and one-stop loans in U.S. middle-market companies.

Performance Overview

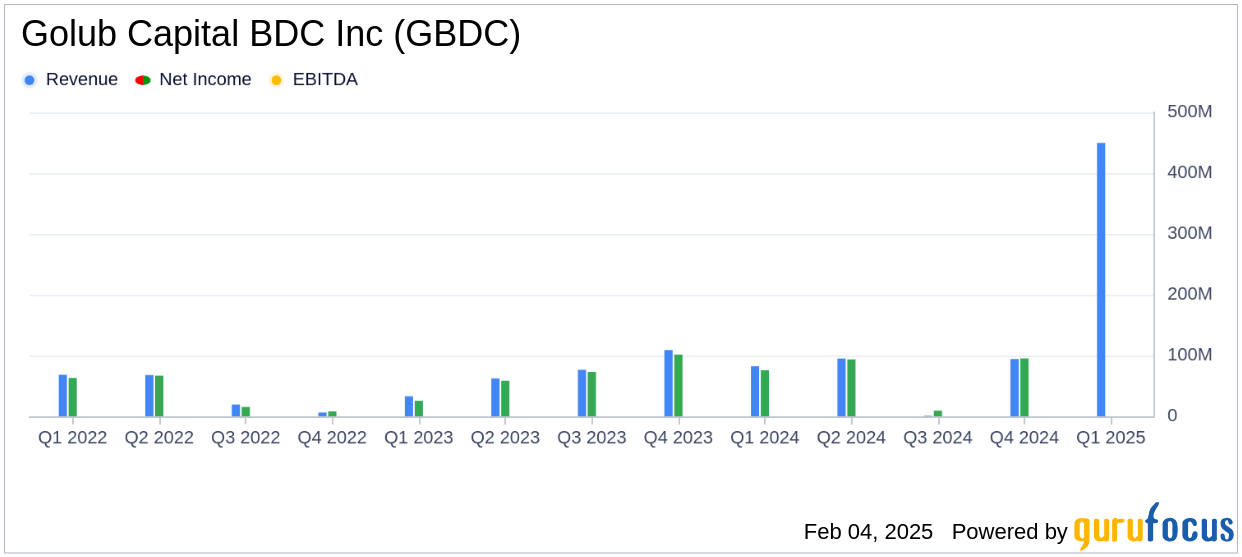

Golub Capital BDC Inc reported adjusted earnings per share (EPS) of $0.42, slightly below the analyst estimate of $0.43. The company's revenue for the quarter was $220.7 million, below the estimated $230.57 million. Despite the revenue shortfall, the EPS performance highlights the company's effective cost management and operational efficiency.

Financial Achievements and Challenges

The company's net asset value (NAV) per share decreased slightly to $15.13 from $15.19 in the previous quarter, primarily due to special and supplemental distributions. The GAAP debt-to-equity ratio increased to 1.19x, with 44% of debt funding being unsecured and 81% floating rate debt funding. Golub Capital BDC Inc's investment grade rating was upgraded to Baa2 (Stable) by Moody's in January 2025, reflecting its strong credit profile.

Profitability remained solid with adjusted net investment income per share of $0.39, or an Adjusted NII ROE of 10.1%.

Income Statement and Balance Sheet Highlights

The company's investment portfolio increased to $8.7 billion at fair value, with $1.2 billion in new investment commitments. The internal performance ratings improved, with nearly 90% of the portfolio rated '4' or '5'. Non-accrual investments decreased to 0.5% of total investments at fair value, indicating strong credit quality.

| Quarter Ended | September 30, 2024 | December 31, 2024 |

|---|---|---|

| Net Investment Income Per Share | $0.45 | $0.37 |

| Adjusted Net Investment Income Per Share | $0.47 | $0.39 |

| Earnings (Loss) Per Share | $0.36 | $0.42 |

| Net Asset Value Per Share | $15.19 | $15.13 |

Analysis and Outlook

Golub Capital BDC Inc's performance in the first quarter of fiscal 2025 demonstrates its resilience and ability to navigate a challenging economic environment. The company's focus on high-quality investments and effective risk management has contributed to its strong financial results. The upgrade in credit rating and the reduction in non-accrual investments further underscore its robust financial health.

As the company continues to expand its investment portfolio and maintain strong credit quality, it remains well-positioned to deliver value to its shareholders. The solid adjusted earnings per share and the strategic management of its debt profile are positive indicators for future performance.

Explore the complete 8-K earnings release (here) from Golub Capital BDC Inc for further details.