On December 31, 2024, Morgan Stanley made a strategic decision to reduce its holdings in Key Tronic Corp by 62,989 shares. The transaction was executed at a price of $4.17 per share. This adjustment reflects a minor change in Morgan Stanley's portfolio, as the firm still holds 1,726,280 shares of Key Tronic Corp. The transaction's impact on Morgan Stanley's portfolio is minimal, with a 0% position ratio, indicating a strategic portfolio adjustment rather than a significant shift in investment strategy.

About Morgan Stanley

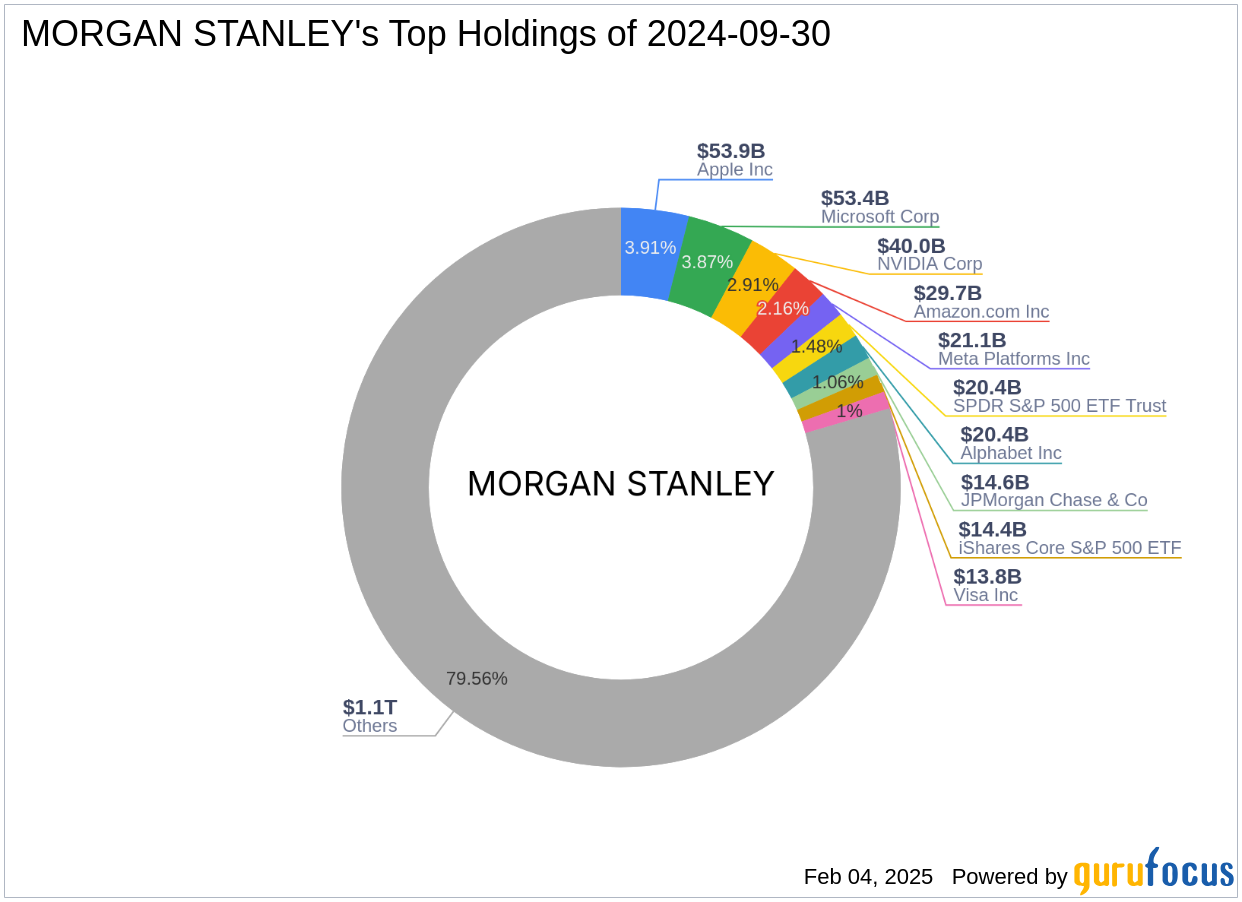

Morgan Stanley, established in 1935, has a rich history rooted in the legacy of JP Morgan & Co. and Dean Witter. Known for its pioneering role in financial technologies and global expansion, the firm operates in 42 countries and manages over $800 billion in total assets. Morgan Stanley's top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). The firm continues to be a dominant player in the financial sector, leveraging its extensive expertise and resources to maintain a competitive edge.

Key Tronic Corp Overview

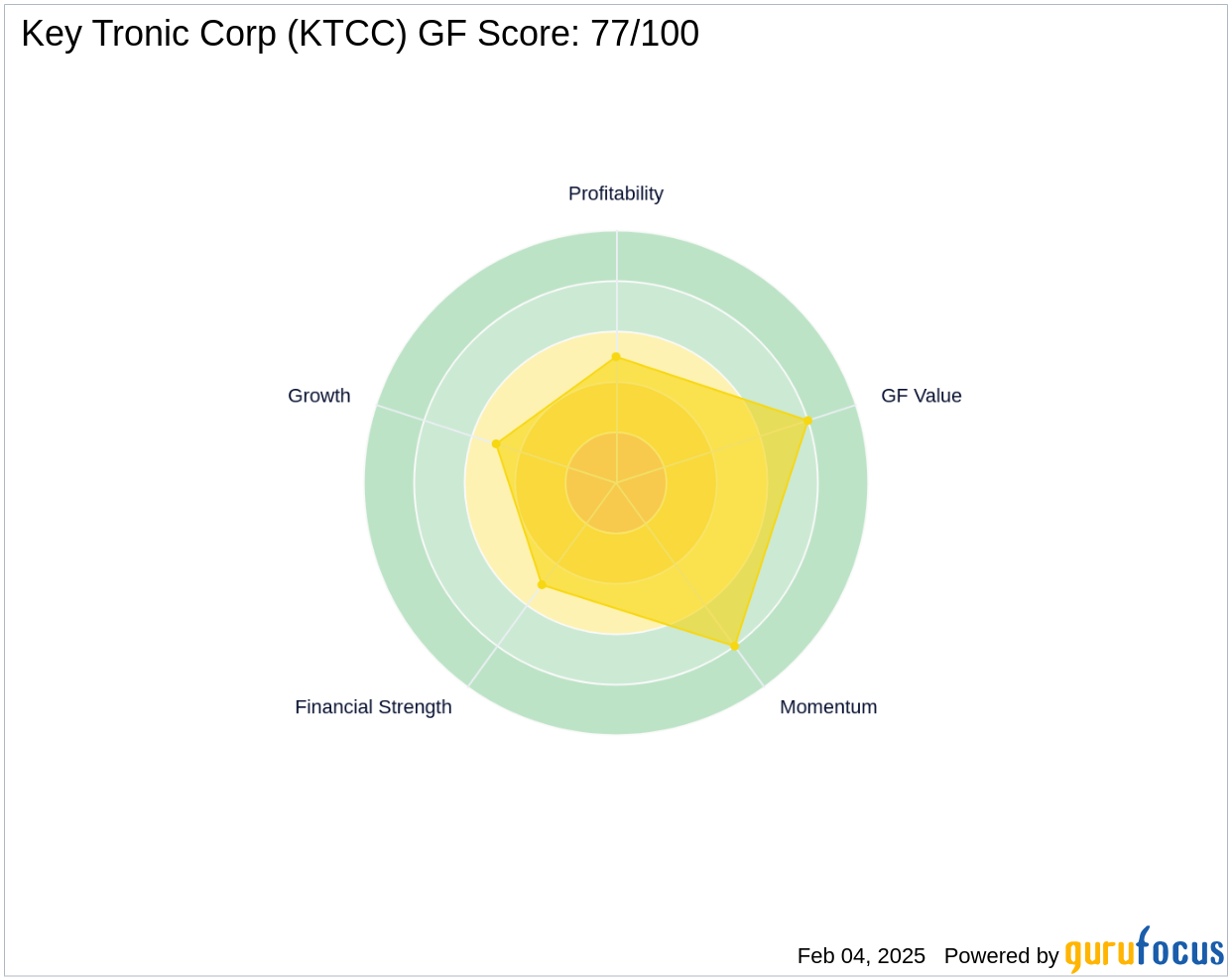

Key Tronic Corp, an electronic manufacturing service provider based in the USA, offers a range of services including electronic and mechanical engineering, PCB assembly, and logistics. The company primarily derives its revenue from the United States. With a current market capitalization of $38.744 million, Key Tronic Corp is positioned within the electronics manufacturing services segment. The company's stock is currently priced at $3.6, with a [GF-Score](https://www.gurufocus.com/term/gf-score/KTCC) of 77/100, indicating a likely average performance in the long term.

Financial Metrics and Valuation

Key Tronic Corp's current stock price of $3.6 is modestly undervalued compared to its [GF Value](https://www.gurufocus.com/term/gf-value/KTCC) of $4.98, resulting in a price to GF Value ratio of 0.73. The year-to-date price change stands at -13.67%, reflecting some challenges in the market. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/KTCC) is ranked 5/10, with a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/KTCC) and [Growth Rank](https://www.gurufocus.com/term/rank-growth/KTCC) also at 5/10. The [Cash to Debt](https://www.gurufocus.com/term/cash-to-debt/KTCC) ratio of 0.05 indicates potential liquidity concerns, while the return on equity (ROE) and return on assets (ROA) are -1.56% and -0.54%, respectively, highlighting challenges in profitability.

Analysis of Key Tronic Corp's Financial Health

Key Tronic Corp's financial health presents a mixed picture. The [Altman Z score](https://www.gurufocus.com/term/zscore/KTCC) of 2.62 suggests moderate financial distress, while the [Piotroski F-Score](https://www.gurufocus.com/term/fscore/KTCC) of 4 indicates some financial stability. The company's [Operating Margin](https://www.gurufocus.com/term/operating-margin/KTCC) growth is -1.20%, and the gross margin growth is -0.90%, reflecting operational challenges. Despite these hurdles, the company has shown a 3.9% revenue growth over the past three years, indicating potential for future improvement.

Implications of the Transaction

Morgan Stanley's decision to reduce its stake in Key Tronic Corp may be seen as a strategic portfolio adjustment rather than a lack of confidence in the company's prospects. The modest undervaluation of Key Tronic Corp, combined with its financial metrics, may influence future investment decisions. For value investors, the current valuation and financial health of Key Tronic Corp present both opportunities and risks, warranting careful consideration when evaluating potential investments in the electronics manufacturing sector.

Conclusion

The transaction underscores Morgan Stanley's active portfolio management approach, reflecting its strategic adjustments in response to market conditions. Key Tronic Corp's current valuation and financial health offer a nuanced perspective for investors, highlighting both potential opportunities and risks. As the electronics manufacturing sector continues to evolve, value investors may find Key Tronic Corp an intriguing prospect, provided they carefully assess the company's financial metrics and market position.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.