On January 31, 2025, NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) made a significant move by acquiring an additional 73,890 shares of Transcat Inc (TRNS, Financial) at a transaction price of $77.02 per share. This acquisition brings the firm's total holdings in Transcat to 932,152 shares, reflecting a strategic decision to increase its stake in the company. The transaction highlights the firm's confidence in Transcat's potential, despite the company's recent market challenges.

NEUBERGER BERMAN GROUP LLC: A Profile

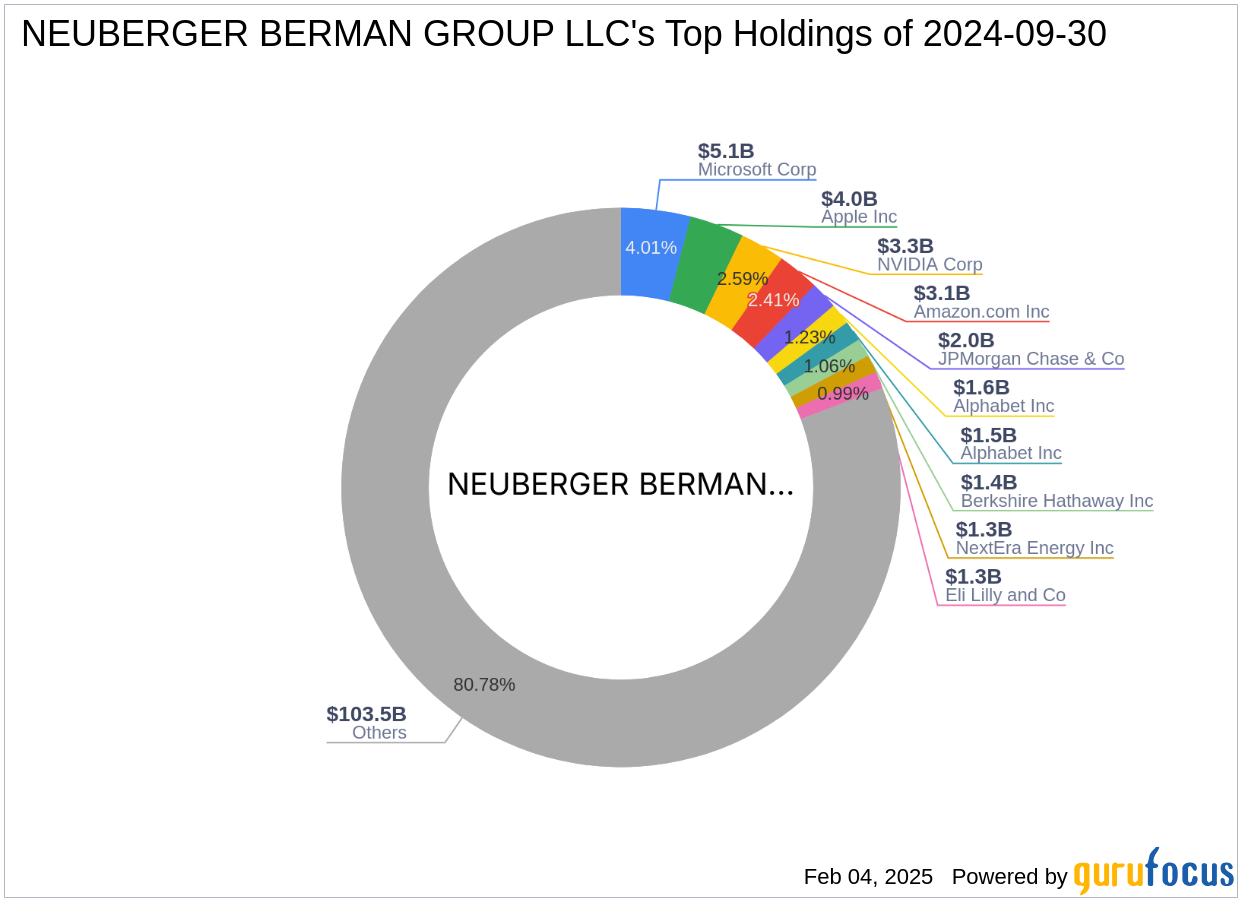

NEUBERGER BERMAN GROUP LLC, headquartered at 1290 Avenue of the Americas, New York, NY, manages a substantial equity portfolio valued at $128.11 billion. While the firm's specific investment philosophy is not detailed, its top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), NVIDIA Corp (NVDA, Financial), and JPMorgan Chase & Co (JPM, Financial). This diverse portfolio underscores the firm's focus on sectors with robust growth potential.

Understanding Transcat Inc

Transcat Inc, operating in the USA, has been publicly traded since its IPO on March 27, 1990. The company specializes in providing calibration and laboratory instrument services, alongside distributing test, measurement, and control instrumentation. Transcat's operations are divided into two key segments: Service and Distribution, with the majority of its revenue derived from the Service segment. The company serves various industries, including pharmaceutical, industrial manufacturing, energy, and chemical processes. As of the latest data, Transcat boasts a market capitalization of $738.225 million.

Financial Metrics and Valuation

Transcat's current stock price stands at $79.3, with a price-to-earnings ratio of 42.18. According to the [GF Valuation](https://www.gurufocus.com/term/gf-value/TRNS), the stock is modestly undervalued, with a GF Value of $91.03, resulting in a price to GF Value ratio of 0.88. Despite a year-to-date price change of -25.24%, the stock's valuation suggests potential for future appreciation.

Performance and Growth Indicators

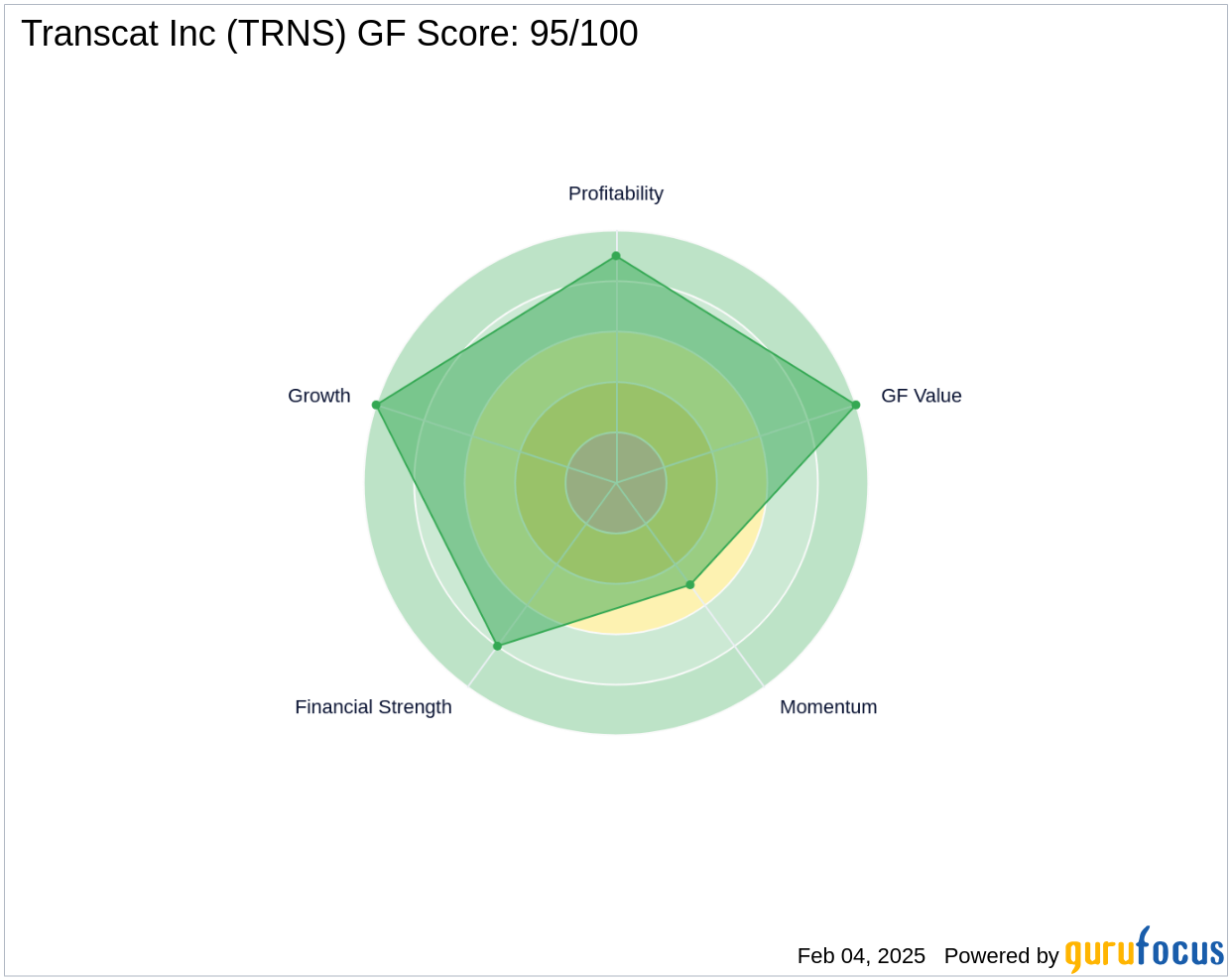

Transcat exhibits strong performance metrics, with a [GF Score](https://www.gurufocus.com/term/gf-score/TRNS) of 95/100, indicating the highest outperformance potential. The company's [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/TRNS) is 8/10, [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/TRNS) is 9/10, and [Growth Rank](https://www.gurufocus.com/term/rank-growth/TRNS) is 10/10. Over the past three years, Transcat has achieved revenue growth of 10.60%, EBITDA growth of 17.30%, and earnings growth of 20.50%, showcasing its robust growth trajectory.

Additional Stock Metrics

Transcat's financial health is further illustrated by its [interest coverage](https://www.gurufocus.com/term/interest-coverage/TRNS) of 53.42 and a [cash to debt ratio](https://www.gurufocus.com/term/cash-to-debt/TRNS) of 0.07. The company's return on equity (ROE) is 6.75%, and return on assets (ROA) is 5.29%. Additionally, Transcat has demonstrated gross margin growth of 6.00% and [Operating Margin](https://www.gurufocus.com/term/operating-margin/TRNS) growth of 3.90%.

Market Sentiment and Momentum

Transcat's market sentiment, as indicated by its 14-day Relative Strength Index (RSI) of 24.84, suggests potential oversold conditions. The Momentum Index for 6 - 1 Month is 0.61, while the 12 - 1 Month index is -4.10, reflecting mixed momentum signals in the short term.

Conclusion

NEUBERGER BERMAN GROUP LLC's strategic addition of shares in Transcat Inc underscores the firm's confidence in the company's potential for long-term growth. Despite recent market challenges, Transcat's robust financial metrics and growth prospects align with the investment philosophy of value investors seeking sustainable gains. This transaction not only strengthens the firm's portfolio but also positions it to benefit from Transcat's future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.