On December 31, 2024, NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) executed a significant transaction involving Rogers Corp (ROG, Financial). The firm added 255,423 shares of Rogers Corp, increasing its position by 35.61%. This strategic move highlights the firm's confidence in Rogers Corp's potential, as it now holds a total of 972,623 shares. The transaction was executed at a price of $101.61 per share, reflecting a 5.20% impact on the firm's holdings in Rogers Corp. This addition represents 0.08% of NEUBERGER BERMAN GROUP LLC (Trades, Portfolio)'s extensive portfolio.

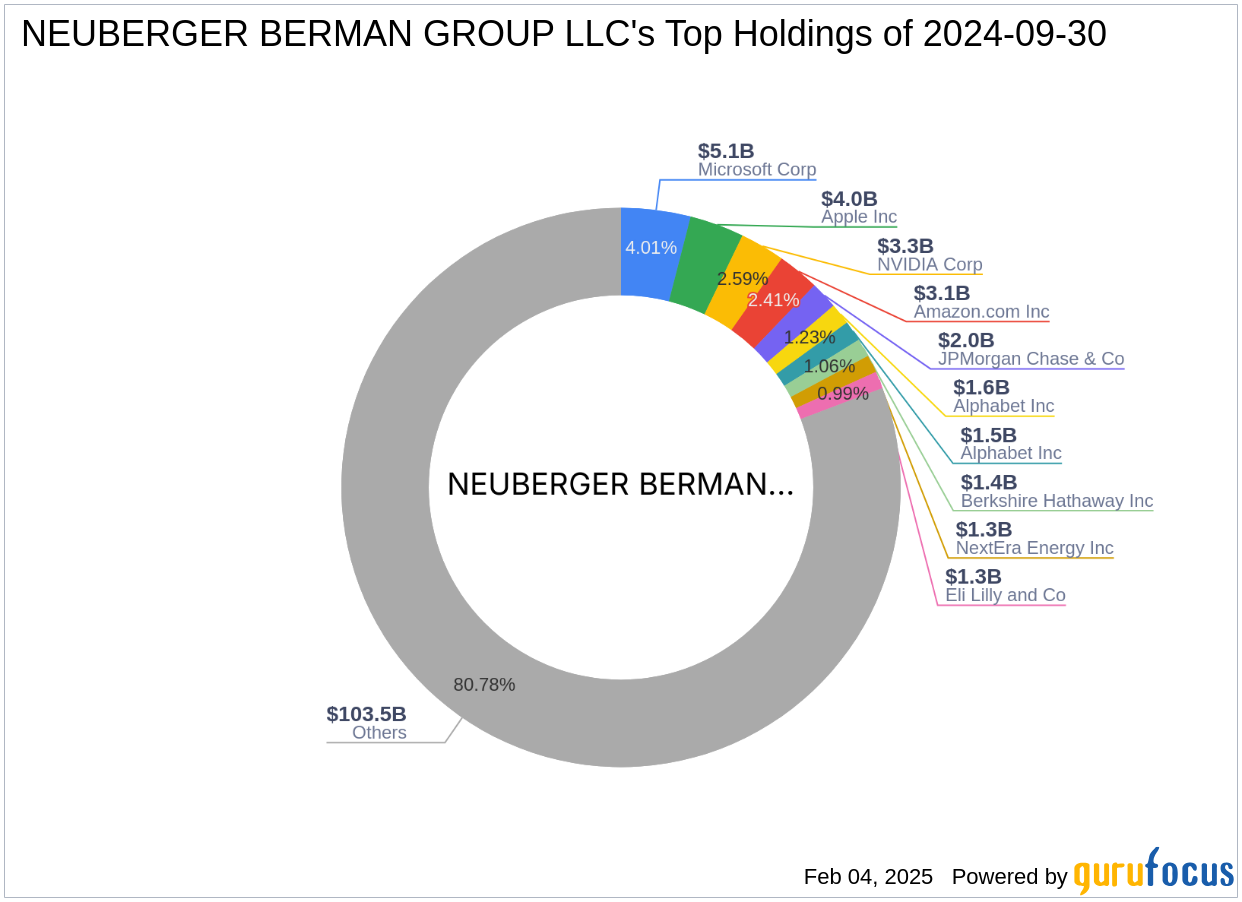

Profile of NEUBERGER BERMAN GROUP LLC (Trades, Portfolio)

NEUBERGER BERMAN GROUP LLC is a prominent investment firm headquartered in New York, managing a diverse portfolio of 1,917 stocks. The firm is known for its substantial investments in major technology and financial services companies, with top holdings including Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). With an equity value of $128.11 billion, the firm primarily focuses on the technology and financial services sectors. This strategic diversification underscores the firm's robust investment philosophy and its commitment to long-term growth.

Overview of Rogers Corp

Rogers Corporation, based in the USA, specializes in designing and manufacturing engineered materials and components for various industries. The company operates through segments such as Advanced Electronics Solutions and Elastomeric Material Solutions. With a market capitalization of $1.67 billion, Rogers Corp serves a global clientele, generating revenue in the United States, China, and Germany. The company's innovative solutions cater to diverse applications, including communications infrastructure, automotive, and consumer electronics markets.

Financial Metrics and Valuation of Rogers Corp

Rogers Corp is currently trading at $89.31, with a price-to-earnings (PE) ratio of 33.32, indicating it is significantly undervalued according to the GF Valuation. The GF Value of the stock is $129.08, suggesting a price to GF Value ratio of 0.69. This valuation highlights a potential investment opportunity for value investors. Despite a recent price decline of 12.11% since the transaction, the company's long-term growth prospects remain promising, as evidenced by its substantial IPO growth of 3,515.79%.

Impact of the Transaction on NEUBERGER BERMAN GROUP LLC (Trades, Portfolio)'s Portfolio

The addition of Rogers Corp shares represents a strategic increase in NEUBERGER BERMAN GROUP LLC (Trades, Portfolio)'s investment, with the total holding now at 972,623 shares. This transaction has a 5.20% impact on the firm's holdings in Rogers Corp, reflecting the firm's confidence in the company's future performance. The decision to increase the stake in Rogers Corp aligns with the firm's investment philosophy of identifying undervalued opportunities with strong growth potential.

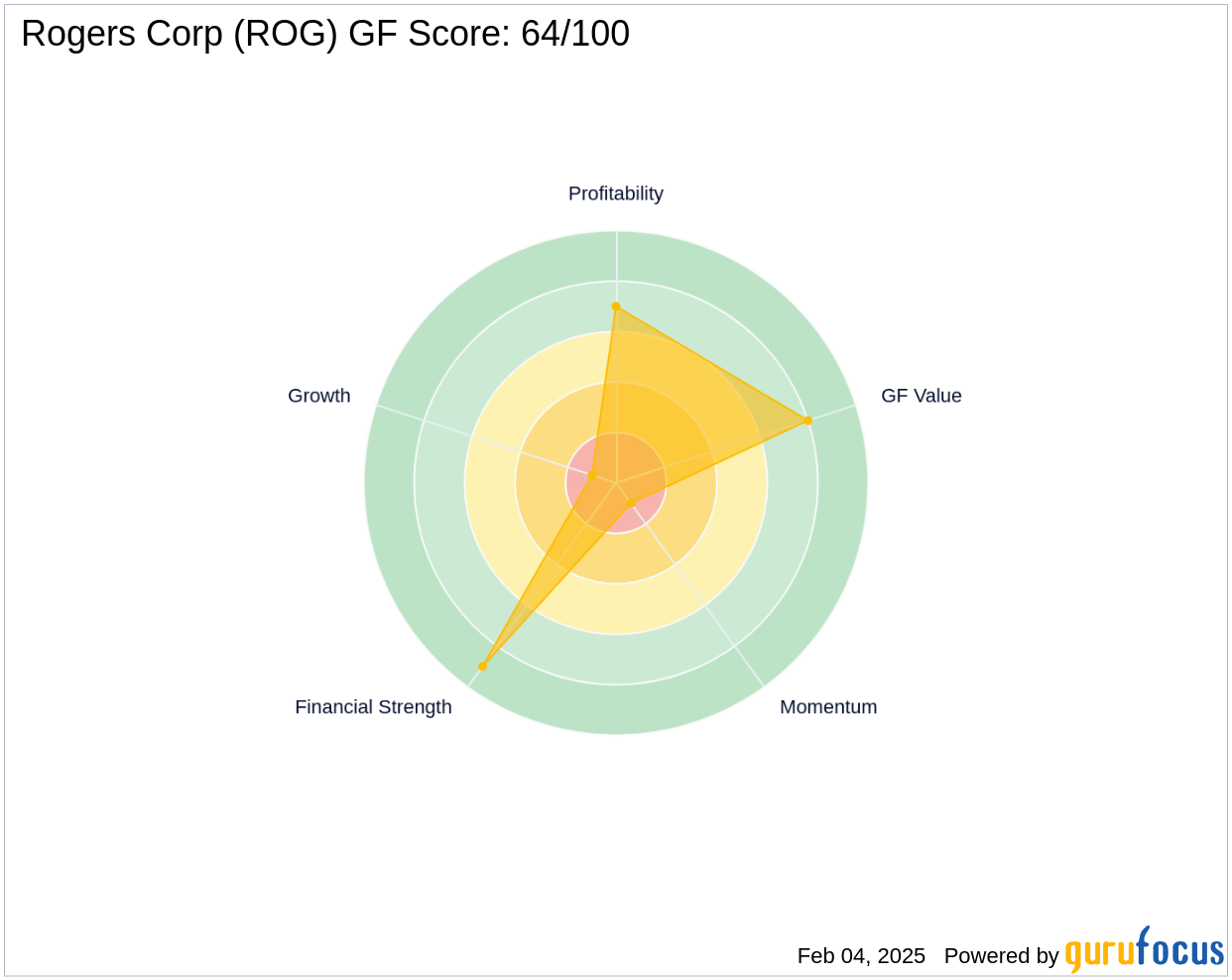

Performance and Growth Prospects of Rogers Corp

Despite a recent decline in stock price, Rogers Corp has demonstrated significant growth since its IPO, with a remarkable increase of 3,515.79%. The company's GF Score is 64/100, indicating poor future performance potential. However, Rogers Corp boasts a strong balance sheet rank of 9/10, suggesting financial stability. The company's interest coverage ratio of 19.04 further supports its financial strength, providing a solid foundation for future growth.

Other Gurus Involved with Rogers Corp

Besides NEUBERGER BERMAN GROUP LLC (Trades, Portfolio), other notable investors in Rogers Corp include Joel Greenblatt (Trades, Portfolio) and Jefferies Group (Trades, Portfolio). GAMCO Investors holds the largest share percentage of Rogers Corp among the gurus, indicating a shared belief in the company's potential. This collective interest from prominent investment firms underscores the attractiveness of Rogers Corp as a viable investment opportunity.

Transaction Analysis

The recent acquisition of Rogers Corp shares by NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) signifies a strategic move to capitalize on the company's undervaluation and growth potential. Despite the current challenges reflected in the stock's performance, the firm's increased stake demonstrates confidence in Rogers Corp's ability to deliver long-term value. This transaction not only enhances the firm's portfolio but also positions it to benefit from any future appreciation in Rogers Corp's stock value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.