On December 31, 2024, BlackRock, Inc. (Trades, Portfolio), a leading global investment firm, made a notable addition to its portfolio by acquiring 6,301,020 shares of Applied Digital Corp. This transaction increased BlackRock's total holdings in the company to 15,419,134 shares. The shares were acquired at a price of $7.64 each, reflecting BlackRock's strategic interest in the digital infrastructure sector. This move underscores the firm's commitment to investing in companies with potential growth in the digital and cloud services industry.

BlackRock, Inc. (Trades, Portfolio): A Profile of a Leading Investment Firm

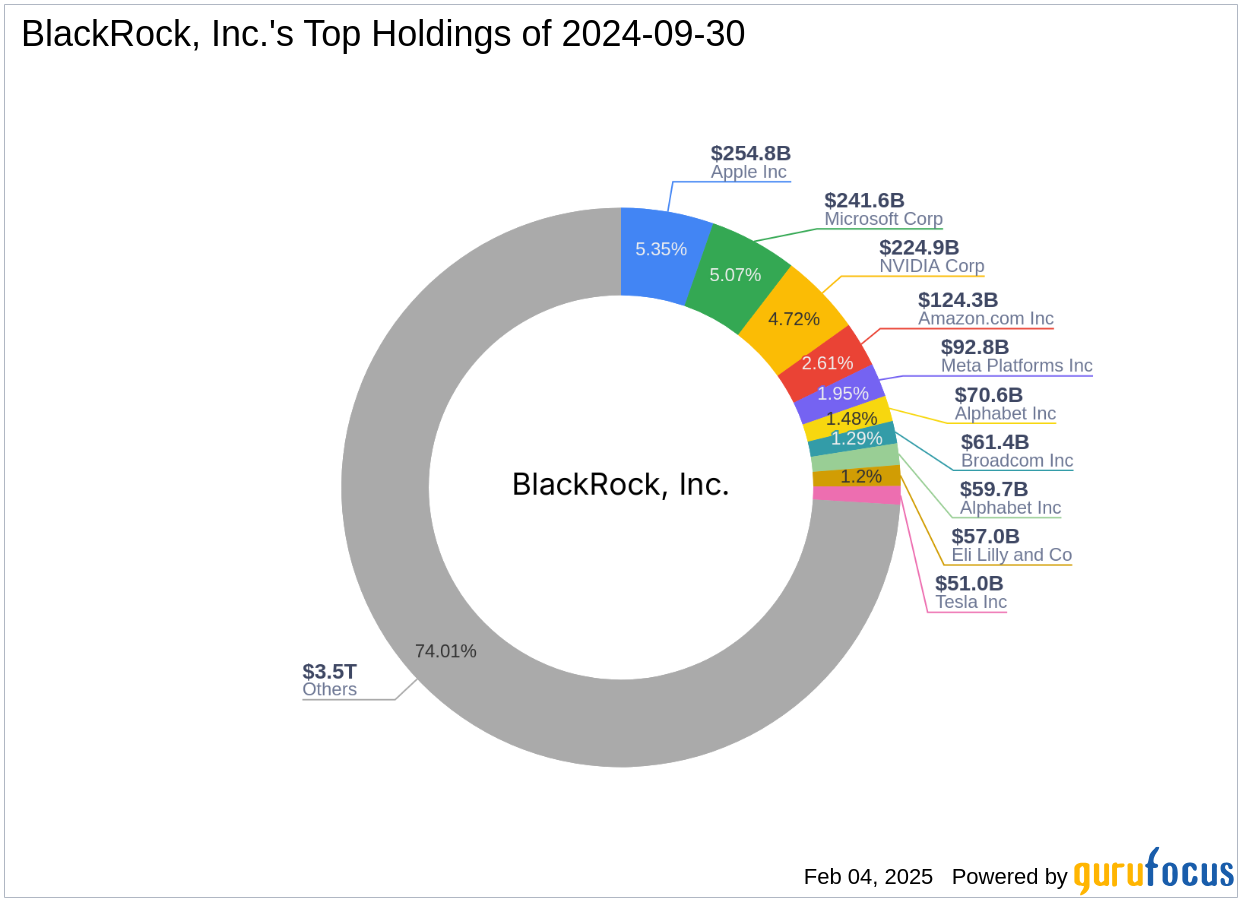

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is renowned for its comprehensive investment management services. With an equity portfolio valued at $4,761.16 trillion, BlackRock is a dominant player in the financial services sector. The firm's investment philosophy emphasizes diversification and long-term growth, with top holdings in major technology companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These holdings reflect BlackRock's focus on technology and financial services as key sectors for investment.

Understanding Applied Digital Corp

Applied Digital Corp is a USA-based company that specializes in designing, developing, and operating next-generation digital infrastructure across North America. The company provides digital infrastructure solutions and cloud services, catering to industries such as High-Performance Computing (HPC) and Artificial Intelligence (AI). Applied Digital's primary revenue source is its Data Center Hosting Business, which offers energized space to crypto mining customers. The company operates in several business segments, including the Cloud Services Business and HPC Hosting Business.

Financial Metrics and Valuation of Applied Digital Corp

As of February 4, 2025, Applied Digital Corp has a market capitalization of $1.71 billion, with its stock priced at $7.69. The stock is considered modestly undervalued according to its GF Value of $10.46, indicating potential for appreciation. Despite this, the company's financial performance presents challenges, with a negative return on equity (ROE) of -125.66% and a return on assets (ROA) of -30.94%. These figures suggest that while the stock may be undervalued, the company's current financial health requires careful consideration.

Performance and Growth Indicators

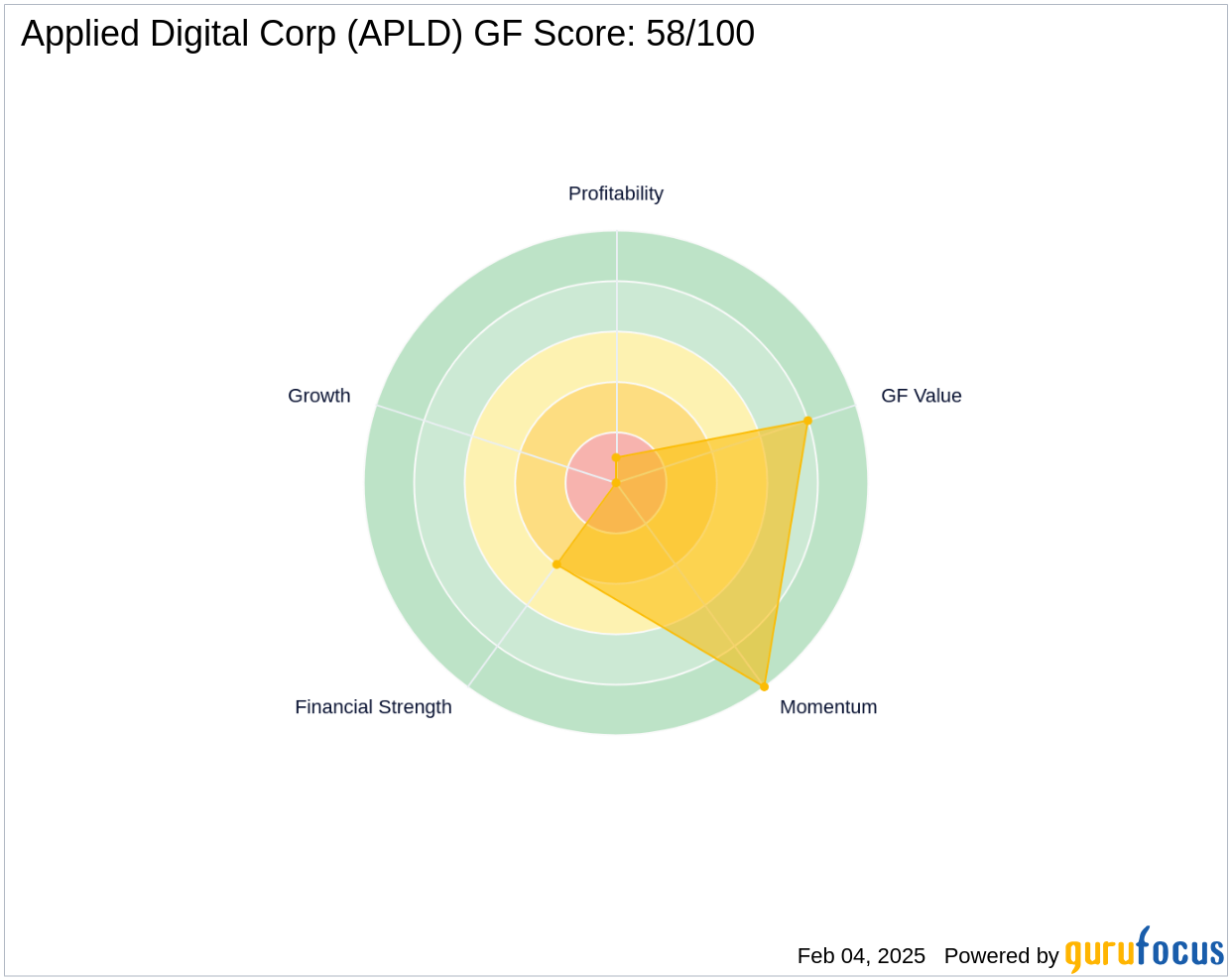

Applied Digital Corp's GF Score of 58/100 suggests poor future performance potential. Key financial ratios, such as the negative ROE and ROA, highlight the company's struggles in generating profits. The company's Profitability Rank is 1/10, and its Growth Rank is 0/10, indicating significant room for improvement. However, Applied Digital boasts a strong Momentum Rank of 10/10, reflecting positive investor sentiment and potential for stock price movement.

Market Position and Sector Analysis

Within the software industry, Applied Digital Corp is positioned as a provider of essential digital infrastructure services. The company's focus on cloud services and data center hosting aligns with growing industry trends towards digital transformation and increased demand for cloud-based solutions. Despite its financial challenges, Applied Digital's strong momentum and strategic positioning in the digital infrastructure sector offer potential for future growth.

Other Notable Investors in Applied Digital Corp

In addition to BlackRock, other prominent investors in Applied Digital Corp include Ken Fisher (Trades, Portfolio). Leucadia National is identified as the largest guru shareholder of the stock, indicating a shared belief in the company's potential. These investments by notable firms highlight the interest in Applied Digital's capabilities and market opportunities.

Transaction Analysis and Impact

BlackRock's acquisition of additional shares in Applied Digital Corp reflects a strategic decision to increase its exposure to the digital infrastructure sector. This transaction, representing 7.30% of BlackRock's holdings in the traded stock, underscores the firm's confidence in Applied Digital's potential for growth. While the company's current financial metrics suggest challenges, BlackRock's investment may signal a long-term view of the company's ability to capitalize on industry trends and improve its financial performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: