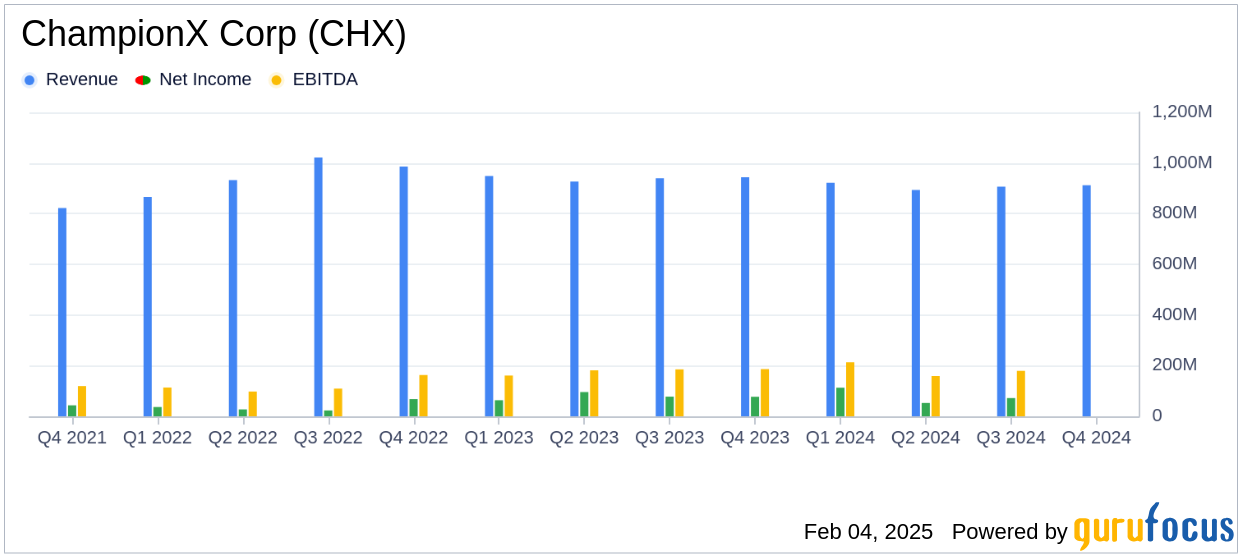

ChampionX Corp (CHX, Financial) released its 8-K filing on February 4, 2025, detailing its financial performance for the fourth quarter and full year of 2024. ChampionX, a leader in chemical solutions and equipment for oil and gas production, reported a fourth-quarter revenue of $912.0 million and a net income attributable to ChampionX of $82.8 million. The company's adjusted EBITDA for the quarter was $212.3 million, reflecting a robust adjusted EBITDA margin of 23.3%.

Company Overview

ChampionX Corp (CHX, Financial) specializes in providing chemical solutions and equipment for both onshore and offshore oil and gas production. The company focuses on the production phase of the well lifecycle, offering services such as artificial lift and drilling technologies. Formed in 2020 after Apergy acquired the chemical technologies business from Ecolab, ChampionX has established itself as a key player in the oil and gas industry.

Performance and Challenges

ChampionX's performance in the fourth quarter was marked by a 1% sequential increase in revenue, driven by seasonal strength in its Production Chemical Technologies business. However, this growth was partially offset by typical seasonal declines in the Production & Automation Technologies segment. The company's ability to maintain a high adjusted EBITDA margin of 23.3% highlights its focus on productivity and profitability, which is crucial in the volatile oil and gas industry.

Financial Achievements

For the full year 2024, ChampionX reported a net income attributable to the company of $320.3 million and an adjusted EBITDA of $784.7 million. The company's cash flow from operating activities was $589.7 million, with a free cash flow of $460.5 million. These achievements underscore ChampionX's strong cash flow profile and its ability to convert a significant portion of its adjusted EBITDA into free cash flow, which is vital for sustaining operations and supporting strategic objectives in the oil and gas sector.

Key Financial Metrics

ChampionX's income before income taxes margin for the fourth quarter was 13.0%, while the adjusted EBITDA margin reached 23.3%. The company's cash from operating activities was $207.3 million, with a free cash flow of $170.1 million. These metrics are important as they reflect the company's operational efficiency and financial health, providing insights into its ability to generate cash and manage expenses effectively.

“2024 was a year in which we continued to demonstrate the unique nature of ChampionX’s cash flow resiliency, driven by the strength of our high-margin operating model and capital-light portfolio of businesses,” stated ChampionX’s President and CEO, Sivasankaran “Soma” Somasundaram.

Segment Performance

In the fourth quarter, the Production Chemical Technologies segment reported revenue of $569.7 million, a 2% sequential increase. The segment's operating profit margin improved by 259 basis points to 18.2%. The Production & Automation Technologies segment saw a 2% sequential decline in revenue to $269.6 million, primarily due to seasonality. However, the segment's operating profit margin increased by 210 basis points to 14.5%.

Analysis and Outlook

ChampionX's strong financial performance in 2024, particularly its ability to generate significant free cash flow, positions the company well for future growth. The company's focus on high-margin operations and its capital-light business model are key strengths that can help it navigate the challenges of the oil and gas industry. With the anticipated growth in global oil production, ChampionX is poised for another year of positive performance relative to market activity.

ChampionX's pending acquisition by SLB, announced in April 2024, is expected to further enhance its market position. The transaction, which is subject to regulatory approvals, reflects the company's strategic alignment with industry trends and its commitment to delivering value to shareholders.

Explore the complete 8-K earnings release (here) from ChampionX Corp for further details.