Criteo SA (CRTO, Financial), a leading ad-tech company in the digital advertising market, released its 8-K filing on February 5, 2025, reporting record financial results for the fourth quarter and fiscal year ended December 31, 2024. The company, known for enabling retailer advertisers to launch multichannel and cross-device marketing campaigns in real time, has demonstrated robust growth and strategic advancements.

Performance Overview

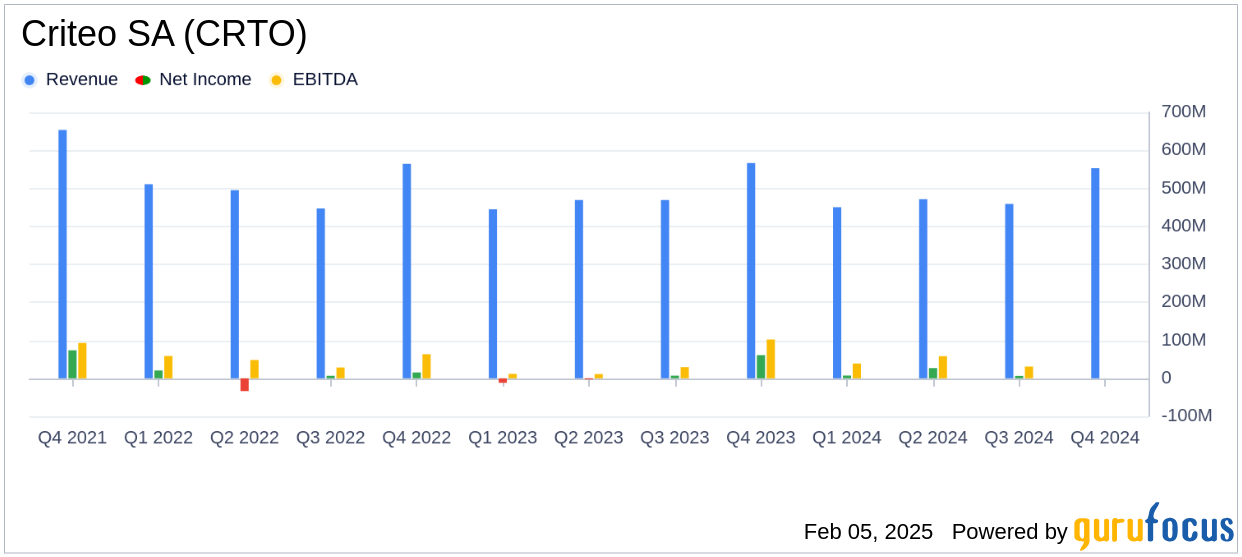

For the fourth quarter of 2024, Criteo SA reported revenue of $553 million, slightly below the previous year's $566 million, marking a 2% decrease. However, the company's gross profit increased by 9% to $301 million, and net income rose by 16% to $72 million, or $1.23 per diluted share. This performance exceeded the analyst estimate of $0.76 per share, showcasing the company's ability to enhance profitability despite a slight dip in revenue.

On an annual basis, Criteo's revenue was $1.9 billion, a 1% decrease from 2023. Yet, the company achieved a significant 14% increase in gross profit to $983 million and more than doubled its net income to $115 million, or $1.90 per diluted share, surpassing the annual estimated earnings per share of $1.49.

Strategic Achievements and Challenges

Criteo's strategic initiatives, including a $225 million share repurchase program and the appointment of Michael Komasinski as the new CEO, underscore its commitment to shareholder value and leadership in commerce media. The company's focus on expanding its platform adoption to 3,500 brands and 225 retailers, including notable names like Harrods, highlights its growth trajectory.

Despite these achievements, Criteo faces challenges such as a slight decline in Performance Media revenue, which decreased by 6% in Q4 2024. This decline was partially offset by the growth in Commerce Audiences and Retail Media, which saw a 20% increase in revenue.

Financial Metrics and Analysis

Key financial metrics reveal Criteo's strong operational performance. The company's gross profit margin improved to 54% in Q4 2024, up from 49% in the previous year. Adjusted EBITDA for the quarter was $144 million, a 4% increase year-over-year, with an adjusted diluted EPS of $1.75, exceeding the analyst estimate of $0.76 per share.

For the fiscal year, Criteo's adjusted EBITDA rose by 29% to $390 million, reflecting effective cost management and higher Contribution ex-TAC. The company's free cash flow also saw a substantial increase, reaching $182 million for the year, a 65% rise from 2023.

“In 2024, we delivered record performance and expanded our adjusted EBITDA margin by 500 basis points to 35%,” said Sarah Glickman, Chief Financial Officer of Criteo. “We deployed $225 million of capital for share repurchases, demonstrating our focus on driving shareholder value.”

Balance Sheet and Cash Flow

Criteo's balance sheet remains strong, with cash and cash equivalents totaling $291 million as of December 31, 2024. The company's total assets were $2.27 billion, with total liabilities of $1.19 billion, resulting in a shareholders' equity of $1.08 billion.

Cash flow from operating activities increased to $169 million in Q4 2024, while free cash flow for the quarter was $146 million, reflecting the company's ability to generate cash and invest in growth initiatives.

Conclusion

Criteo SA's record financial performance in Q4 2024, coupled with strategic initiatives and strong financial metrics, positions the company well for continued growth in the competitive digital advertising market. The company's focus on expanding its platform and enhancing shareholder value through share repurchases underscores its commitment to long-term success.

Explore the complete 8-K earnings release (here) from Criteo SA for further details.