On December 31, 2024, STATE STREET CORP (Trades, Portfolio) executed a notable transaction by acquiring an additional 381,540 shares of Global Net Lease Inc (GNL, Financial) at a trade price of $7.3 per share. This acquisition increased the firm's total holdings in GNL to 11,801,057 shares. The transaction reflects STATE STREET CORP (Trades, Portfolio)'s strategic decision to bolster its investment in the real estate sector, specifically within the diversified portfolio of commercial properties managed by GNL. Despite the significant number of shares acquired, the transaction did not substantially alter the firm's overall portfolio, maintaining a position ratio of 5.10% in the traded stock.

STATE STREET CORP (Trades, Portfolio): A Leading Investment Firm

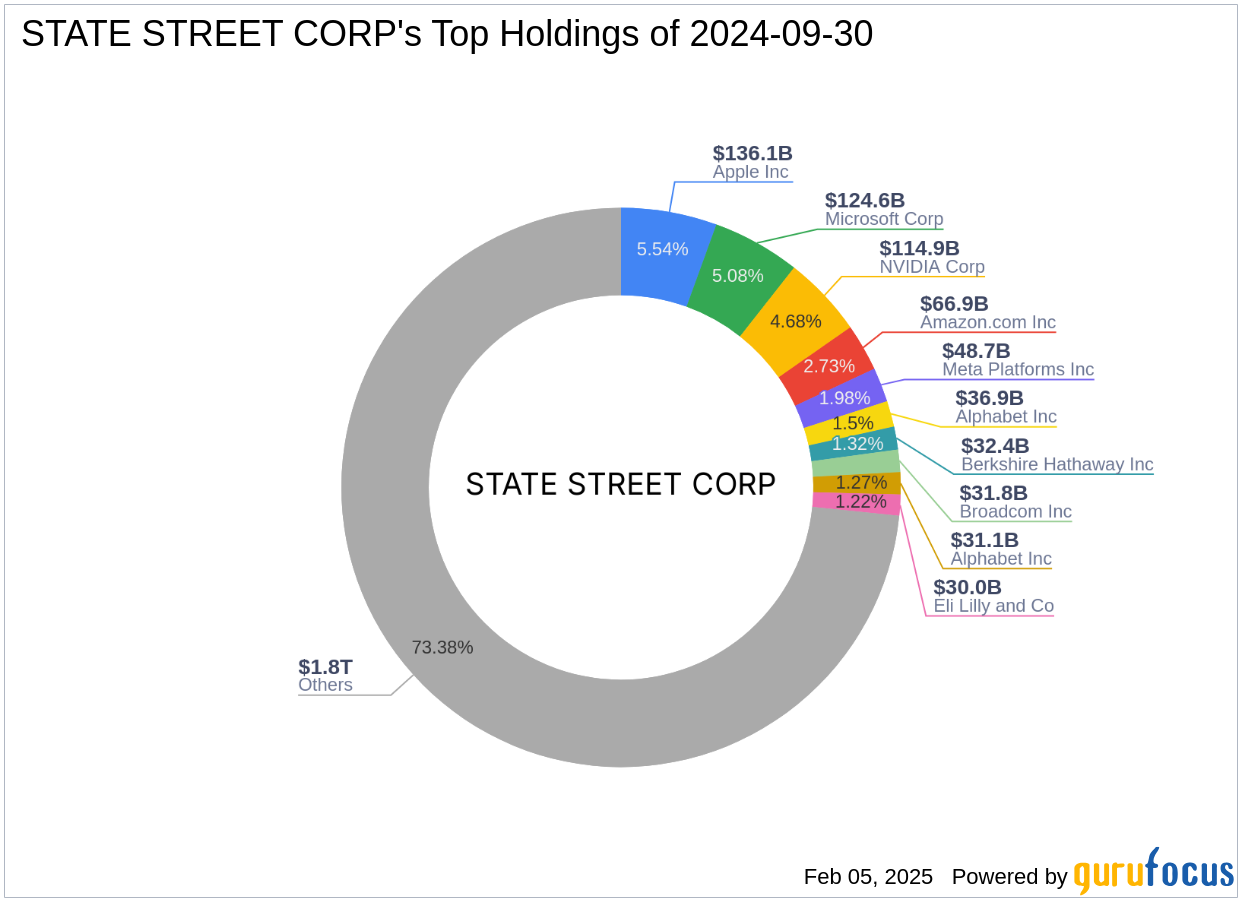

STATE STREET CORP (Trades, Portfolio), headquartered at One Lincoln Street, Boston, MA, is a prominent investment firm recognized for its substantial equity holdings, valued at $2,454.55 trillion. The firm primarily focuses on the technology and financial services sectors, with top holdings in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). This strategic focus underscores the firm's commitment to investing in sectors with significant growth potential and technological innovation.

Global Net Lease Inc: A Diversified REIT

Global Net Lease Inc is a real estate investment trust (REIT) that manages a globally diversified portfolio of commercial real estate properties. The company operates across various segments, including Industrial & Distribution, Multi-Tenant Retail, Office, and Single-Tenant Retail, with operations spanning the USA, UK, Canada, and Europe. GNL derives the majority of its revenue from the industrial and distribution segment, highlighting its strategic focus on sectors with stable demand and growth potential.

Impact of the Transaction

The addition of GNL shares to STATE STREET CORP (Trades, Portfolio)'s portfolio signifies a strategic move to enhance its holdings in the real estate sector. Despite the acquisition, the firm's portfolio composition remains largely unchanged, with the GNL position ratio at 5.10%. This transaction may indicate STATE STREET CORP (Trades, Portfolio)'s confidence in GNL's long-term potential, despite the current valuation concerns and market performance challenges faced by the company.

Financial Metrics and Valuation of GNL

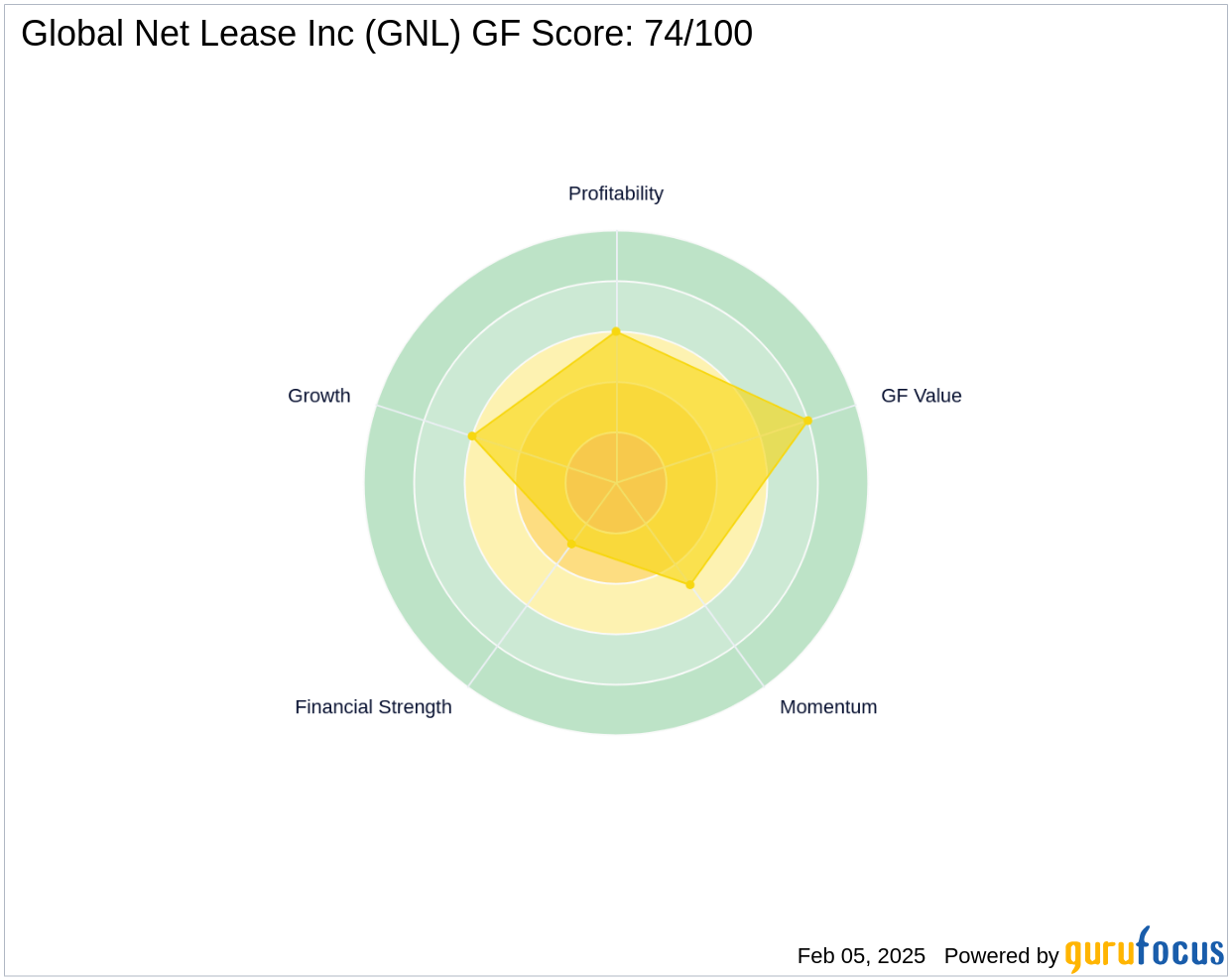

Global Net Lease Inc currently has a market capitalization of $1.66 billion, with a stock price of $7.215. The stock is considered a "Possible Value Trap" with a GF Value of $10.39, resulting in a price to GF Value ratio of 0.69. This suggests that the stock is trading below its intrinsic value, but investors should exercise caution due to potential risks. GNL's financial metrics reveal a challenging landscape, with a balance sheet rank of 3/10 and a Profitability Rank of 6/10.

Performance and Growth Indicators

Since the transaction, GNL has experienced a -1.16% price change, and a significant -76.12% change since its IPO. The company's GF Score is 74/100, indicating likely average performance. The balance sheet rank is 3/10, while the profitability rank stands at 6/10. These metrics suggest that while GNL has potential, it also faces significant challenges in terms of financial strength and growth prospects.

Conclusion and Implications for Investors

STATE STREET CORP (Trades, Portfolio)'s decision to increase its stake in Global Net Lease Inc may signal confidence in the company's long-term potential, despite current valuation concerns. Value investors should consider the firm's strategic positioning and the potential risks associated with GNL's financial metrics and market performance. The transaction highlights the importance of thorough analysis and due diligence when evaluating investment opportunities in the real estate sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.