On December 31, 2024, State Street Corp, a prominent investment firm, made a strategic decision to reduce its holdings in The ODP Corp (ODP, Financial). The firm decreased its position by 15,762 shares at a traded price of $22.74, bringing its total holdings to 1,526,963 shares. This transaction reflects a slight adjustment in the firm's portfolio, which is known for its significant investments in major technology and financial services companies.

State Street Corp: A Profile of the Investment Firm

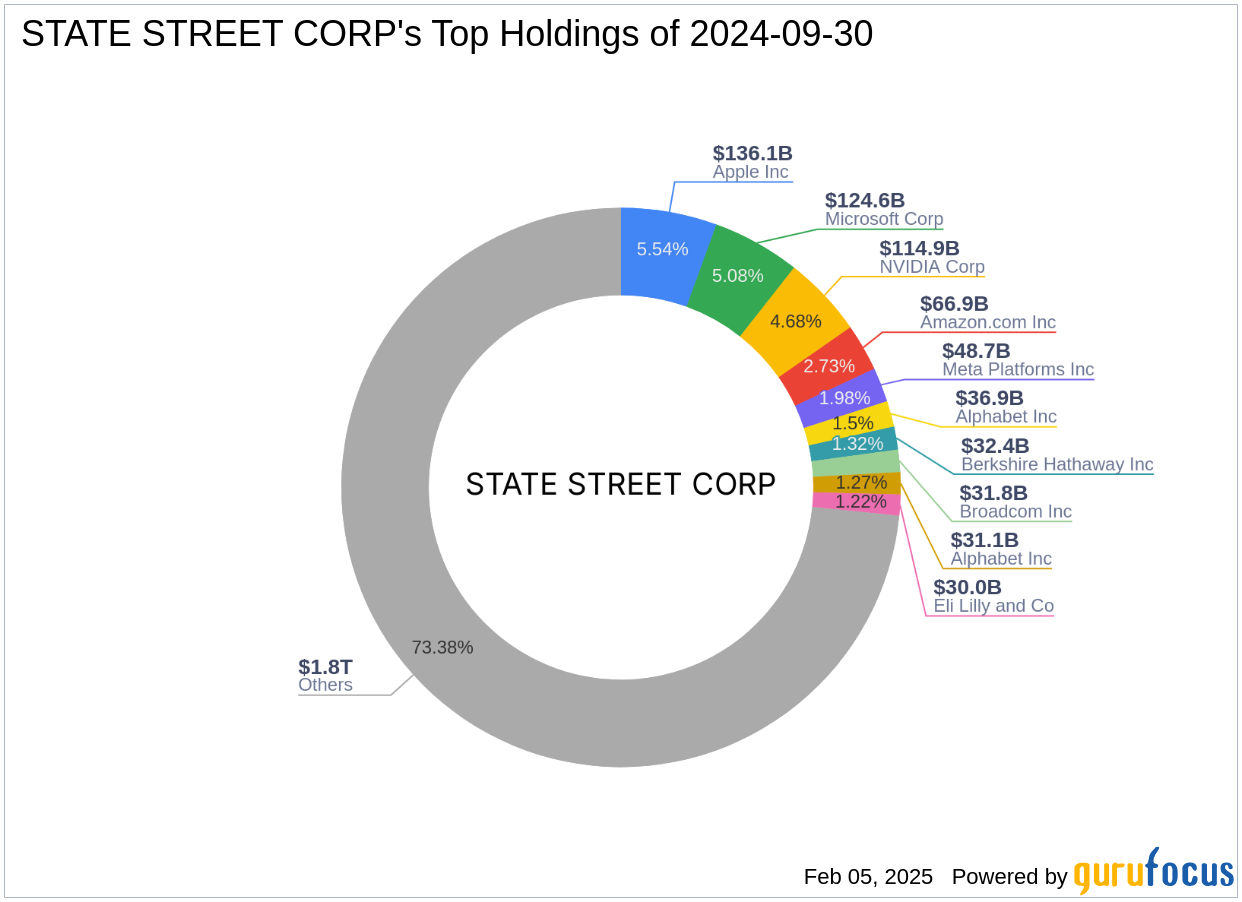

State Street Corp, headquartered in Boston, MA, is a leading investment firm with a substantial equity base of $2,454.55 trillion. The firm is renowned for its investments in top-tier technology and financial services companies, including Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). While the firm's specific investment philosophy is not explicitly detailed, its portfolio reflects a strong focus on technology and financial services sectors.

An Overview of The ODP Corp

The ODP Corp operates a comprehensive B2B distribution platform, with divisions such as ODP Business Solutions and Office Depot Division. The company, which has a market capitalization of $652.664 million, is a key player in the retail-cyclical industry. Its business model includes various segments like the Veyer Division, which focuses on supply chain and distribution services, and the Varis Division, which offers a tech-enabled B2B procurement marketplace.

Financial Metrics and Valuation of The ODP Corp

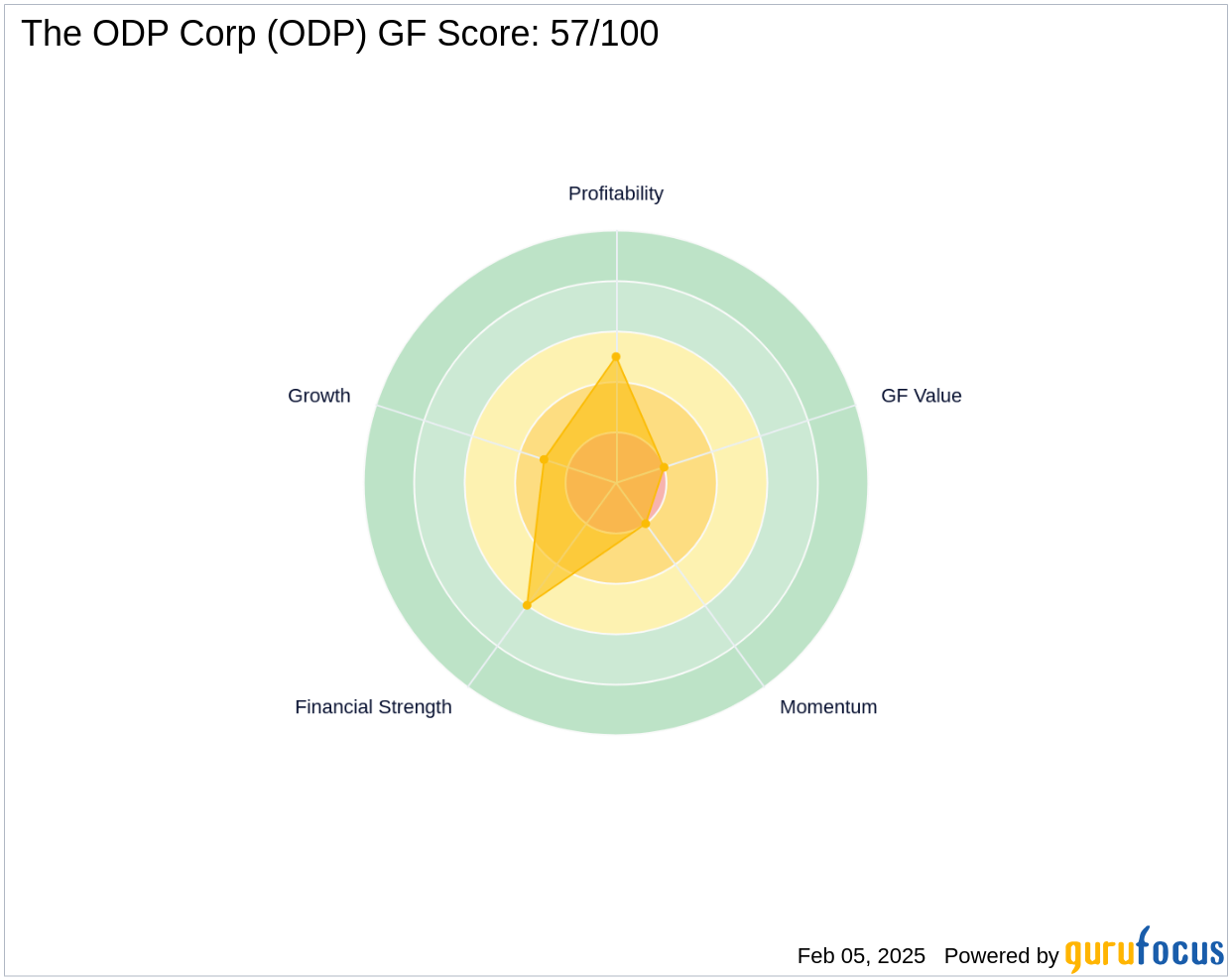

The current stock price of The ODP Corp stands at $21.67, with a GF Value of $52.54, indicating a possible value trap. The price to GF Value ratio is 0.41, suggesting potential undervaluation. However, the year-to-date performance shows a decline of 1.5%. The company's GF Score is 57/100, indicating poor future performance potential.

Performance and Growth Indicators

The ODP Corp's financial strength is reflected in its balance sheet and profitability ranks of 6/10 and 5/10, respectively. However, the Growth Rank is 3/10, with a 3-year revenue growth of 5.40%. The company's cash to debt ratio is 0.17, indicating significant financial leverage. The interest coverage ratio is 5.75, showing the company's ability to cover its interest expenses.

Market Sentiment and Momentum

The Relative Strength Index (RSI) 14 Day for The ODP Corp is 37.91, suggesting potential oversold conditions. The Momentum Index for 6 - 1 Month is -44.27, reflecting negative momentum. These indicators highlight the current market sentiment and the challenges the company faces in gaining positive momentum.

Other Notable Gurus Holding ODP

In addition to State Street Corp, other notable investment firms holding shares in The ODP Corp include Greenlight Capital, HOTCHKIS & WILEY, Joel Greenblatt (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss. These firms' involvement indicates a continued interest in the company's potential despite its current challenges.

Conclusion: Strategic Implications for Value Investors

State Street Corp's decision to reduce its holdings in The ODP Corp reflects a strategic adjustment in its portfolio. For value investors, the current valuation and financial metrics of The ODP Corp present both challenges and opportunities. While the stock appears undervalued based on the price to GF Value ratio, the potential value trap and poor future performance indicators warrant careful consideration. Investors should weigh these factors when evaluating the stock's potential in their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: