On December 31, 2024, Morgan Stanley made a significant move by reducing its holdings in RCM Technologies Inc (RCMT, Financial). The firm decreased its position by 174,583 shares, representing a 43.48% reduction in its stake. The transaction was executed at a price of $22.16 per share, leaving Morgan Stanley with 226,984 shares in RCM Technologies. This strategic decision reflects the firm's ongoing assessment of its investment portfolio and market conditions.

Morgan Stanley: A Legacy of Financial Innovation

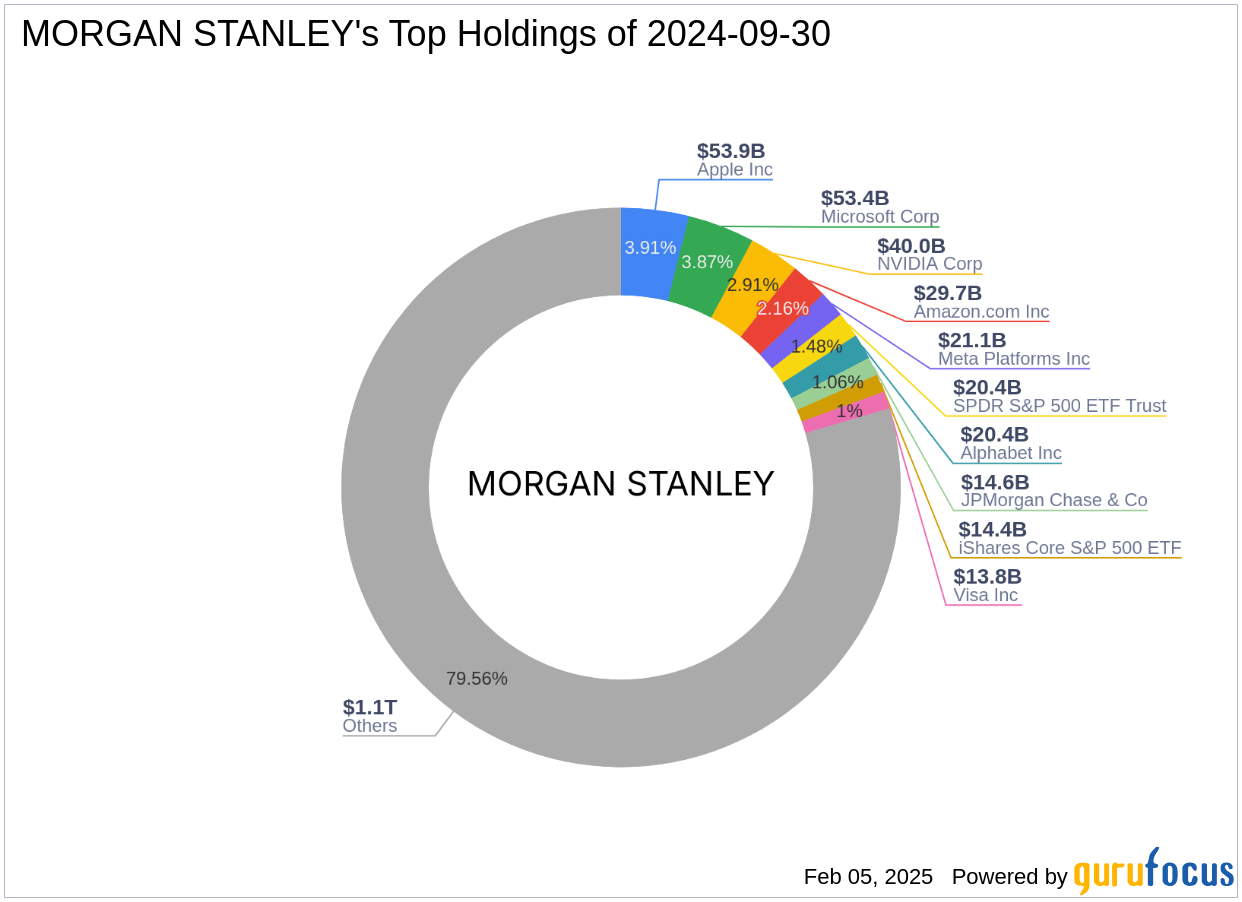

Established in 1935, Morgan Stanley has a rich history rooted in the legacy of JP Morgan & Co. Over the decades, the firm has been at the forefront of financial innovation, pioneering computer models for financial analysis and automated trade processing systems. Today, Morgan Stanley operates in 42 countries, employing over 60,000 people. The firm's investment philosophy focuses on the technology and financial services sectors, with top holdings in companies like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial).

RCM Technologies Inc: A Provider of Business and Technology Solutions

RCM Technologies Inc is a prominent provider of business and technology solutions, specializing in engineering, life sciences, IT, and specialty health care. The company operates primarily in the USA, with additional operations in Canada, Puerto Rico, and Serbia. With a market capitalization of $153.535 million and a PE ratio of 10.36, RCM Technologies is positioned as a modestly undervalued stock, with a GF Value of $23.13. The company's current stock price is $20.21, reflecting a price to GF Value ratio of 0.87.

Stock Performance and Valuation

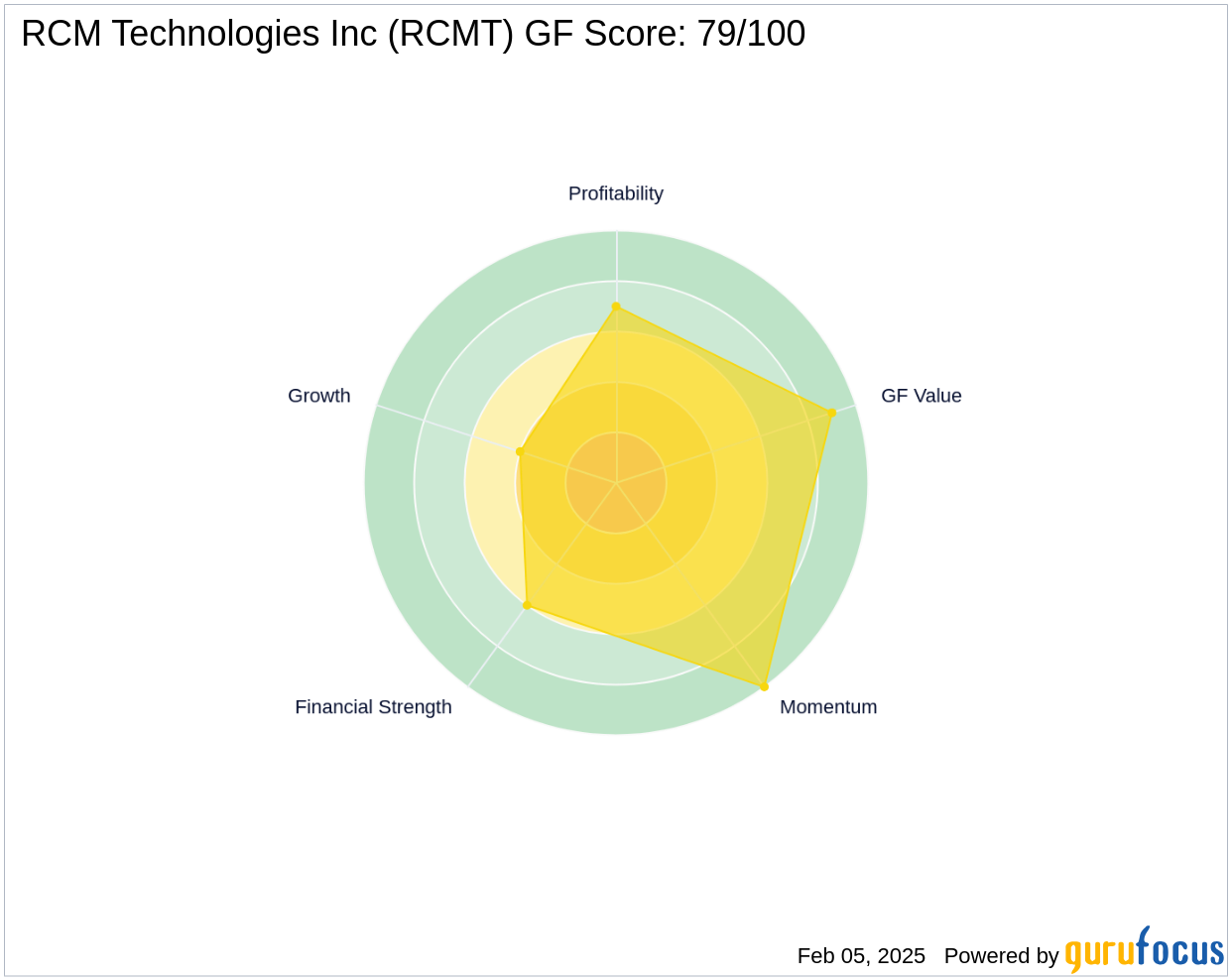

RCM Technologies has experienced a year-to-date performance decline of 10.06%. Despite this, the stock is considered modestly undervalued, with a GF Value of $23.13. The company's financial health is reflected in its Balance Sheet Rank of 6/10 and a Profitability Rank of 7/10. However, its Growth Rank is lower at 4/10, indicating potential challenges in growth prospects. The GF Score of 79/100 suggests likely average performance in the long term.

Financial Health and Growth Prospects

RCM Technologies' financial health is supported by an interest coverage ratio of 12.09 and an Altman Z score of 3.98, indicating a stable financial position. The company's Piotroski F-Score of 4 suggests moderate financial strength. Despite a strong Momentum Rank of 10/10, the company's Operating Margin growth remains stagnant, highlighting areas for potential improvement.

Implications of the Transaction

The reduction in Morgan Stanley's holdings in RCM Technologies now represents 3.00% of the firm's portfolio. This decision may be influenced by an analysis of market conditions and the company's performance metrics. For RCM Technologies, the future outlook will depend on its ability to capitalize on growth opportunities and improve its market valuation. Investors should consider these factors when evaluating the stock's potential.

Conclusion

In summary, Morgan Stanley's reduction in RCM Technologies highlights the firm's strategic portfolio management. RCM Technologies' financial health and valuation metrics provide valuable insights for value investors. Understanding the decision-making process of a major investment firm like Morgan Stanley can offer guidance in evaluating stock performance and potential investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.