On December 31, 2024, Impax Asset Management Group plc (Trades, Portfolio) made a strategic decision to reduce its holdings in Watts Water Technologies Inc (NYSE: WTS). The firm decreased its position by 400,934 shares, impacting its portfolio by -0.32%. The shares were traded at a price of $203.3 each. Following this transaction, Impax Asset Management retains 1,091,042 shares of Watts Water Technologies, which now constitute 0.88% of the firm's portfolio. This move reflects a calculated adjustment in the firm's investment strategy, aligning with its focus on sustainable investments.

Impax Asset Management Group plc (Trades, Portfolio): A Profile

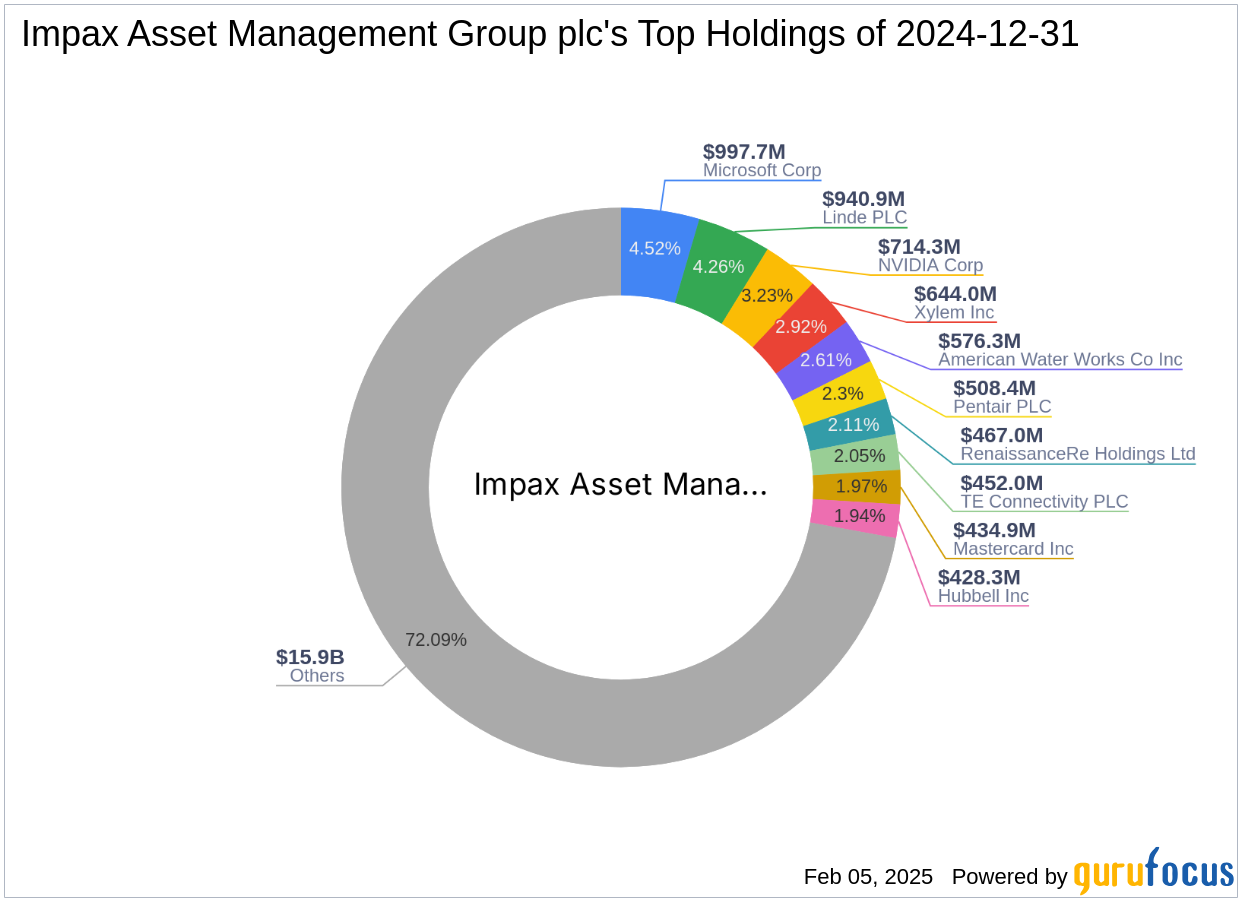

Impax Asset Management Group plc (Trades, Portfolio) is a prominent investment firm headquartered on the 7th Floor, London, SW1Y 4AJ. The firm is renowned for its commitment to sustainable investments, managing a total equity of $22.08 billion. Its top holdings include industry giants such as Microsoft Corp (MSFT, Financial), NVIDIA Corp (NVDA, Financial), American Water Works Co Inc (AWK, Financial), Linde PLC (LIN, Financial), and Xylem Inc (XYL, Financial). The firm's investment strategy is heavily weighted towards the Industrials and Technology sectors, reflecting its focus on long-term growth and sustainability.

Watts Water Technologies Inc: Company Overview

Watts Water Technologies Inc, based in the USA, has been a key player in the industrial products sector since its IPO on July 5, 1995. The company specializes in providing safety, energy efficiency, and water conservation products. Its diverse product portfolio includes drainage and water re-use products, HVAC and gas products, residential and commercial flow control, and water quality products. With a market capitalization of $6.88 billion, Watts Water Technologies serves markets across the Americas, Europe, the Middle East, and Africa.

Financial Metrics and Valuation

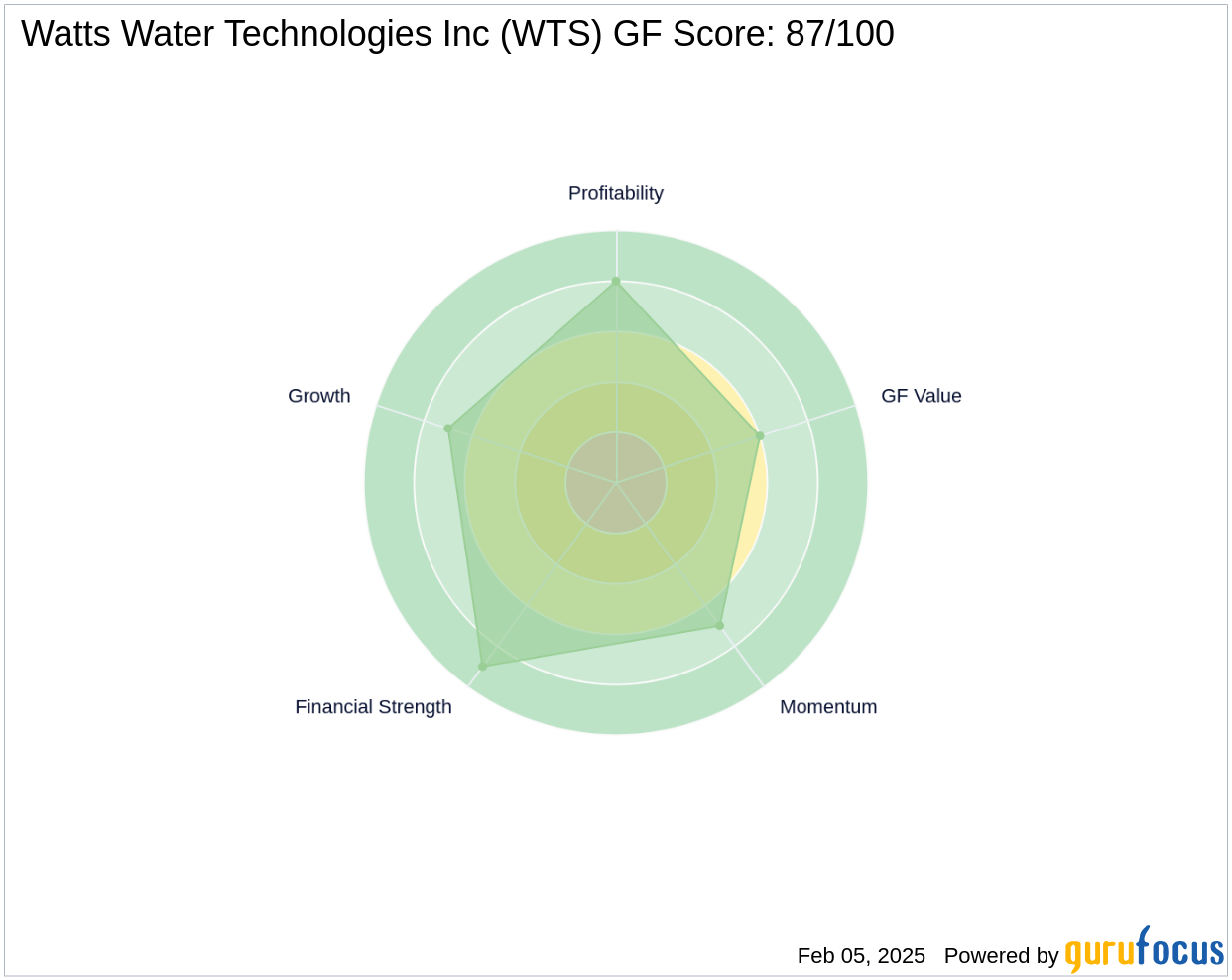

Watts Water Technologies Inc is currently trading at $206.53 per share, with a price-to-earnings ratio of 24.76. The company is considered fairly valued with a [GF Value](https://www.gurufocus.com/term/gf-score/WTS) of $196.35. The [GF Score](https://www.gurufocus.com/term/gf-score/WTS) of 87/100 indicates good outperformance potential. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/WTS) is ranked 9/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/WTS) is 8/10, and [Growth Rank](https://www.gurufocus.com/term/rank-growth/WTS) is 7/10. These metrics highlight the company's robust financial health and growth prospects.

Performance and Growth Indicators

Watts Water Technologies has demonstrated impressive growth over the past three years, with revenue growth at 11.40%, EBITDA growth at 21.50%, and earnings growth at 28.70%. The company boasts a return on equity (ROE) of 17.85% and a return on assets (ROA) of 12.21%. These figures underscore the company's strong operational performance and efficient use of resources. Additionally, the company's [interest coverage](https://www.gurufocus.com/term/interest-coverage/WTS) ratio of 24.85 further emphasizes its financial stability.

Other Notable Gurus Holding Watts Water Technologies Inc

In addition to Impax Asset Management, other notable investment firms hold significant positions in Watts Water Technologies. The largest holder is GAMCO Investors, with other prominent investors including Keeley-Teton Advisors, LLC (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). These firms' involvement indicates a strong institutional interest in the company, reflecting confidence in its long-term potential.

Conclusion

Impax Asset Management Group plc (Trades, Portfolio)'s decision to reduce its stake in Watts Water Technologies Inc is a strategic move aligned with its investment philosophy. This adjustment allows the firm to optimize its portfolio while maintaining a significant position in a company with strong financial health and market presence. For value investors, Watts Water Technologies presents a compelling opportunity, given its robust growth indicators and stable financial metrics. The firm's focus on sustainable investments and the stock's favorable [GF Value Rank](https://www.gurufocus.com/term/rank-gf-value/WTS) and [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/WTS) make it a noteworthy consideration for those seeking long-term value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: