On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) made a strategic move by acquiring 138,863,891 shares in WPP PLC, marking a notable addition to its investment portfolio. This transaction resulted in a 0.15% increase in BlackRock's position in WPP, reflecting the firm's confidence in the advertising giant's potential. The shares were acquired at a trade price of $51.40, bringing BlackRock's total holdings in WPP to 139,491,936 shares. This acquisition underscores BlackRock's ongoing strategy to diversify its portfolio and strengthen its presence in the media sector.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

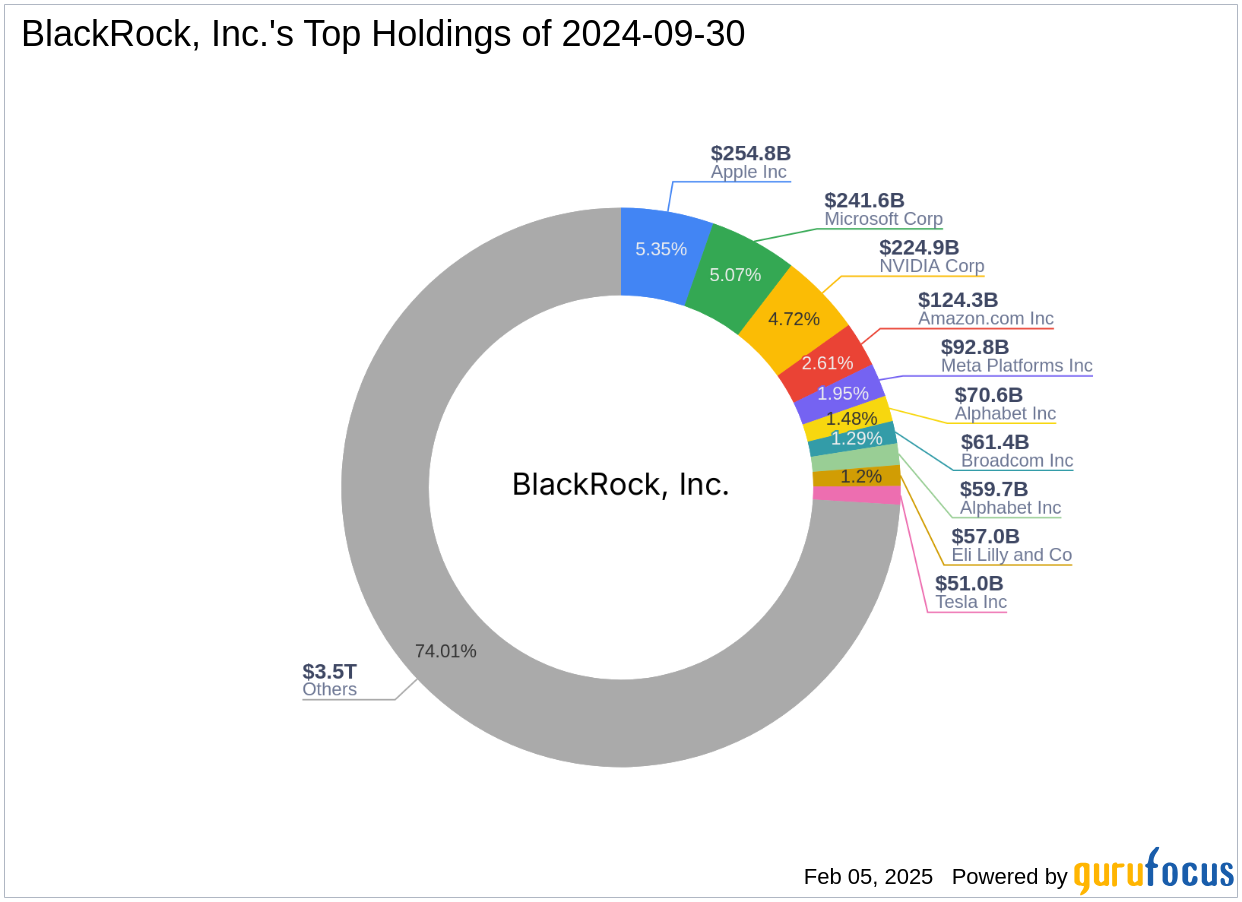

Headquartered at 50 Hudson Yards, New York, NY, BlackRock, Inc. (Trades, Portfolio) is a leading global investment management firm. While the firm's specific investment philosophy is not detailed, its top holdings include major technology companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With an equity value of $4,761.16 trillion, BlackRock's investment strategy prominently features the technology and financial services sectors, reflecting its focus on high-growth industries.

WPP PLC: An Overview of the Advertising Leader

WPP PLC, headquartered in the United Kingdom, is recognized as the world's largest advertising holding company. The company offers a wide range of services, including traditional and digital advertising, public relations, and consulting. With a market capitalization of $10.5 billion, WPP operates primarily in developed regions such as North America, the UK, and Western Europe. As of the latest data, WPP's stock is priced at $48.68, with a price-to-earnings ratio of 41.15. The stock is considered modestly undervalued with a GF Value of $59.48, indicating potential for future growth.

Financial Metrics and Valuation Insights

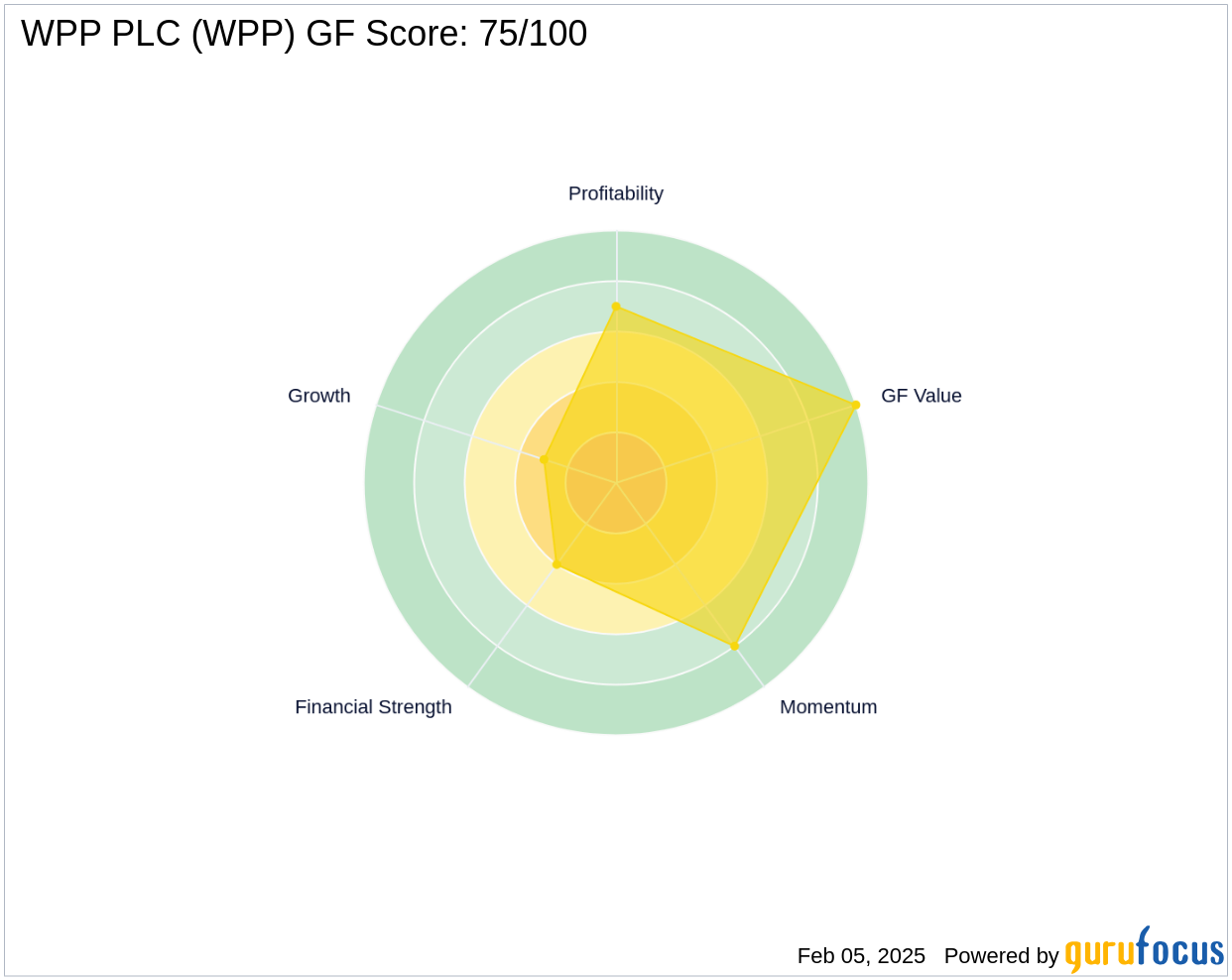

WPP's financial metrics reveal a mixed performance. The company's GF Score of 75/100 suggests likely average performance. Over the past three years, WPP has achieved a revenue growth of 11.40% and an earnings growth of 16.00%. Despite these positive growth indicators, the company's Growth Rank is relatively low at 3/10, and its Balance Sheet Rank stands at 4/10. The Operating Margin growth remains stagnant, while the gross margin has decreased by 1.90%.

Market Position and Momentum

Operating within the diversified media industry, WPP's market position is bolstered by its extensive global reach and comprehensive service offerings. The company's Momentum Index (6-1 Month) is 9.66, and its RSI (14 Day) is 50.09, indicating a balanced momentum. However, the year-to-date price change is -4.68%, reflecting some challenges in maintaining stock price stability. The interest coverage ratio of 1.76 suggests moderate financial strength, while the Altman Z score of 0.95 indicates potential financial distress.

Notable Investors in WPP PLC

Aside from BlackRock, Inc. (Trades, Portfolio), other significant investors in WPP include Hotchkis & Wiley Capital Management LLC, the largest shareholder, and Brandes Investment Partners, LP (Trades, Portfolio). These investors' involvement highlights the continued interest and confidence in WPP's business model and growth prospects.

Conclusion: Strategic Implications of BlackRock's Investment

BlackRock, Inc. (Trades, Portfolio)'s substantial addition to its holdings in WPP PLC signifies a strategic bet on the advertising giant's future performance. This move could enhance WPP's market position, providing the company with additional capital to navigate industry challenges and capitalize on growth opportunities. For BlackRock, this investment aligns with its broader strategy of diversifying its portfolio across high-potential sectors, potentially yielding favorable returns in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: