BlackRock's Recent Transaction with Netstreit Corp

On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) executed a strategic transaction involving Netstreit Corp (NTST, Financial), a real estate investment trust (REIT) focused on single-tenant retail commercial real estate. The firm added 56,258 shares of Netstreit Corp at a price of $14.15 per share, bringing its total holdings in the company to 8,144,840 shares. This acquisition reflects BlackRock's confidence in Netstreit Corp's potential within the retail real estate sector, aligning with its investment strategy of focusing on sectors with essential services and growth potential.

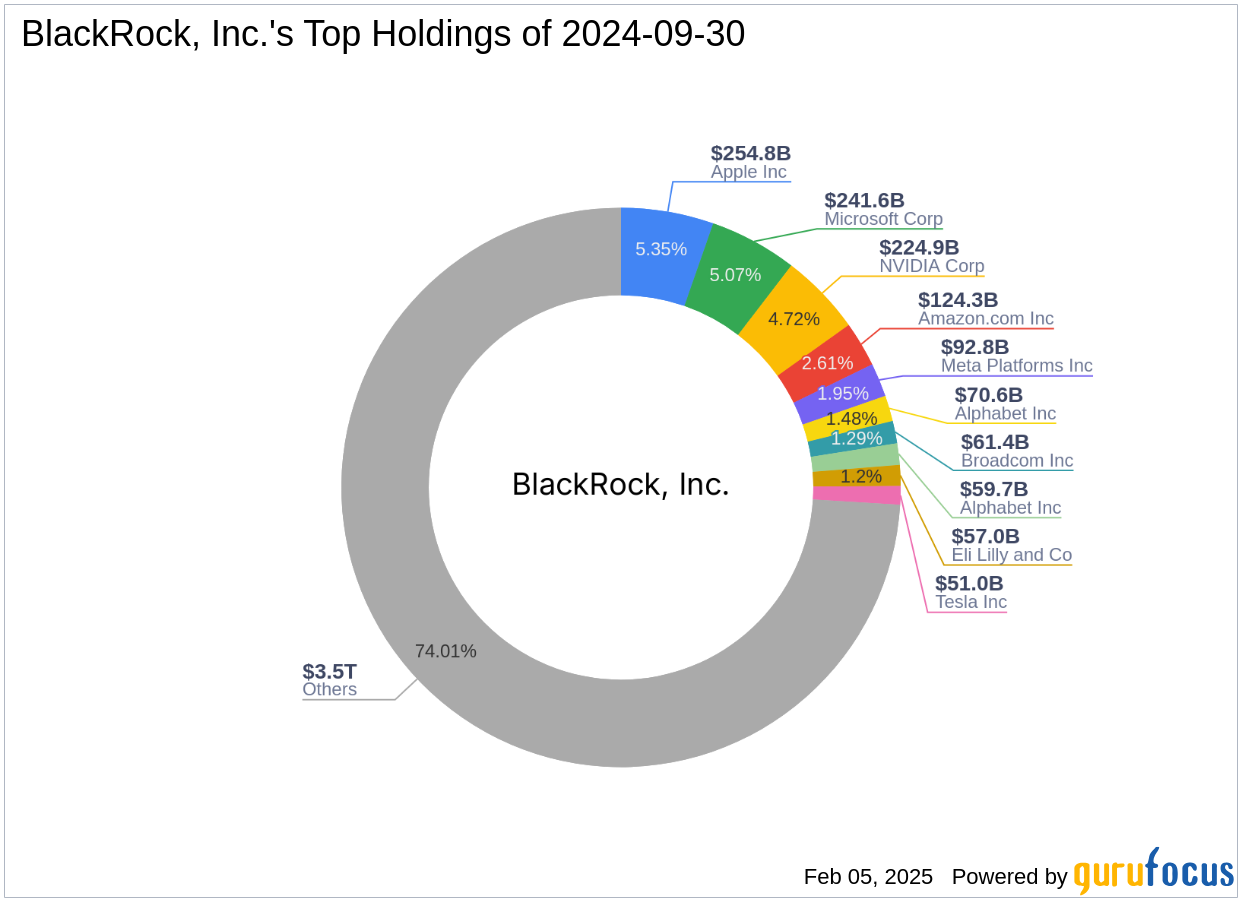

About BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a prominent investment firm known for its significant equity holdings. With a total equity value of $4,761.16 trillion, BlackRock focuses primarily on the technology and financial services sectors. The firm's top holdings include major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). This diverse portfolio underscores BlackRock's strategic approach to investing in high-growth sectors.

Netstreit Corp: A Focus on Essential Retail Real Estate

Netstreit Corp, based in the USA, is structured as an umbrella partnership real estate investment trust. The company acquires, owns, and manages single-tenant retail commercial real estate subject to long-term net leases with high-credit quality tenants. Netstreit targets industries where a physical location is critical to sales and profits, focusing on necessity goods and essential services in the retail sector, including home improvement, auto parts, drug stores, and convenience stores. With a market capitalization of $1.2 billion and a current stock price of $14.685, Netstreit is considered modestly undervalued with a GF Value of $19.57, indicating a price to GF Value ratio of 0.75.

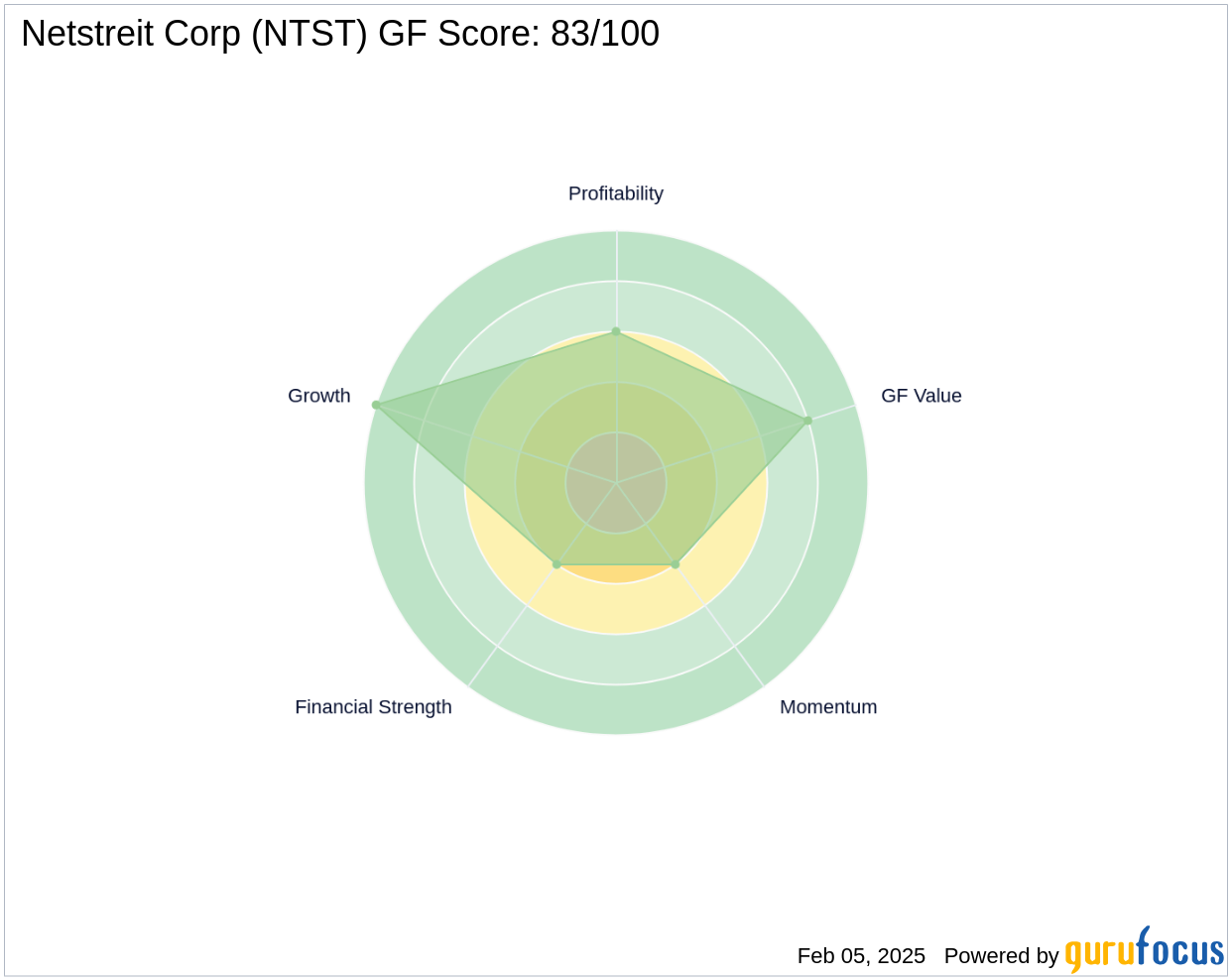

Financial Metrics and Growth Indicators

Netstreit Corp has demonstrated promising growth indicators, with a [GF-Score](https://www.gurufocus.com/term/gf-score/NTST) of 83/100, suggesting good outperformance potential. Over the past three years, the company has achieved a revenue growth of 6.50% and an EBITDA growth of 13.30%. Despite these positive growth metrics, the company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/NTST) is ranked at 4/10, indicating some financial constraints. The [interest coverage](https://www.gurufocus.com/term/interest-coverage/NTST) ratio stands at 1.10, reflecting limited ability to cover interest expenses.

Market Position and Stock Performance

Netstreit Corp's stock has experienced a year-to-date price change of 5.34% and a gain of 3.78% since BlackRock's transaction. The stock's [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/NTST) and RSI values suggest moderate market activity and investor interest. Despite these gains, the stock has seen a price change of -18.42% since its IPO. The company's [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/NTST) is 6/10, indicating moderate profitability potential.

Conclusion: Strategic Confidence in Netstreit Corp

BlackRock, Inc. (Trades, Portfolio)'s addition of Netstreit Corp shares underscores the firm's strategic confidence in the company's potential within the retail real estate sector. This transaction aligns with BlackRock's investment philosophy of focusing on sectors with essential services and growth potential. As Netstreit continues to target high-credit quality tenants in essential retail sectors, BlackRock's investment may prove beneficial in capturing future growth opportunities in the real estate market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.