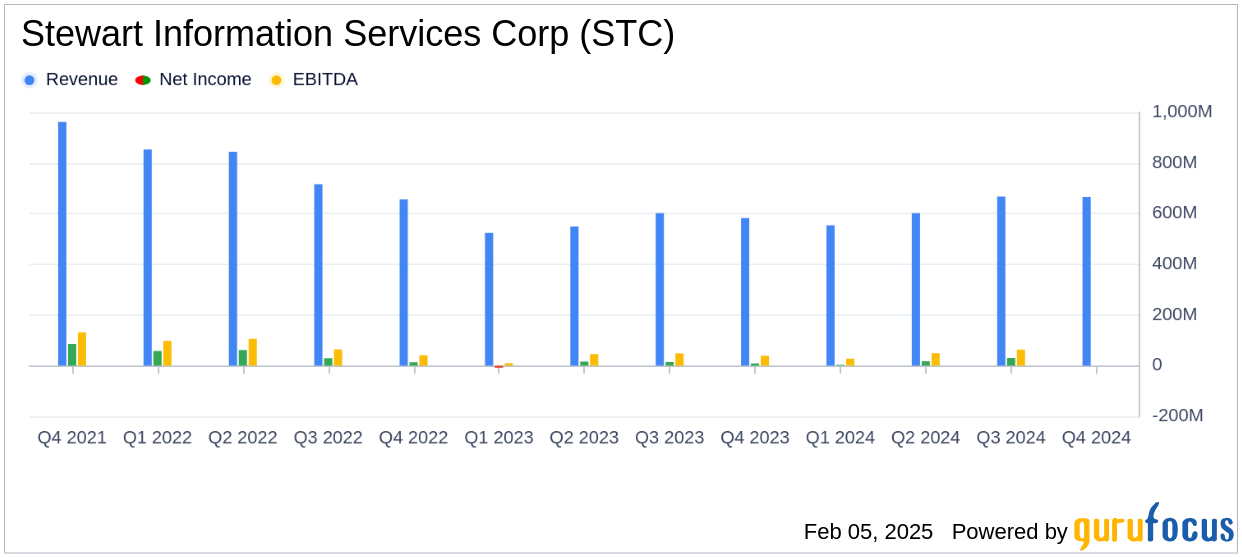

Stewart Information Services Corp (STC, Financial) released its 8-K filing on February 5, 2025, reporting a notable increase in both quarterly and annual financial performance. The company, a leader in title insurance and real estate services, reported total revenues of $665.9 million for the fourth quarter of 2024, surpassing the analyst estimate of $645.95 million. This represents a significant increase from the $582.2 million reported in the same quarter of the previous year.

Company Overview

Stewart Information Services Corp is a customer-focused company providing title insurance and real estate services. It operates through three segments: Title Insurance and Related Services, Real Estate Solutions, and Corporate and Other. The Title segment is the primary revenue generator, offering services such as title searching, examining, closing, and insuring. The Real Estate Solutions segment supports the mortgage industry with appraisal management, online notarization, and other services.

Performance and Challenges

In the fourth quarter of 2024, Stewart Information Services Corp reported a net income of $22.7 million, a substantial increase from $8.8 million in the prior year quarter. On an adjusted basis, net income was $31.5 million, compared to $16.6 million in the previous year. The company's diluted earnings per share (EPS) stood at $0.80, below the analyst estimate of $0.85. Adjusted EPS was $1.12, exceeding expectations.

“We are pleased with our fourth quarter and full year 2024 results as they demonstrate both our progress and resilience in these continued challenging macro-housing conditions,” commented Fred Eppinger, chief executive officer.

Financial Achievements

The company's full-year 2024 net income reached $73.3 million, with an adjusted net income of $94.4 million, compared to $30.4 million and $66.6 million, respectively, in 2023. Full-year diluted EPS was $2.61, slightly below the annual estimate of $2.65. Adjusted EPS was $3.35, showcasing strong performance in a challenging market.

Key Financial Metrics

Stewart Information Services Corp's Title segment saw a 12% increase in operating revenues, driven by higher direct and agency title operations. The Real Estate Solutions segment reported a 42% increase in operating revenues, primarily due to growth in credit information and valuation services. Consolidated employee costs rose by 12%, reflecting higher incentive compensation and increased salaries.

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Total Revenues | $665.9 million | $582.2 million |

| Net Income | $22.7 million | $8.8 million |

| Diluted EPS | $0.80 | $0.32 |

| Adjusted Net Income | $31.5 million | $16.6 million |

| Adjusted EPS | $1.12 | $0.60 |

Analysis and Conclusion

Stewart Information Services Corp's strong revenue growth and improved net income highlight its resilience and strategic positioning in the real estate services industry. Despite missing the EPS estimate, the company's adjusted earnings exceeded expectations, reflecting effective cost management and operational efficiency. The increase in revenues across its segments underscores the company's ability to adapt and thrive in a challenging macroeconomic environment.

For value investors, Stewart Information Services Corp's performance in 2024 demonstrates its potential for sustained growth and profitability, making it a noteworthy consideration in the title insurance and real estate services sector.

Explore the complete 8-K earnings release (here) from Stewart Information Services Corp for further details.