Overview of the Transaction

On December 31, 2024, Morgan Stanley executed a significant transaction involving Virtus Total Return Fund Inc (ZTR, Financial). The firm reduced its holdings in the fund by 1,768,566 shares, marking a -51.41% change in its position. This reduction leaves Morgan Stanley with 1,671,707 shares of ZTR, with the transaction executed at a price of $5.86 per share. The decision to decrease its stake in Virtus Total Return Fund Inc is noteworthy, given the firm's extensive portfolio and strategic investment approach.

Profile of Morgan Stanley

Morgan Stanley, a prominent global financial services firm, has a rich history dating back to its founding in 1935. Originating from the legacy of JP Morgan & Co. and the Dean Witter brokerage house, the firm has grown through significant milestones, including the development of one of the first computer models for financial analysis in 1962 and the creation of the first automated trade processing system in 1984. Morgan Stanley went public in 1986 and has since expanded its global presence, operating in 42 countries with over 1,300 offices and 60,000 employees. The firm is organized into three main divisions: Institutional Securities, Wealth Management, and Investment Management, managing over $800 billion in total assets.

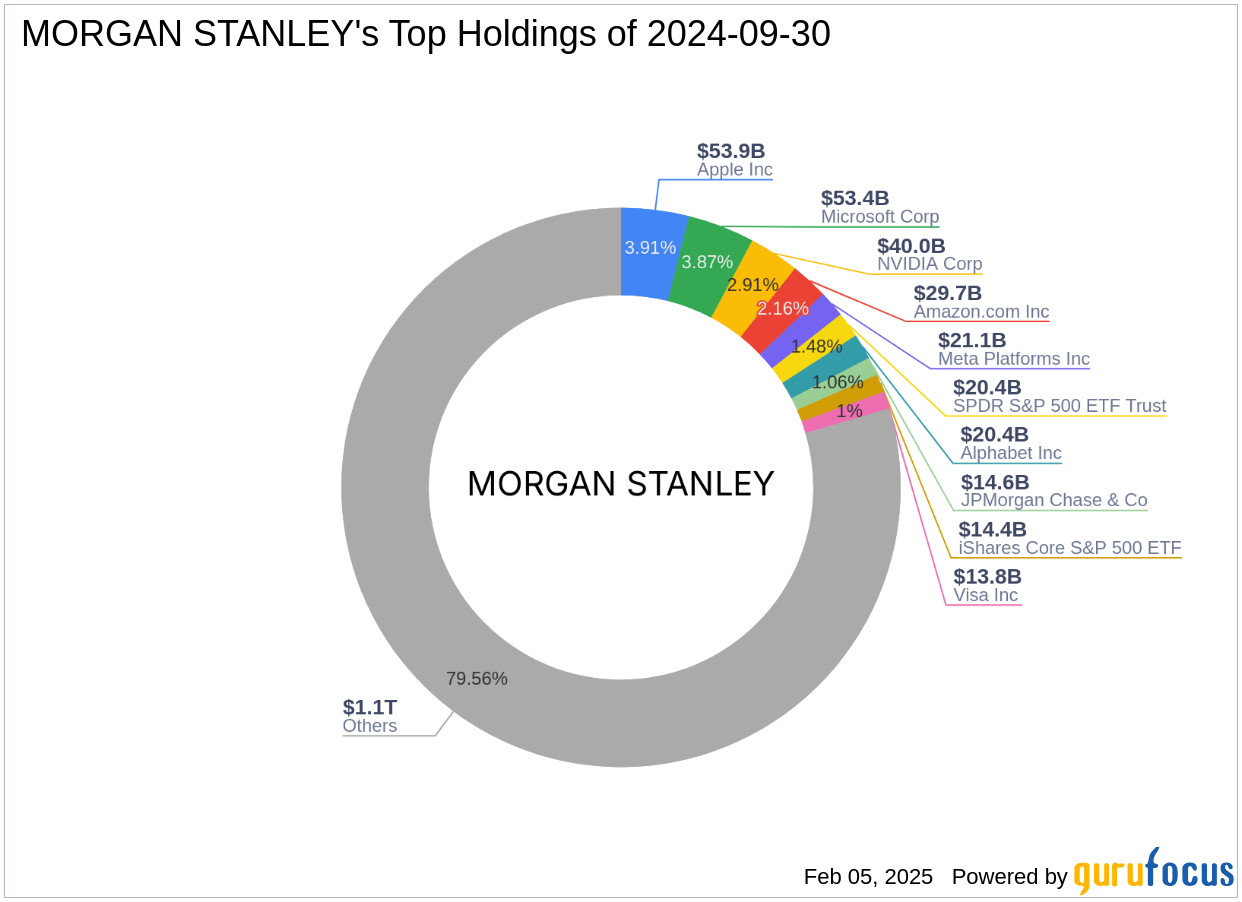

Investment Philosophy and Portfolio

Morgan Stanley's investment philosophy is characterized by a focus on long-term growth and value creation. The firm employs a diversified approach to portfolio management, with significant holdings in major technology and financial services companies. Some of its top holdings include Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With a total equity of $1,378.25 trillion, Morgan Stanley's portfolio is heavily weighted towards the technology and financial services sectors, reflecting its strategic emphasis on these high-growth areas.

Virtus Total Return Fund Inc Overview

Virtus Total Return Fund Inc is a closed-end, diversified management investment company based in the USA. The fund's primary investment objective is capital appreciation, with current income as a secondary goal. It achieves this through a balanced approach, investing in both equity and fixed income securities. The fund focuses on infrastructure operators across various industries, including communications, utilities, energy, and transportation. As of the latest data, Virtus Total Return Fund Inc has a market capitalization of $376.493 million and a price-to-earnings ratio of 15.84.

Financial Metrics and Valuation

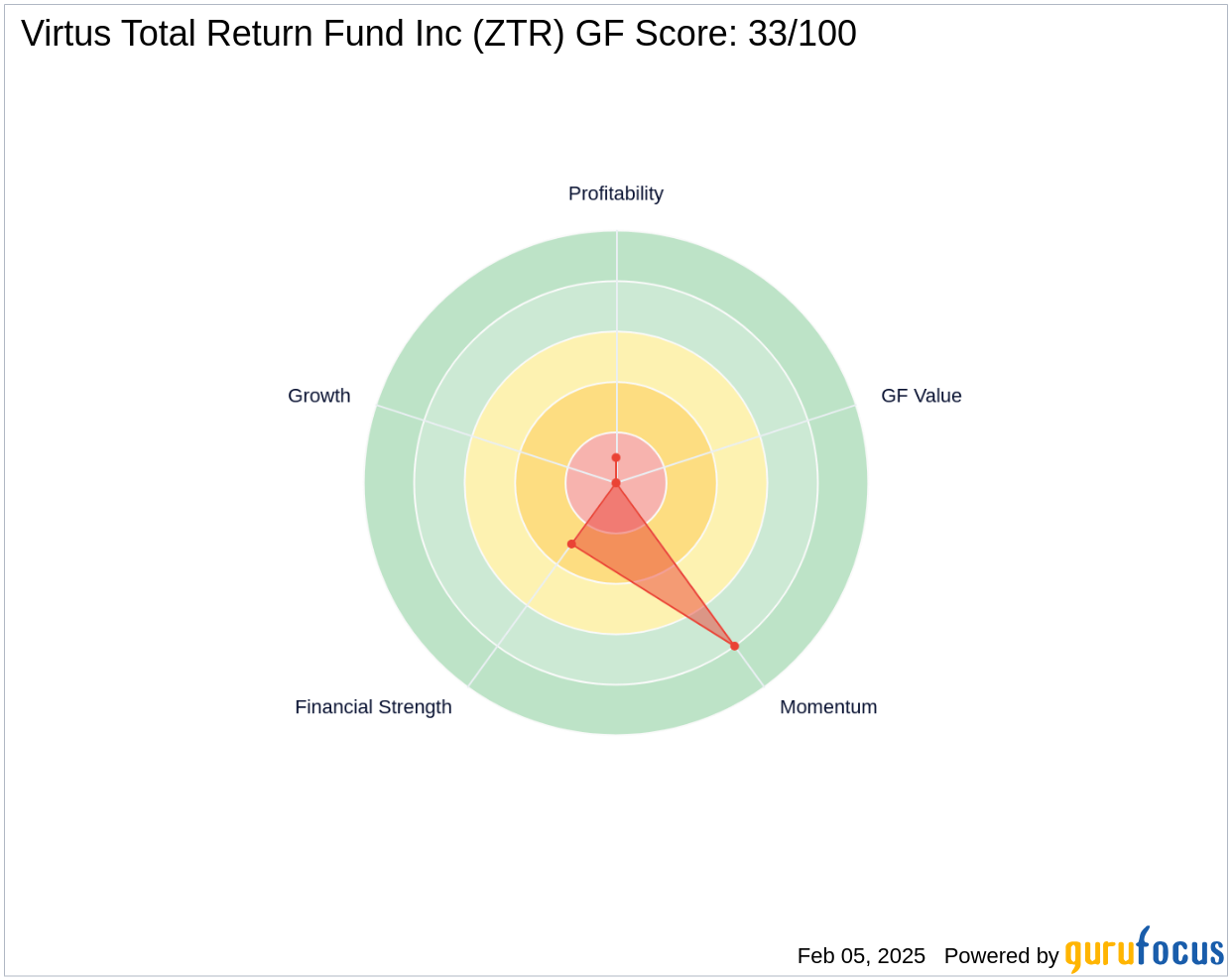

Analyzing the financial metrics of Virtus Total Return Fund Inc reveals a complex picture. The fund's current market capitalization stands at $376.493 million, with a price-to-earnings ratio of 15.84. However, the lack of GF Valuation data presents challenges in assessing the stock's intrinsic value. This absence of data implies that investors must rely on other metrics and qualitative factors to evaluate the fund's potential. The fund's GF-Score is 33/100, indicating a poor future performance potential.

Stock Performance and Rankings

Virtus Total Return Fund Inc has experienced varied stock performance metrics. The year-to-date price change is 3.39%, while the stock has seen a -84.09% change since its IPO. The fund's Financial Strength is ranked 3/10, and its Profitability Rank is 1/10, reflecting challenges in these areas. The Momentum Rank is relatively higher at 8/10, suggesting some positive short-term trends.

Implications of the Transaction

The decision by Morgan Stanley to reduce its stake in Virtus Total Return Fund Inc may be driven by several factors, including a strategic reallocation of assets or a reassessment of the fund's performance potential. This transaction could impact Morgan Stanley's portfolio by freeing up capital for other investments or adjusting its exposure to specific sectors. Additionally, the broader market may interpret this move as a signal of Morgan Stanley's evolving investment strategy, potentially influencing other investors' perceptions of Virtus Total Return Fund Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.