On December 31, 2024, AllianceBernstein L.P. made a significant move by acquiring an additional 355,830 shares of Third Coast Bancshares Inc (TCBX, Financial) at a price of $33.95 per share. This transaction increased the firm's total holdings in TCBX to 688,427 shares. The acquisition represents a strategic addition to AllianceBernstein's portfolio, with TCBX now accounting for 0.01% of the firm's total portfolio. This move reflects AllianceBernstein's ongoing interest in diversifying its investments and capitalizing on potential growth opportunities within the banking sector.

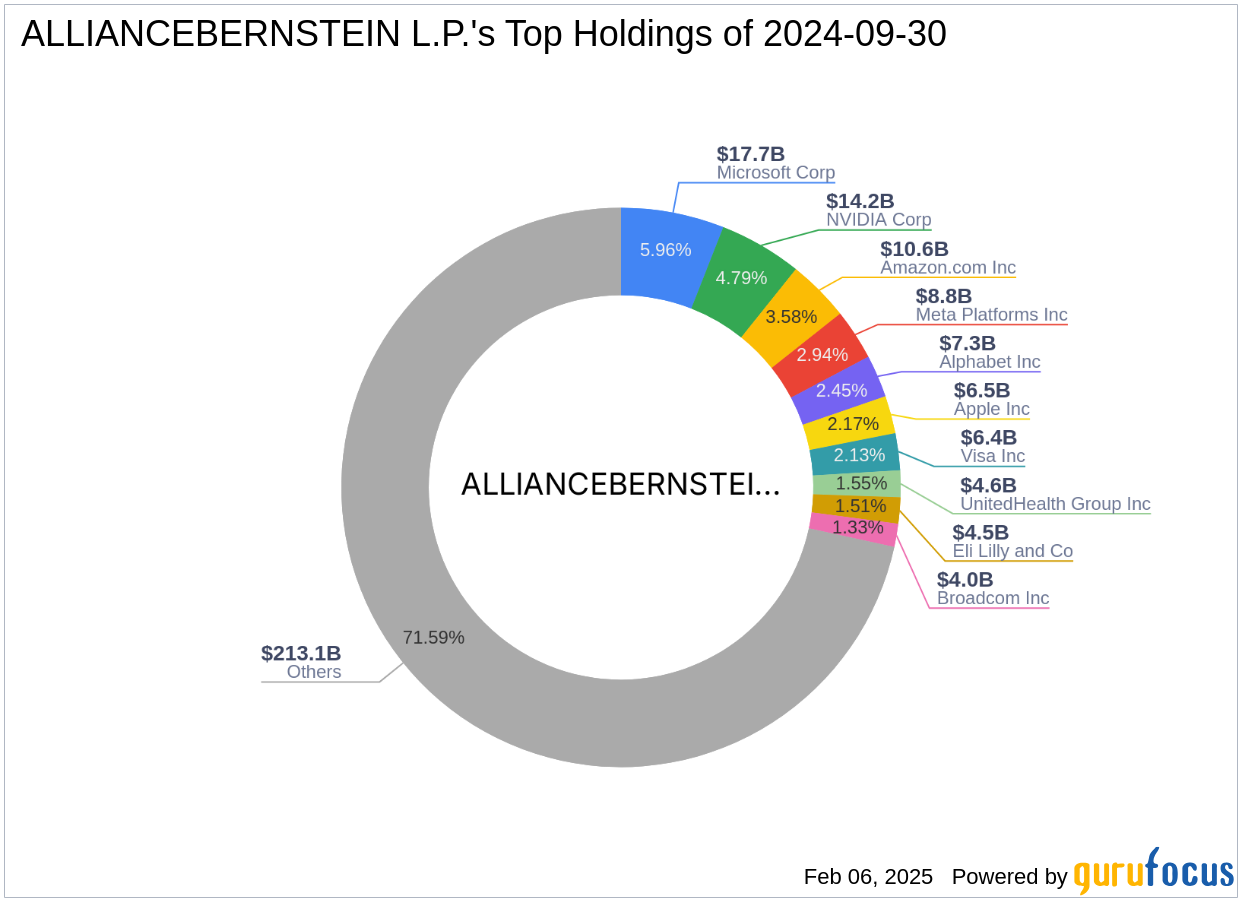

AllianceBernstein L.P.: A Global Investment Powerhouse

AllianceBernstein L.P. has a rich history dating back to 1967 and 1971, with its origins rooted in the creation of Sanford C. Bernstein and Alliance Capital. The merger of these two entities in 2000 formed the current AllianceBernstein, a firm renowned for its expertise in both growth and value equity, as well as fixed-income management. Headquartered in New York City, AllianceBernstein operates globally with 46 locations across 22 countries. The firm manages nearly half a trillion dollars in assets, with a strong focus on technology and healthcare sectors. AllianceBernstein's investment philosophy emphasizes a balanced approach, leveraging its extensive research capabilities to deliver value to its clients.

Third Coast Bancshares Inc: A Focus on Community Banking

Third Coast Bancshares Inc, a bank holding company based in the USA, specializes in providing commercial banking solutions to small and medium-sized businesses. With eleven branches across major Texas markets and one in Detroit, Texas, the company focuses on community banking, generating revenue primarily from interest on loans and customer service fees. As of the latest data, Third Coast Bancshares has a market capitalization of $522.288 million. Despite its relatively recent IPO in November 2021, the company has established a solid presence in its operational regions.

Impact of the Transaction on AllianceBernstein's Portfolio

The acquisition of additional shares in TCBX by AllianceBernstein signifies a strategic enhancement of its investment portfolio. With TCBX now representing 0.01% of the firm's portfolio, this move underscores AllianceBernstein's confidence in the potential of Third Coast Bancshares. The total holding of 688,427 shares highlights the firm's commitment to this investment, despite the stock being significantly overvalued with a GF Value of $21.66 and a price-to-GF Value ratio of 1.75. This strategic decision aligns with AllianceBernstein's broader investment strategy, which often involves identifying undervalued opportunities with potential for long-term growth.

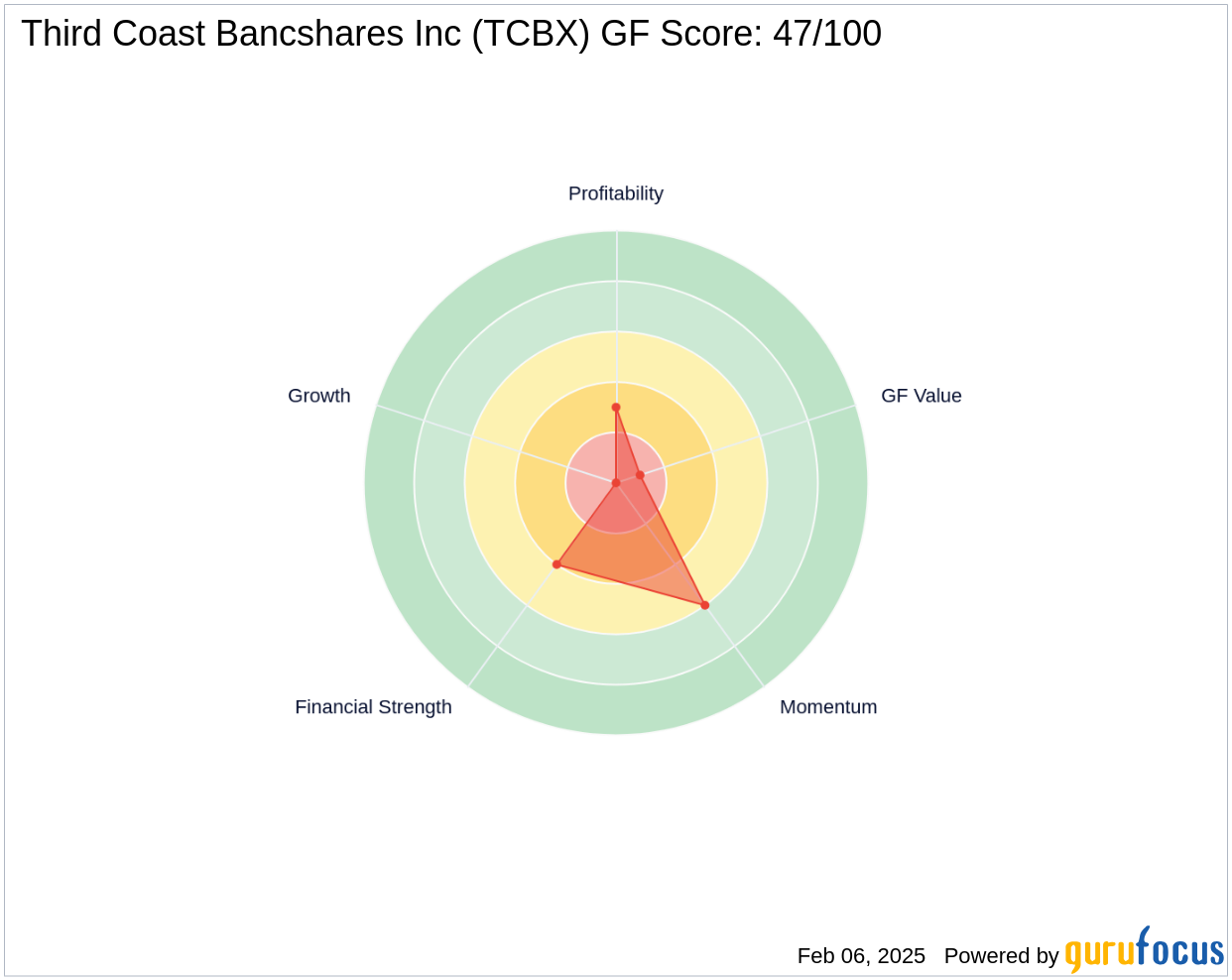

Financial Metrics and Valuation of TCBX

Third Coast Bancshares Inc currently holds a PE ratio of 13.69 and a GF Score of 47/100, indicating a challenging outlook for future performance. The stock is considered significantly overvalued, with a GF Value of $21.66 and a price-to-GF Value ratio of 1.75. These metrics suggest that while the stock has experienced a gain of 11.72% since the transaction, its valuation may not align with its intrinsic value, posing potential risks for investors.

Performance and Growth Prospects of TCBX

Since the acquisition, TCBX has seen a stock gain of 11.72%, reflecting positive market sentiment. However, the company faces growth challenges, evidenced by a 3-year revenue growth rate of -7.20% and a Profitability Rank of 3/10. These figures highlight the need for strategic initiatives to drive growth and improve profitability. Despite these challenges, the company's focus on community banking and its established presence in key markets provide a foundation for potential future growth.

Conclusion: Strategic Implications and Future Outlook

AllianceBernstein's increased stake in Third Coast Bancshares Inc reflects a calculated risk, balancing potential growth opportunities against the challenges of overvaluation and limited profitability. This investment aligns with the firm's strategy of diversifying its portfolio and exploring opportunities within the banking sector. While the current valuation metrics suggest caution, the long-term prospects of TCBX, driven by its community banking focus, may offer significant rewards for patient investors. As AllianceBernstein continues to monitor this investment, the firm will likely assess both the risks and opportunities associated with its expanded position in Third Coast Bancshares.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.