On December 31, 2024, AllianceBernstein L.P. made a strategic move by acquiring an additional 2,707 shares of Pathfinder Bancorp Inc (PBHC, Financial) at a price of $17.50 per share. This transaction increased the firm's total holdings in Pathfinder Bancorp to 288,511 shares, representing 6.10% of the firm's portfolio in this stock. The acquisition reflects AllianceBernstein's continued interest in Pathfinder Bancorp, a company known for its commercial banking services.

AllianceBernstein L.P.: A Global Investment Powerhouse

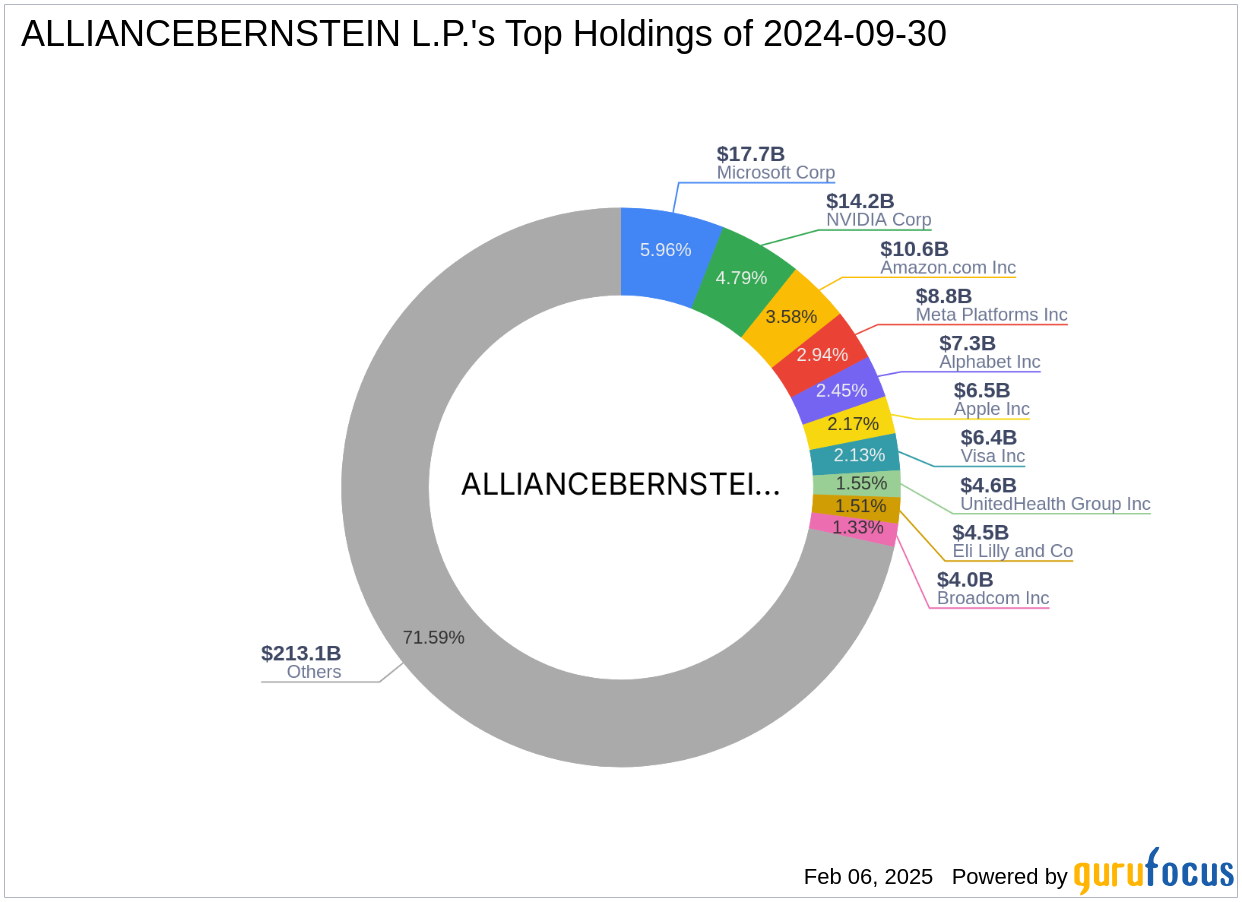

AllianceBernstein L.P. has a rich history dating back to 1967 and 1971, with the formation of Sanford C. Bernstein and Alliance Capital, respectively. The merger of these two entities in 2000 created the current AllianceBernstein, a firm renowned for its expertise in growth and value equity, as well as fixed-income management. With over 3,500 employees and nearly half a trillion in assets under management, AllianceBernstein operates globally, providing investment services and solutions to institutions and individual investors. The firm's top holdings include major technology and healthcare companies such as Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), and others.

Pathfinder Bancorp Inc: A Focus on Commercial Banking

Pathfinder Bancorp Inc, a holding company for Pathfinder Bank, is engaged in providing commercial banking services. The bank attracts deposits from the public and invests these funds in various loans and securities. With a market capitalization of $105.716 million and a PE ratio of 28.78, Pathfinder Bancorp is considered fairly valued according to its GF Value. The company's principal income source is interest on loans and investment securities.

Impact of the Transaction on AllianceBernstein's Portfolio

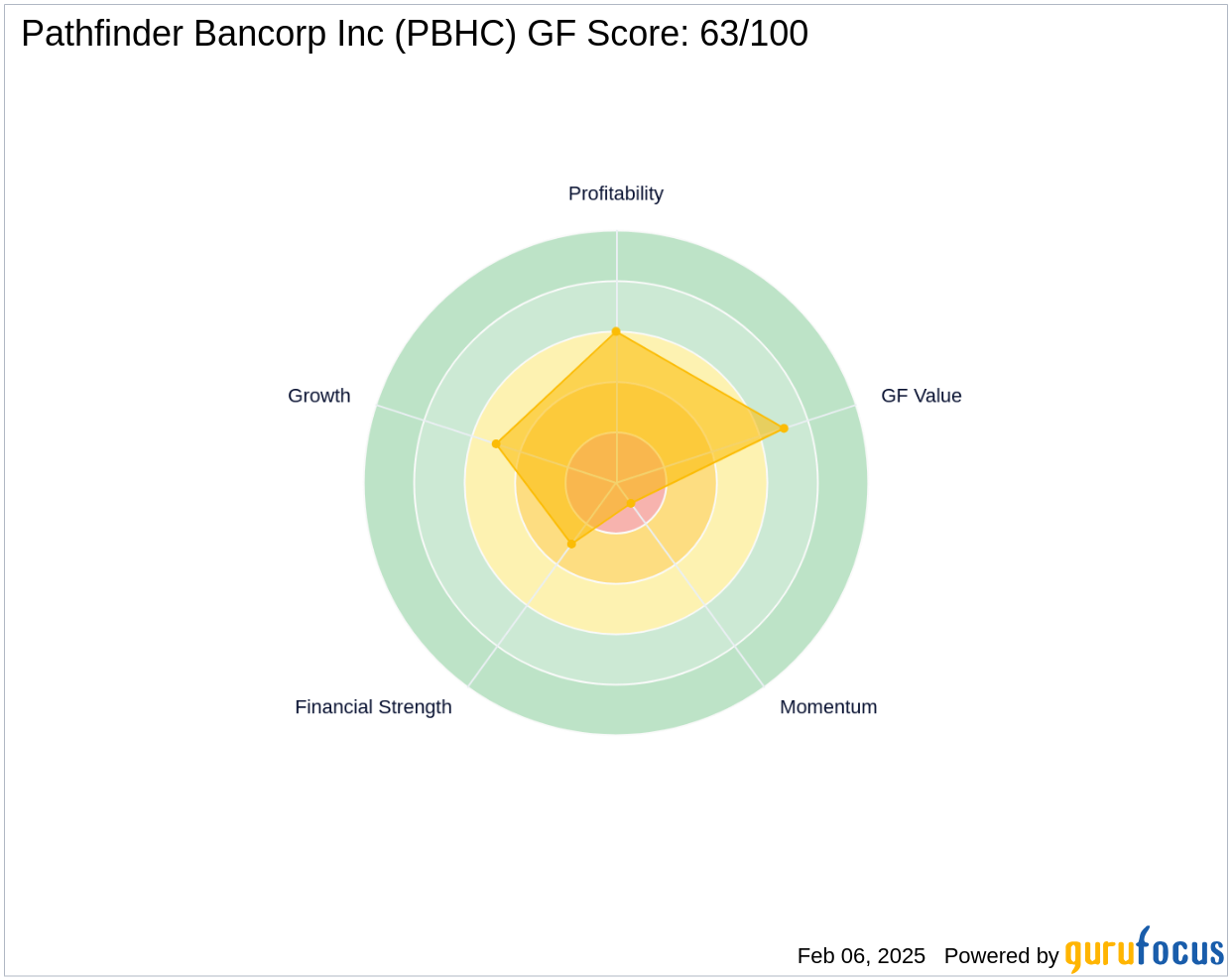

The acquisition of additional shares in Pathfinder Bancorp Inc has a notable impact on AllianceBernstein's portfolio. With Pathfinder Bancorp now representing 6.10% of the firm's holdings in the stock, this move underscores AllianceBernstein's confidence in the bank's potential. Despite a slight decline of -1.34% in the stock price since the transaction, Pathfinder Bancorp's valuation metrics, including a Price to GF Value ratio of 1.01 and a GF Value of $17.06, suggest that the stock is fairly valued. The company's GF Score of 63/100 indicates a poor future performance potential, while its balance sheet rank is 3/10.

Stock Performance and Valuation

Currently, Pathfinder Bancorp Inc's stock is priced at $17.265, reflecting a slight decrease since the transaction. The stock's valuation metrics, including a GF Value Rank of 7/10, suggest that it is fairly valued. The company's Profitability Rank is 6/10, and its Growth Rank is 5/10, indicating moderate growth and profitability potential. However, the Momentum Rank is low at 1/10, suggesting limited momentum in the stock's performance.

Conclusion: Strategic Addition by AllianceBernstein

AllianceBernstein's strategic addition of Pathfinder Bancorp Inc shares highlights the firm's investment philosophy of balancing growth and value. While the stock's current valuation and performance metrics suggest a cautious outlook, the acquisition reflects AllianceBernstein's confidence in Pathfinder Bancorp's potential. For value investors, this transaction may present an opportunity to consider the stock's current valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.