Overview of BlackRock, Inc. (Trades, Portfolio)'s Recent Transaction

On December 31, 2024, BlackRock, Inc. (Trades, Portfolio), a leading global investment firm, executed a significant transaction involving eGain Corp. The firm reduced its holdings in eGain Corp by 81,400 shares at a price of $6.23 per share. This transaction resulted in BlackRock, Inc. (Trades, Portfolio) holding a total of 1,410,020 shares in eGain Corp, representing 4.90% of the firm's portfolio. The decision to reduce the stake in eGain Corp reflects BlackRock, Inc. (Trades, Portfolio)'s strategic portfolio management approach, which is closely watched by value investors for insights into market trends and investment strategies.

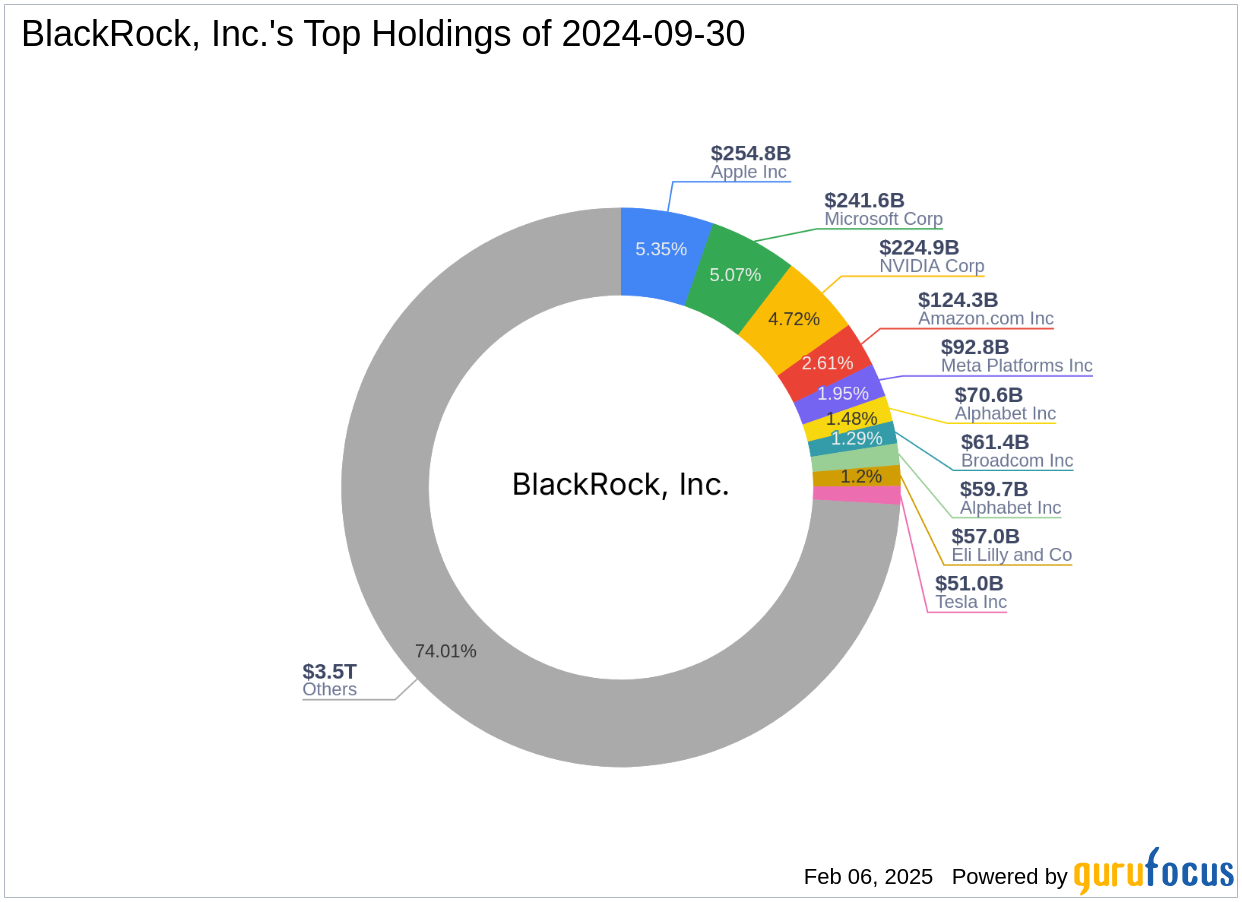

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

BlackRock, Inc. (Trades, Portfolio) is renowned as one of the world's largest investment management firms, headquartered at 50 Hudson Yards, New York. The firm is known for its diversified investment portfolio, which includes top holdings in major technology and financial services companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). With an equity value of $4,761.16 trillion, BlackRock, Inc. (Trades, Portfolio) is a dominant player in the investment sector, focusing on long-term growth and value creation.

Details of the eGain Corp Transaction

The recent transaction saw BlackRock, Inc. (Trades, Portfolio) reducing its stake in eGain Corp by 81,400 shares, with each share priced at $6.23. This move is part of the firm's broader strategy to optimize its investment portfolio. The reduction in shares did not significantly impact the overall portfolio, as eGain Corp's position accounted for a minor portion of BlackRock, Inc. (Trades, Portfolio)'s extensive holdings. However, such transactions are crucial for maintaining a balanced and diversified investment strategy.

Understanding eGain Corp's Business Model

eGain Corp is a prominent player in the software industry, specializing in automating customer engagement through its innovative Software as a Service (SaaS) platform. The company leverages digital, artificial intelligence (AI), and knowledge capabilities to serve industries such as financial services, telecommunications, retail, government, healthcare, and utilities. With operations in the United States, the United Kingdom, and India, eGain Corp derives most of its revenue from North America. The company has a market capitalization of $181.127 million and is currently trading at $6.35 per share.

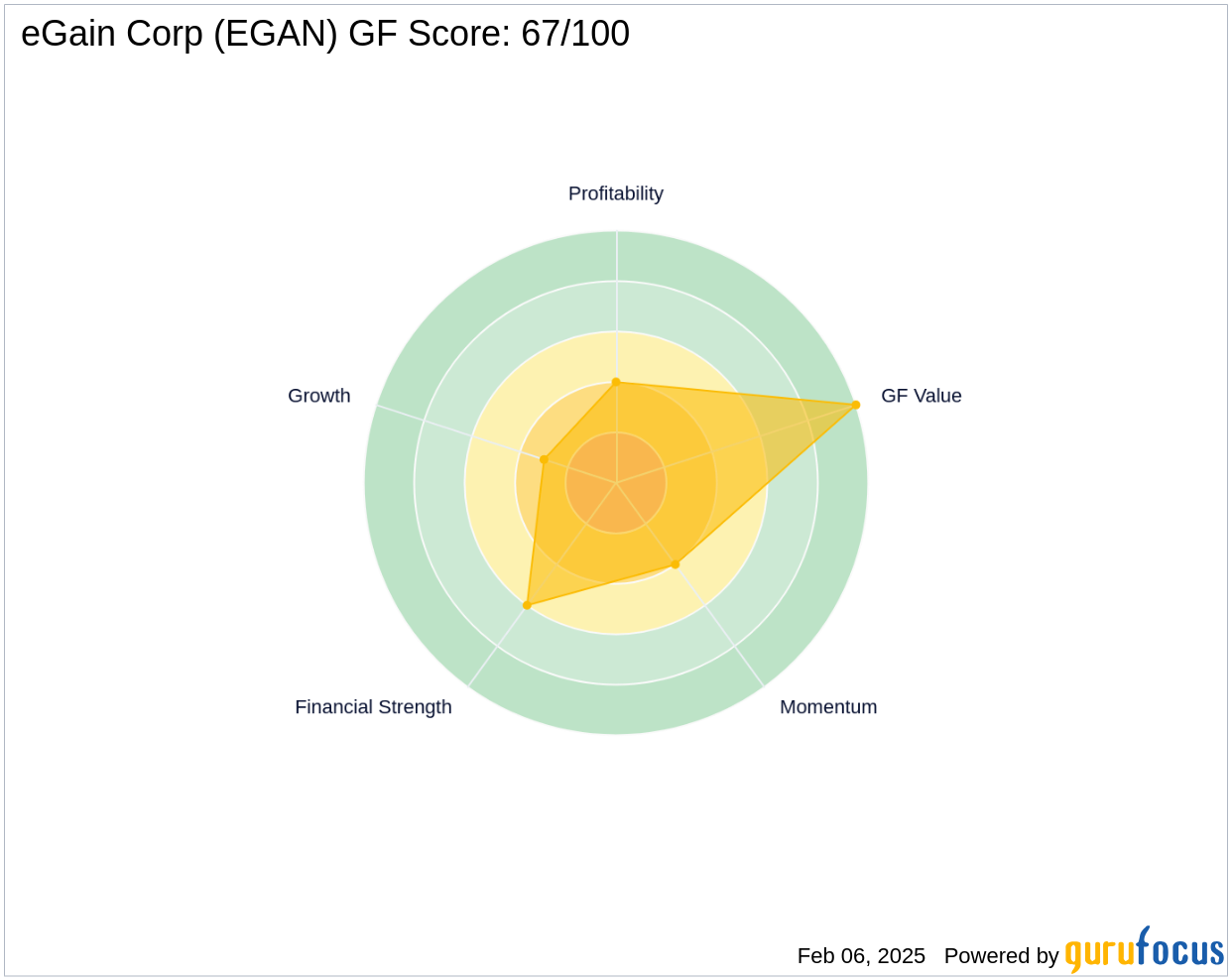

Financial Performance and Valuation of eGain Corp

eGain Corp's financial performance is characterized by a [GF-Score](https://www.gurufocus.com/term/gf-score/EGAN) of 67/100, indicating poor future performance potential. The company's [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/EGAN) is 4/10, and its [Growth Rank](https://www.gurufocus.com/term/rank-growth/EGAN) is 3/10, reflecting challenges in sustaining growth. Despite these challenges, eGain Corp is considered [modestly undervalued](https://www.gurufocus.com/term/rank-gf-value/EGAN) with a GF Value of $7.71, suggesting a potential upside for investors. The company's [Operating Margin](https://www.gurufocus.com/term/operating-margin/EGAN) growth remains stagnant, while its revenue growth over the past three years stands at 7.10%.

Market Context and Implications for Value Investors

eGain Corp operates in a competitive software industry, where innovation and customer engagement are key drivers of success. The company's focus on AI and SaaS solutions positions it well within the industry, although it faces challenges in profitability and growth. BlackRock, Inc. (Trades, Portfolio)'s decision to reduce its stake in eGain Corp may signal a strategic shift or a reassessment of the company's growth potential. For value investors, this transaction highlights the importance of evaluating a company's financial health, market position, and industry trends before making investment decisions.

Conclusion: Significance of the Transaction

The reduction of BlackRock, Inc. (Trades, Portfolio)'s stake in eGain Corp is a noteworthy development for both the investment firm and the software company. While the transaction represents a minor adjustment in BlackRock, Inc. (Trades, Portfolio)'s vast portfolio, it underscores the firm's commitment to strategic portfolio management. For eGain Corp, the transaction may prompt a closer examination of its financial performance and market strategy. Value investors should consider the implications of such transactions on their investment strategies, particularly in assessing the potential risks and rewards associated with eGain Corp's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.