On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) made a significant move by acquiring an additional 798,399 shares of UWM Holdings Corp (UWMC, Financial) at a price of $5.87 per share. This transaction increased BlackRock's total holdings in UWM Holdings to 5,595,013 shares. The acquisition reflects BlackRock's strategic interest in the residential mortgage loan origination and servicing sector, as UWM Holdings Corp is a key player in this industry. This transaction is noteworthy as it positions UWM Holdings Corp to represent 3.50% of BlackRock's portfolio, indicating a substantial commitment to this investment.

BlackRock, Inc. (Trades, Portfolio): A Leading Investment Firm

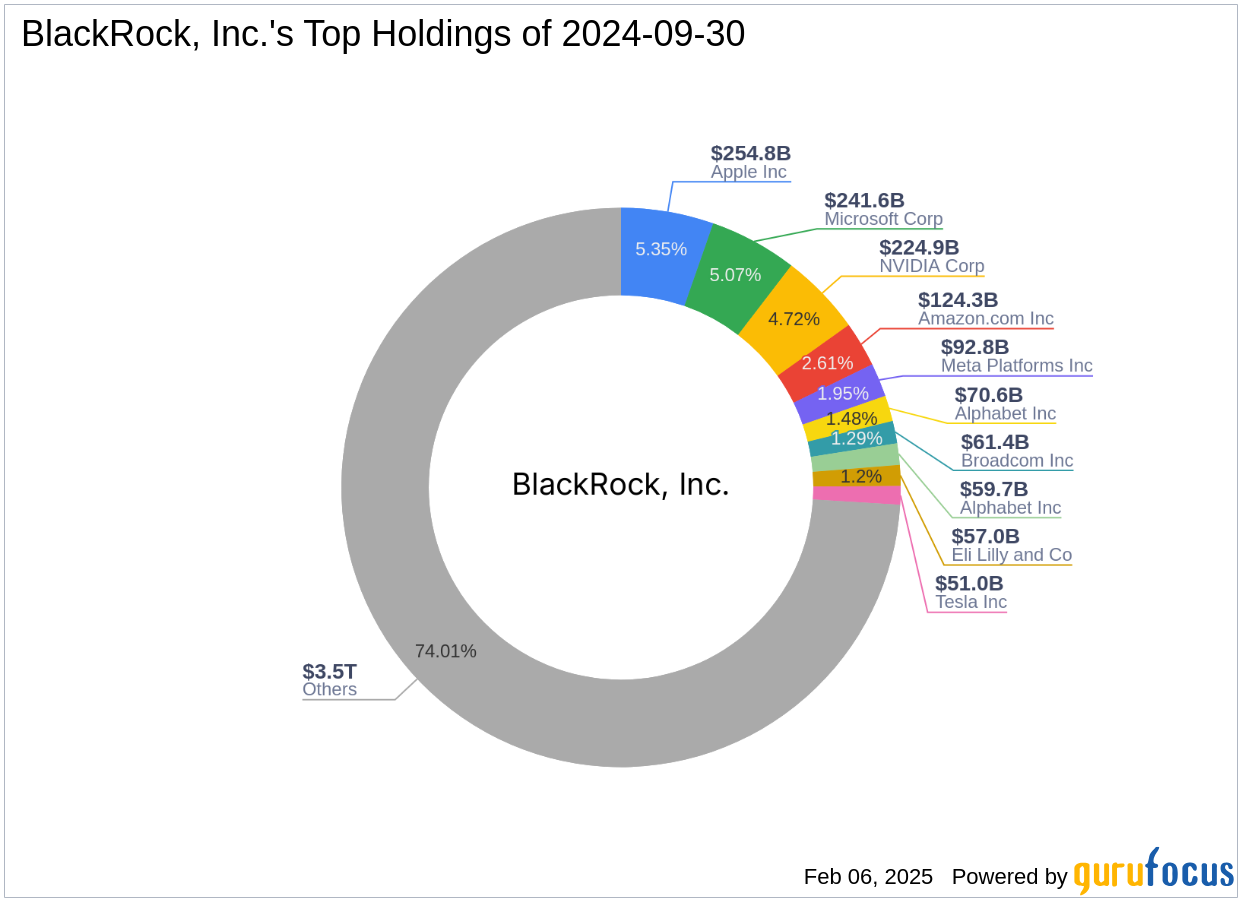

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is one of the world's most prominent investment firms, known for its extensive portfolio and strategic investment philosophy. With an equity of $4,761.16 trillion, BlackRock is a powerhouse in the financial world. The firm's investment strategy focuses on long-term growth and value, with top holdings in major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These holdings underscore BlackRock's emphasis on sectors with robust growth potential.

UWM Holdings Corp: A Key Player in Mortgage Services

UWM Holdings Corp is a prominent company engaged in the origination, sale, and servicing of residential mortgage loans. Operating across the United States, UWM Holdings provides services to independent mortgage advisors, making it a significant entity in the mortgage industry. With a market capitalization of $950.642 million, UWM Holdings is a substantial player in its sector. Despite its current stock price of $6.02, the company is considered a "Possible Value Trap" according to its GF Valuation status, suggesting investors should exercise caution.

Financial Metrics and Stock Analysis

UWM Holdings Corp's financial metrics present a mixed picture. The company's current stock price of $6.02 is slightly above the acquisition price, reflecting a 2.56% gain since the transaction. However, the stock has experienced a -49.62% change since its IPO. The company's GF Score is 43/100, indicating a challenging outlook for future performance. Additionally, the Balance Sheet Rank is 2/10, suggesting potential financial vulnerabilities. These metrics highlight the need for careful consideration by investors.

Impact of BlackRock's Transaction

BlackRock's decision to increase its stake in UWM Holdings Corp has significant implications for both the firm and the stock. With UWM Holdings now representing 3.50% of BlackRock's portfolio, the firm demonstrates confidence in the company's potential. This move could be driven by strategic considerations, such as the potential for growth in the mortgage sector or the belief in UWM Holdings' ability to overcome current challenges. The transaction also reflects BlackRock's broader investment strategy of diversifying its portfolio across various sectors.

Market Performance and Historical Context

UWM Holdings Corp has faced a challenging market environment, with a -49.62% change since its IPO. Despite a recent 2.56% gain since BlackRock's transaction, the company continues to navigate a complex landscape. The stock's historical performance underscores the volatility and challenges within the mortgage industry. However, the recent acquisition by BlackRock may signal a turning point, potentially providing the company with the support needed to improve its market position.

Conclusion

In summary, BlackRock, Inc. (Trades, Portfolio)'s acquisition of additional shares in UWM Holdings Corp highlights the firm's strategic interest in the mortgage sector. While UWM Holdings faces financial challenges, BlackRock's investment may provide the company with the necessary backing to navigate these difficulties. The future outlook for UWM Holdings will depend on its ability to leverage this support and address its financial vulnerabilities. As part of BlackRock's diverse portfolio, UWM Holdings represents a calculated risk that aligns with the firm's long-term investment philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.