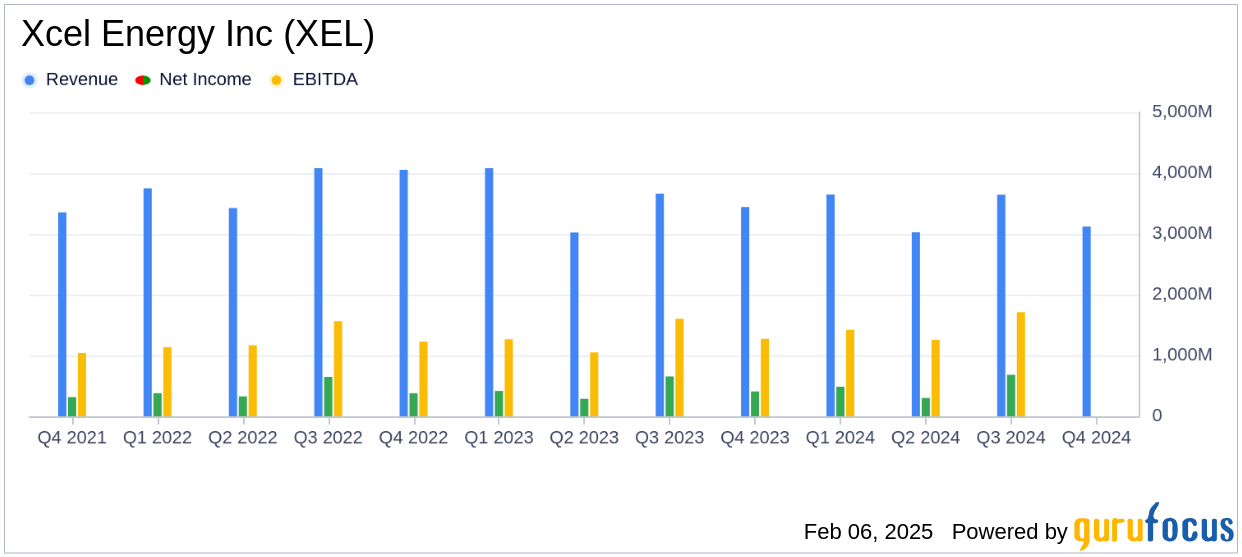

Xcel Energy Inc (XEL, Financial) released its 8-K filing on February 6, 2025, detailing its financial performance for the year 2024. The company, which manages utilities serving millions of electric and natural gas customers across eight states, reported GAAP earnings per share (EPS) of $3.44, falling short of the annual analyst estimate of $3.56. The company's revenue for the year was $13.44 billion, also below the estimated $14.59 billion.

Company Overview

Xcel Energy Inc (XEL, Financial) is a major player in the U.S. utility sector, serving 3.8 million electric customers and 2.2 million natural gas customers. The company operates through its subsidiaries, including Northern States Power, Public Service Company of Colorado, and Southwestern Public Service Company, and is recognized as one of the largest renewable energy suppliers in the country.

Performance and Challenges

In 2024, Xcel Energy Inc (XEL, Financial) reported GAAP earnings of $1.94 billion, or $3.44 per share, compared to $1.77 billion, or $3.21 per share, in 2023. The ongoing earnings per share were $3.50, up from $3.35 in the previous year. The increase in ongoing earnings was attributed to enhanced recovery of infrastructure investments, although this was partially offset by higher depreciation, interest charges, and operational and maintenance expenses.

“In 2024, we delivered on our earnings guidance for the 20th year in a row - one of the best track records in the industry - against a very difficult backdrop of challenges throughout the year,” said Bob Frenzel, chairman, president, and CEO of Xcel Energy.

Financial Achievements and Industry Importance

Xcel Energy Inc (XEL, Financial) reaffirmed its 2025 EPS guidance of $3.75 to $3.85 per share, highlighting its commitment to infrastructure and technology investments aimed at enhancing electrical systems. These investments are crucial for maintaining reliability and meeting increasing energy demands, especially in the regulated utilities sector where infrastructure resilience is paramount.

Key Financial Metrics

The company's income statement revealed total operating revenues of $13.44 billion for 2024, down from $14.21 billion in 2023. Operating expenses decreased to $11.06 billion from $11.73 billion, primarily due to lower costs of electric fuel and purchased power, and natural gas sold and transported. However, operating and maintenance expenses rose to $2.54 billion from $2.44 billion, reflecting increased operational activities and regulatory deferrals.

| Metric | 2024 | 2023 |

|---|---|---|

| Operating Revenues | $13.44 billion | $14.21 billion |

| Operating Expenses | $11.06 billion | $11.73 billion |

| Net Income | $1.94 billion | $1.77 billion |

| GAAP EPS | $3.44 | $3.21 |

Analysis and Outlook

Xcel Energy Inc (XEL, Financial) continues to focus on expanding its infrastructure to support renewable energy and meet customer demands. Despite the challenges of increased operational costs and interest charges, the company's strategic investments are expected to bolster its long-term growth. The reaffirmation of its 2025 EPS guidance indicates confidence in overcoming current hurdles and achieving financial targets.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Xcel Energy Inc for further details.