On December 31, 2024, STATE STREET CORP (Trades, Portfolio), a prominent investment firm, expanded its portfolio by acquiring an additional 20,234 shares of Universal Corp (UVV, Financial) at a price of $54.84 per share. This transaction increased the firm's total holdings in Universal Corp to 1,239,027 shares. The strategic move reflects the firm's confidence in Universal Corp's potential, as the stock now represents 5.00% of STATE STREET CORP (Trades, Portfolio)'s holdings in the company. This acquisition is part of the firm's ongoing strategy to optimize its investment portfolio and capitalize on opportunities within the tobacco industry.

Profile of STATE STREET CORP (Trades, Portfolio)

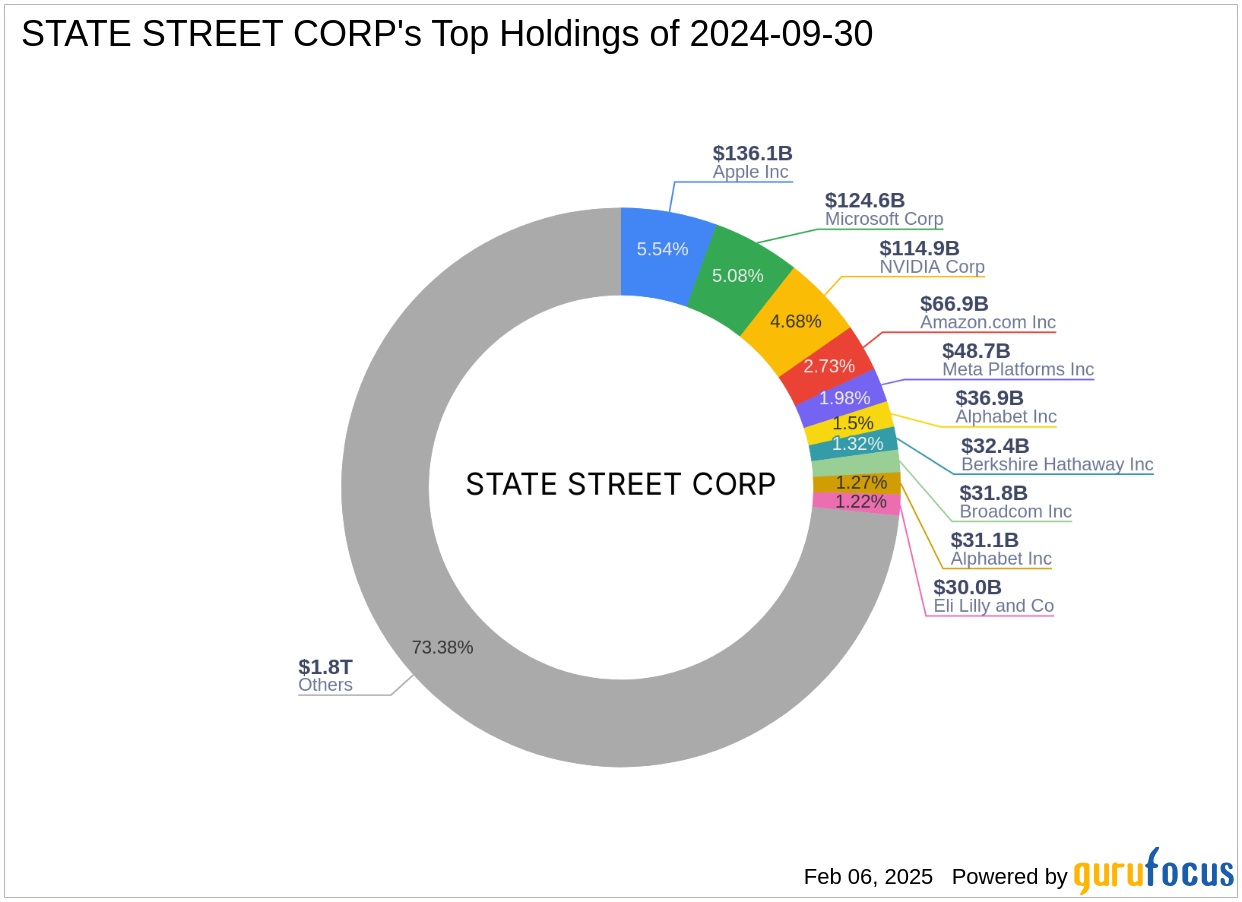

STATE STREET CORP (Trades, Portfolio), headquartered in Boston, MA, is a leading investment firm known for its robust investment philosophy and substantial equity of $2,454.55 trillion. The firm is renowned for its diversified portfolio, with top holdings in major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). STATE STREET CORP (Trades, Portfolio)'s investment strategy focuses on long-term growth and value, leveraging its expertise in technology and financial sectors to drive returns.

Overview of Universal Corp

Universal Corp, a global leaf tobacco supplier based in the USA, operates primarily through its Tobacco Operations and Ingredients Operations segments. The company procures leaf tobacco from farmers, processes it, and sells it to manufacturers of consumer tobacco products. Universal Corp does not produce or sell consumer products directly. The company generates the majority of its revenue from the United States, positioning itself as a key player in the tobacco industry.

Financial Metrics and Valuation of Universal Corp

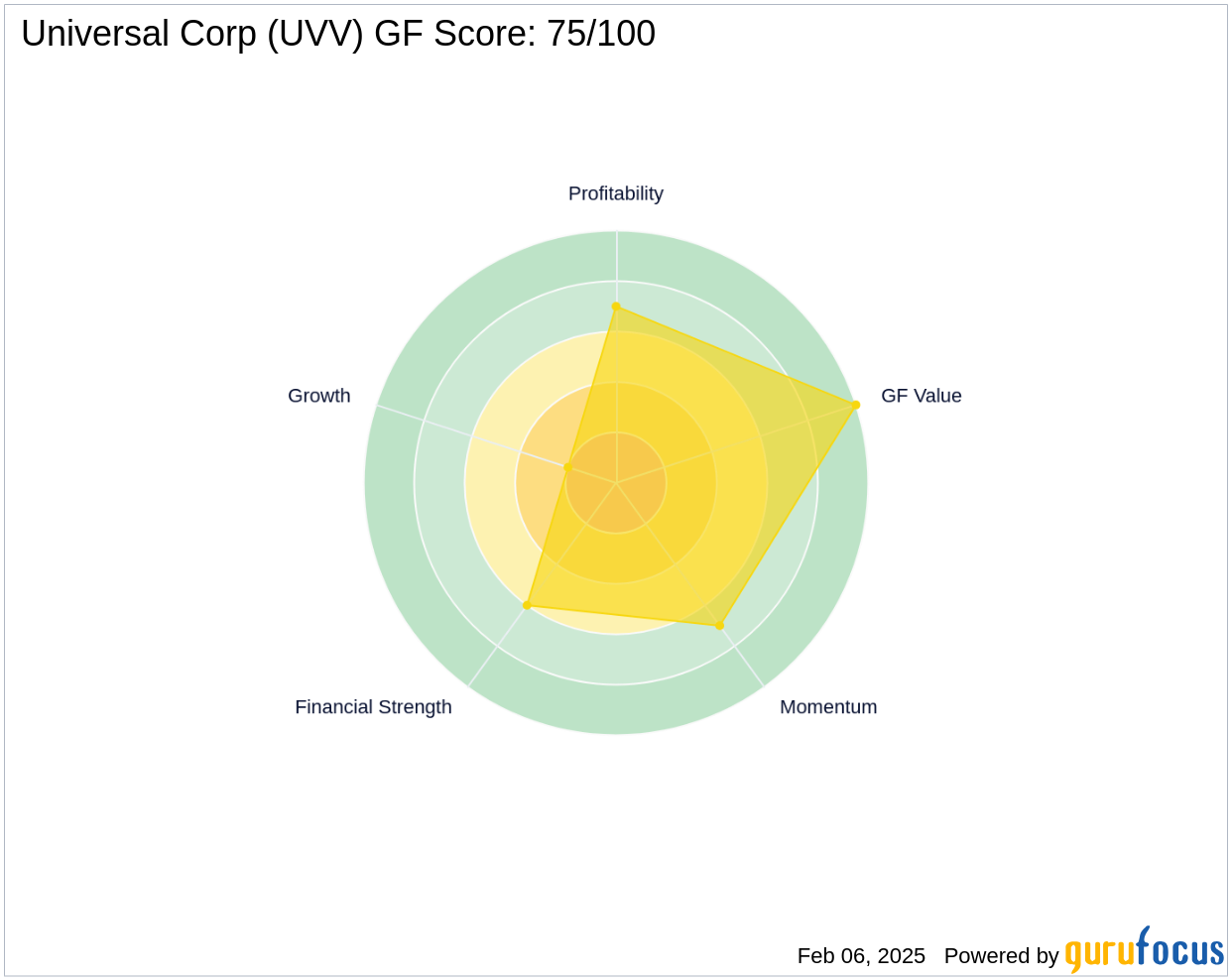

Universal Corp has a market capitalization of $1.3 billion and a current stock price of $52.75. The stock's price-to-earnings (PE) ratio stands at 10.85, indicating a modest undervaluation based on the GF Valuation of 66.53. The stock's GF Score of 75/100 suggests likely average performance, reflecting a balanced outlook for potential investors.

Impact of the Transaction on STATE STREET CORP (Trades, Portfolio)'s Portfolio

The acquisition of additional shares in Universal Corp signifies a strategic decision by STATE STREET CORP (Trades, Portfolio) to enhance its position in the company. With Universal Corp now comprising 5.00% of the firm's holdings in the stock, this move underscores the firm's confidence in the company's future prospects and its alignment with the firm's investment objectives.

Performance and Growth Indicators of Universal Corp

Universal Corp's profitability and growth metrics reveal a mixed performance. The company boasts a Profitability Rank of 7/10, indicating strong profitability, while its Growth Rank of 2/10 highlights challenges in growth. Over the past three years, Universal Corp has achieved revenue growth of 11.10% and EBITDA growth of 13.50%, reflecting its ability to generate consistent returns.

Market and Industry Context

Within the tobacco products industry, Universal Corp maintains a stable position, supported by an interest coverage ratio of 3.24 and a cash-to-debt ratio of 0.08. These metrics indicate the company's financial stability and potential risk factors. The company's Altman Z score of 2.75 further reflects its financial health and resilience in a competitive market.

Conclusion

STATE STREET CORP (Trades, Portfolio)'s increased investment in Universal Corp highlights a strategic move to capitalize on the company's potential within the tobacco industry. Despite modest growth challenges, Universal Corp's strong profitability and stable financial metrics suggest a promising outlook. As the firm continues to refine its portfolio, this acquisition may contribute to its long-term investment success, aligning with its broader strategy of leveraging opportunities in key sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.