On February 6, 2025, Open Text Corp (OTEX, Financial) released its 8-K filing for the second quarter of fiscal year 2025, showcasing a mixed financial performance. The company, a leader in Information Management software and solutions, reported total revenues of $1.335 billion, which exceeded the analyst estimate of $1,317.77 million. However, Open Text Corp exceeded earnings expectations with a GAAP EPS of $0.87 and a Non-GAAP EPS of $1.11, both surpassing the estimated EPS of $0.45.

Company Overview

Open Text Corp is renowned for its comprehensive Information Management platform, the OpenText Cloud Platform, which includes six business clouds: Content Cloud, Cybersecurity Cloud, Application Automation Cloud, Business Network Cloud, IT Operations Management Cloud, and Analytics Cloud. The company primarily derives its revenue from the United States, offering secure and scalable solutions to enterprises, SMBs, governments, and consumers globally.

Performance and Challenges

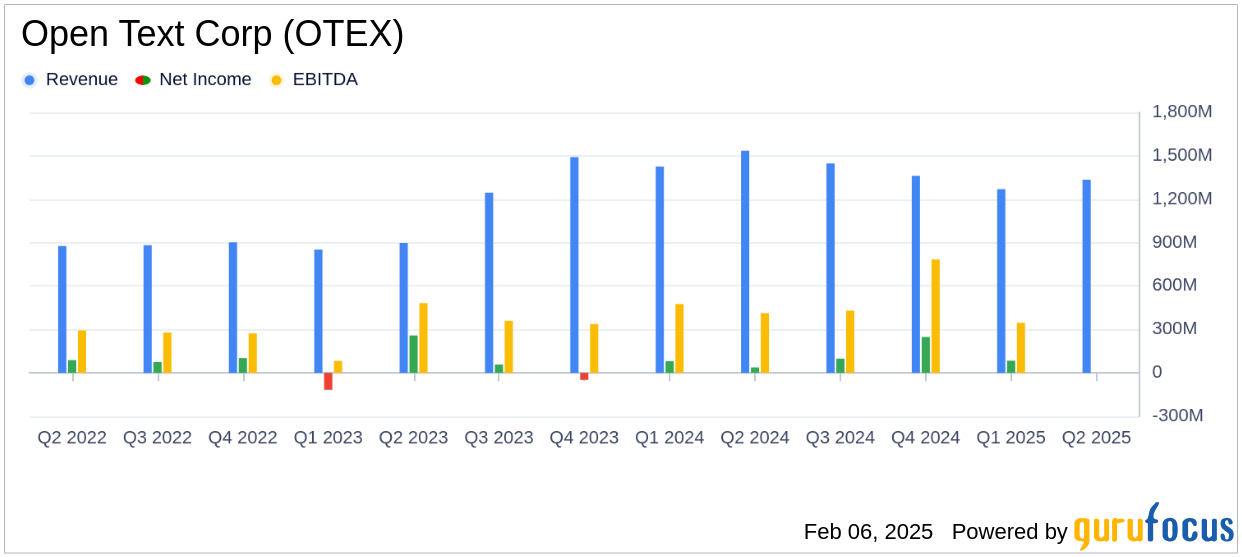

Open Text Corp's Q2 FY2025 results reflect a 13.1% year-over-year decline in total revenues, attributed to the divestiture of AMC. Adjusted for this divestiture, the revenue decline was 4.9%. Despite this, the company achieved a net income margin of 17% and a robust adjusted EBITDA margin of 37.6%. The cloud revenues increased by 2.7% year-over-year, indicating growth in this segment.

Financial Achievements

The company's financial achievements are significant in the software industry, where maintaining high margins and cash flows is crucial. Open Text Corp reported operating cash flows of $348 million and free cash flows of $307 million, demonstrating strong cash generation capabilities. The company returned $134 million to shareholders through dividends and share repurchases, highlighting its commitment to shareholder value.

Key Financial Metrics

| Metric | Q2 FY'25 | Q2 FY'24 | % Change |

|---|---|---|---|

| Total Revenues | $1,335 million | $1,535 million | (13.1)% |

| GAAP EPS, diluted | $0.87 | $0.14 | 521.4% |

| Non-GAAP EPS, diluted | $1.11 | $1.24 | (10.5)% |

| Adjusted EBITDA | $501 million | $566 million | (11.4)% |

Analysis and Commentary

Open Text Corp's performance in Q2 FY2025 underscores the strength of its operating model, despite revenue challenges. The company's focus on cloud growth and operational efficiency has resulted in a solid adjusted EBITDA margin. According to Mark J. Barrenechea, OpenText CEO & CTO,

“OpenTexts Q2 results demonstrate the strength of our operating model, delivering $501 million of adjusted EBITDA, and 37.6% adjusted EBITDA margin, and generating $307 million of Free Cash Flows (FCF).”

Madhu Ranganathan, OpenText President & CFO, emphasized the company's strategic initiatives, stating,

“Our initiatives to drive efficiencies across the business and our execution in the second half of fiscal 2025 will put us in a position to deliver a strong fiscal 2026.”

Conclusion

Open Text Corp's Q2 FY2025 results highlight its ability to navigate revenue challenges while maintaining strong profitability and cash flow metrics. The company's strategic focus on cloud services and operational efficiency positions it well for future growth. Investors and stakeholders will be keen to see how Open Text Corp leverages its next-generation platform, Titanium X, to drive further innovation and resilience in the evolving multi-cloud environment.

Explore the complete 8-K earnings release (here) from Open Text Corp for further details.