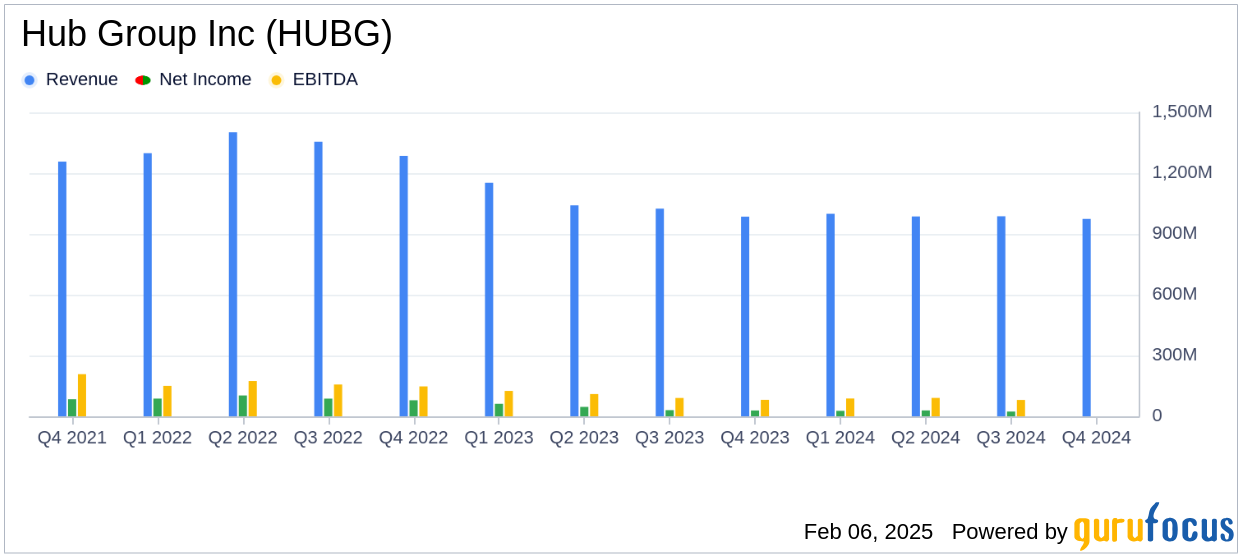

On February 6, 2025, Hub Group Inc (HUBG, Financial) released its 8-K filing detailing its fourth quarter and full year 2024 financial results. The company reported a fourth quarter revenue of $1 billion, aligning closely with analyst estimates of $1.001 billion. However, the reported GAAP earnings per share (EPS) of $0.40 fell short of the estimated $0.49. For the full year, Hub Group achieved a revenue of $4 billion and a GAAP EPS of $1.70, both slightly above the annual estimates of $3.985 billion in revenue and $1.81 in EPS.

Company Overview

Hub Group Inc (HUBG, Financial) is a leading provider of rail intermodal services, with approximately 60% of its revenue derived from its Intermodal and Transportation Solutions (ITS) division. This division includes intermodal operations utilizing Class I rail carriers, dedicated truckload shipping, and logistics services such as truck brokerage, transportation management, warehousing, and final mile delivery. The company is known for strategic acquisitions that enhance its service offerings.

Performance and Challenges

The fourth quarter saw a slight decline in revenue to $974 million, down 1% from the previous year. This was attributed to strong intermodal volume growth and surcharge revenue being offset by declines in fuel, brokerage, consolidation, and managed transportation revenue. The full year revenue also decreased by 6% compared to 2023. Despite these challenges, the company managed to improve its operating income margin, indicating effective cost management and operational efficiency.

Financial Achievements

Hub Group's financial achievements include a strong balance sheet with $127 million in cash and a net debt/adjusted EBITDA ratio of 0.5x, which is below the company's target range. The company returned nearly $100 million to shareholders through share repurchases and dividends in 2024, demonstrating a commitment to shareholder value. Additionally, the completion of a joint venture with EASO expanded Hub Group's intermodal presence in North America, particularly in Mexico.

Key Financial Metrics

Important metrics from the financial statements include a fourth quarter GAAP operating income of $32 million, representing 3.2% of revenue, and an adjusted operating income of $38 million or 3.9% of revenue. The full year GAAP operating income was $140 million, or 3.6% of revenue, with an adjusted operating income of $157 million or 4.0% of revenue. These metrics highlight the company's ability to maintain profitability despite revenue challenges.

| Metric | Q4 2024 | Full Year 2024 |

|---|---|---|

| Revenue | $974 million | $3.95 billion |

| GAAP EPS | $0.40 | $1.70 |

| Adjusted EPS | $0.48 | $1.91 |

| Operating Income Margin | 3.2% | 3.6% |

Analysis and Outlook

Hub Group's performance in 2024 reflects a challenging environment with mixed results. While the company faced revenue declines, it successfully improved its operating margins and maintained a strong financial position. The strategic joint venture with EASO and continued focus on intermodal growth positions Hub Group for potential future success. The 2025 outlook projects revenue between $4.0 billion and $4.3 billion, with EPS expected to range from $1.90 to $2.40, indicating cautious optimism for the coming year.

I am proud of the team’s performance in 2024 as our disciplined market approach resulted in Intermodal volume growth of 14% and ITS adjusted operating margin of 3.1% in the quarter, a 50-basis point improvement over Q4 2023," said Phil Yeager, Hub Group’s President, Chief Executive Officer and Vice Chairman.

Explore the complete 8-K earnings release (here) from Hub Group Inc for further details.