On February 6, 2025, IBEX Ltd (IBEX, Financial) released its 8-K filing, showcasing a robust financial performance for the second fiscal quarter ended December 31, 2024. The company, known for its innovative business process outsourcing and customer engagement solutions, reported record quarterly revenue and significant earnings per share (EPS) growth.

Company Overview

IBEX Ltd (IBEX, Financial) is a global leader in business process outsourcing, offering comprehensive customer lifecycle experience solutions. The company operates through its Business Process Outsourcing segment, providing services in Digital and omni-channel Customer Experience, Digital Marketing and E-Commerce, and Digital CX surveys and analytics. IBEX serves a diverse range of industries, including telecommunications, financial services, and healthcare.

Financial Performance and Achievements

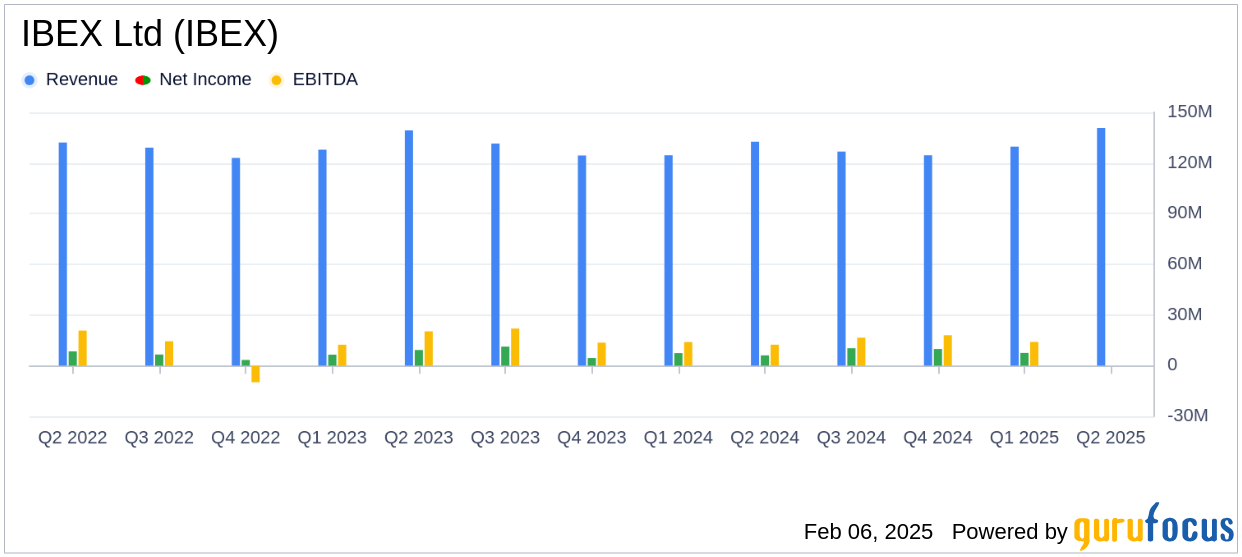

IBEX Ltd (IBEX, Financial) reported a quarterly revenue of $140.7 million, surpassing the analyst estimate of $134.63 million and marking a 6.1% increase from the previous year's quarter. This growth was driven by strong performances in the HealthTech, Travel, Transportation and Logistics, and Retail & E-commerce sectors, despite a decline in the FinTech vertical.

The company's net income rose to $9.3 million, a 52.6% increase from the prior year, with a net income margin of 6.6%. Diluted EPS increased to $0.57, significantly higher than the previous year's $0.33. The adjusted EPS was $0.59, reflecting a 36.3% increase.

Strategic Moves and Challenges

IBEX Ltd (IBEX, Financial) executed a strategic share repurchase of approximately 3.6 million shares from The Resource Group International Limited, eliminating its controlled company status. This move, along with the addition of new board members, is expected to enhance corporate governance and shareholder value.

Despite the positive financial results, the company faces challenges, including a decline in the FinTech sector and increased capital expenditures driven by capacity expansion. These challenges could impact future profitability if not managed effectively.

Key Financial Metrics

| Metric | Q2 2024 | Q2 2023 | Change |

|---|---|---|---|

| Revenue | $140.7 million | $132.6 million | 6.1% |

| Net Income | $9.3 million | $6.1 million | 52.6% |

| Adjusted EBITDA | $16.5 million | $14.3 million | 15.4% |

| Adjusted EPS | $0.59 | $0.44 | 36.3% |

Analysis and Outlook

IBEX Ltd (IBEX, Financial) has demonstrated strong financial performance, driven by strategic client acquisitions and market expansion. The company's ability to increase revenue and profitability metrics highlights its competitive edge in the BPO industry. However, the decline in the FinTech sector and increased capital expenditures pose potential risks that need to be addressed.

Looking ahead, IBEX Ltd (IBEX, Financial) has raised its fiscal year 2025 guidance, expecting revenue between $525 to $535 million and adjusted EBITDA between $68 to $69 million. These projections reflect the company's confidence in its growth strategy and ability to deliver value to shareholders.

“We achieved strong top and bottom line second quarter results. We accelerated our top-line momentum with over 6% revenue growth, driven by new client wins over the last year and continued expansion of our embedded client base made possible by our strong service delivery,” said Taylor Greenwald, CFO of ibex.

Explore the complete 8-K earnings release (here) from IBEX Ltd for further details.