Alpine Income Property Trust Inc (PINE, Financial) released its 8-K filing on February 6, 2025, detailing its financial performance for the fourth quarter and full year of 2024. The company, a real estate investment trust (REIT) specializing in single-tenant commercial properties, reported a net loss of $0.06 per diluted share for the fourth quarter, falling short of the analyst estimate of $0.02 earnings per share. However, the company achieved Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) of $0.44 per diluted share, reflecting a robust operational performance.

Company Overview

Alpine Income Property Trust Inc is a real estate company that owns and operates a portfolio of single-tenant commercial properties. Its portfolio consists of 138 net leased properties located in 104 markets across 35 states in the United States. The majority of the firm's revenue is derived from rental income from these properties.

Performance and Challenges

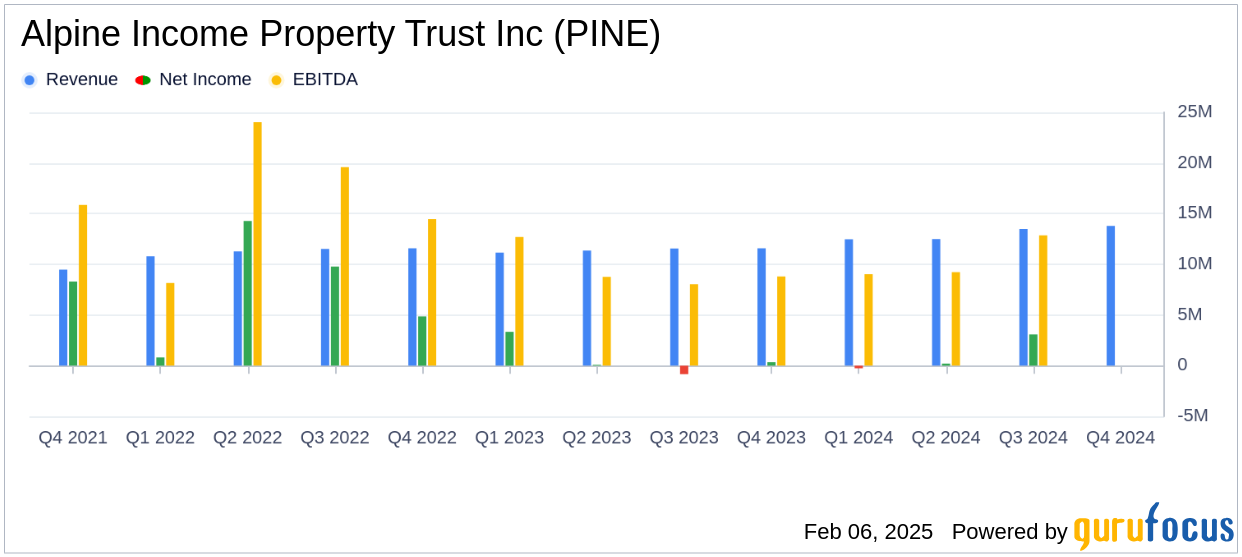

For the fourth quarter of 2024, Alpine Income Property Trust Inc reported total revenues of $13.79 million, surpassing the estimated revenue of $13.47 million. Despite this revenue beat, the company faced a net loss attributable to PINE of $958,000, compared to a net income of $335,000 in the same quarter of the previous year. This loss highlights the challenges the company faces in managing its portfolio and operational costs.

Financial Achievements

Alpine Income Property Trust Inc's financial achievements include closing investments worth $134.7 million at an 8.7% cash yield in 2024. The company also increased its dividend for Q1 2025, reflecting confidence in its cash flow and operational stability. These achievements are significant for a REIT, as they demonstrate effective capital allocation and a focus on shareholder returns.

Key Financial Metrics

In terms of key financial metrics, the company reported FFO of $6.97 million and AFFO of $6.89 million for the fourth quarter. The FFO per diluted share was $0.44, up from $0.37 in the same period last year, while AFFO per diluted share increased to $0.44 from $0.38. These metrics are crucial for REITs as they provide a clearer picture of operational performance by excluding non-cash expenses like depreciation.

“We completed a robust year growing AFFO per share by 17%, permitting us to once again increase our dividend while maintaining a well-covered payout ratio,” said John P. Albright, President and Chief Executive Officer of Alpine Income Property Trust.

Investment and Disposition Activity

During 2024, Alpine Income Property Trust Inc made significant investments, acquiring 12 properties for $103.6 million and three commercial loans and investments totaling $31.1 million. The company also disposed of 15 properties for $61.96 million, achieving a weighted average exit cash cap rate of 6.9%. These strategic moves are part of the company's efforts to optimize its portfolio and enhance returns.

Balance Sheet and Dividends

As of December 31, 2024, Alpine Income Property Trust Inc had an outstanding balance of $102.0 million under its revolving credit facility, with $89.5 million available capacity. The company declared a quarterly cash dividend of $0.285 per share for Q1 2025, representing a 1.8% increase from the previous quarter, with an annualized yield of approximately 6.6%.

Analysis and Outlook

Alpine Income Property Trust Inc's performance in 2024 reflects both the opportunities and challenges faced by REITs in the current market environment. While the company has demonstrated strong revenue growth and strategic investment activity, the net loss in the fourth quarter underscores the need for continued focus on cost management and portfolio optimization. The increase in dividends and strong AFFO growth are positive indicators for investors seeking stable income from REIT investments.

Explore the complete 8-K earnings release (here) from Alpine Income Property Trust Inc for further details.